Hong Leong Asia’s China Yuchai director and ex-chief accountant detained by Chinese authorities

Two senior executives linked to Hong Leong Asia’s key Chinese subsidiary, China Yuchai International, have been detained by Chinese authorities, though details remain unclear. The announcement prompted a steep decline in Hong Leong Asia’s share price as investors reacted to the uncertainty.

- Director of China Yuchai International (CYI) and former chief accountant of Guangxi Yuchai Machinery detained by Chinese authorities.

- Hong Leong Asia, holding 48.7% of CYI, said reasons and charges are unverified.

- Market reacted sharply, with Hong Leong Asia shares plunging over 20% in early trading.

Hong Leong Asia announced on 20 October 2025 that Wu Qiwei (吴启伟), a director of China Yuchai International (CYI, 中国玉柴国际) and president of its main subsidiary Guangxi Yuchai Machinery, and Qin Xiaohong, the company’s former chief accountant, have been detained by Chinese authorities.

The Singapore-listed conglomerate, which holds a 48.7 per cent stake in CYI, said it has not yet verified the reasons for the detainment or any related charges.

According to Hong Leong Asia’s statement, Li Hanyang, chairman of Guangxi Yuchai Machinery’s board, will continue to oversee operations.

Meanwhile, Chen Hai, the company’s vice-president, is assisting in performing the duties of president in Wu’s absence.

CYI is a major manufacturer specialising in the design, production, and sale of engines for vehicles, construction equipment, agricultural machinery, and marine applications.

The detainment follows a strong financial performance in the first half of 2025.

CYI reported a 52.2 per cent increase in net profit, rising from 240.3 million yuan (S$43.7 million) to 365.8 million yuan, driven by higher sales across most engine categories.

Parent company Hong Leong Asia also recorded a 13.1 per cent year-on-year increase in net profit, reaching S$56 million, mainly due to Guangxi Yuchai’s contribution.

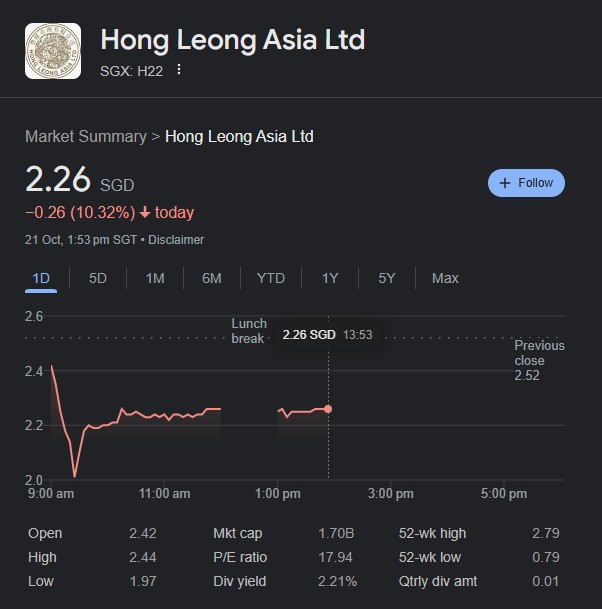

Despite the strong results, news of the detainment led to sharp market reactions.

Hong Leong Asia’s shares plunged by as much as 20.6 per cent in early trading on Tuesday, 21 October, after closing the previous Friday 4.6 per cent lower at S$2.52.