42 under probe in Singapore police crackdown on scams, S$1.9m seized

Singapore police arrested nine and are investigating 33 others after a month-long anti-scam operation seized S$1.9 million in suspected proceeds and froze 400 bank accounts. The crackdown also disrupted over 900 online enablers and stopped S$820,000 in potential scam losses.

- Singapore police arrested nine and are probing 33 others in connection with scams after a joint operation from 15 April to 13 May 2025.

- The operation seized S$1.9 million, froze 400 accounts, disrupted 900 online enablers, and terminated 806 mobile lines.

- Authorities also foiled two scams in April, saving potential victims S$820,000.

SINGAPORE: A total of 42 individuals are under investigation after a near month-long joint operation led by the Anti-Scam Command (ASC) of the Singapore Police Force targeting scams involving impersonation, investment fraud, and bogus job offers.

In a media release issued on 29 May 2025, police confirmed that approximately S$1.9 million in suspected criminal proceeds was seized during the operation, which ran from 15 April to 13 May.

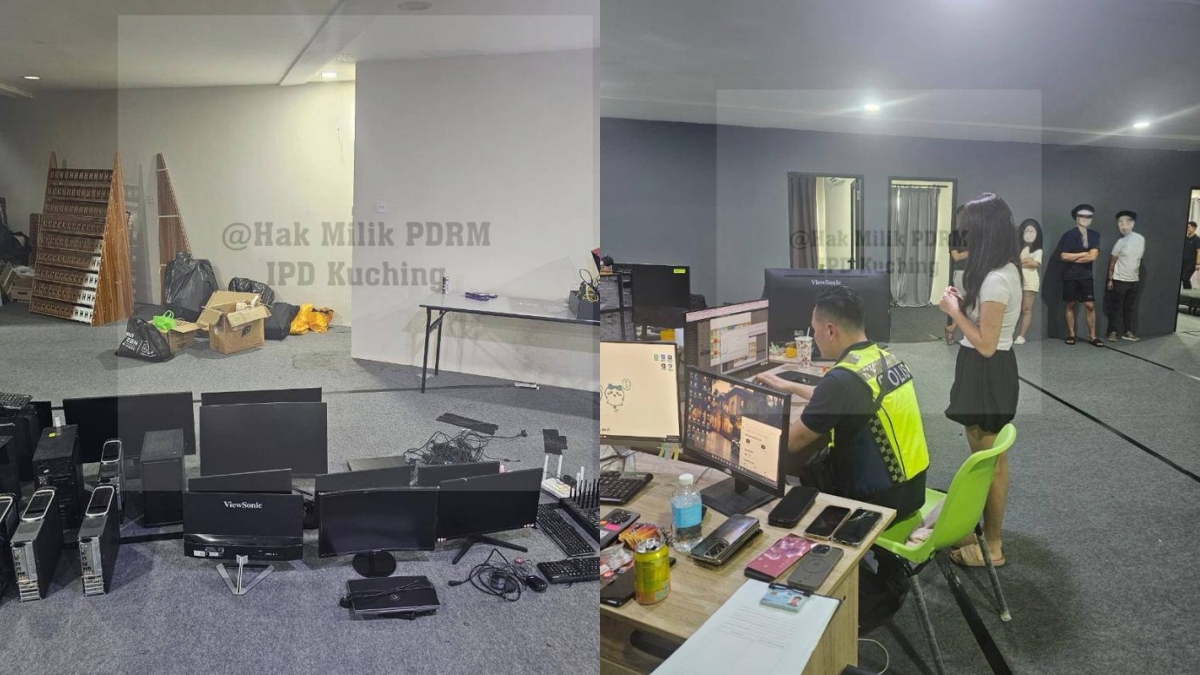

The effort was conducted in collaboration with officers from the police land divisions’ Scam Strike Teams and participating local banks.

As part of the operation, 400 bank accounts were frozen. Islandwide raids were carried out to locate those suspected of surrendering their bank accounts to criminal syndicates for money laundering purposes.

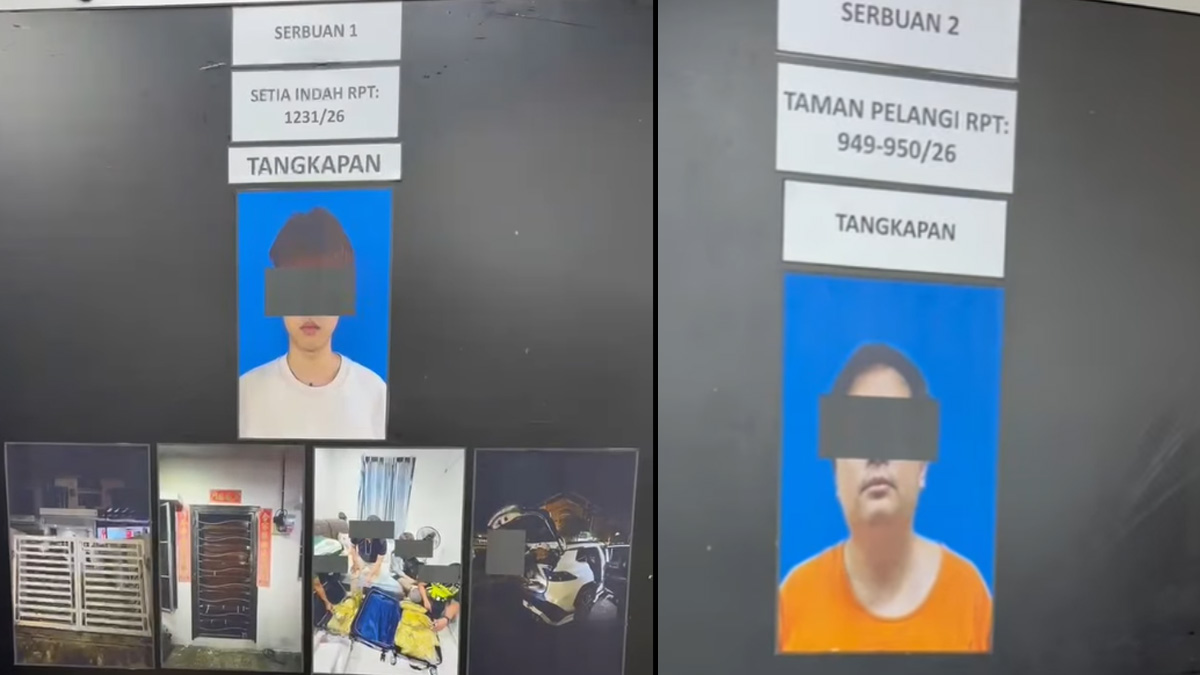

Nine individuals – seven men and two women aged between 18 and 33 – were arrested. Another 33 persons are currently assisting with investigations.

Police believe the 42 suspects were linked to over 200 scam cases.

More than 900 online enablers were also disrupted and 806 mobile lines believed to be used for scam operations were terminated.

According to the authorities, individuals convicted of helping others retain benefits from criminal conduct may face up to three years’ imprisonment, a fine of up to S$50,000, or both.

For unauthorised access to computer material, offenders may be jailed up to two years, fined up to S$5,000, or both.

The police reiterated their warning to the public not to share Singpass credentials, bank accounts, or mobile lines, as this could result in legal accountability for criminal misuse.

S$820,000 in scam losses prevented in two cases

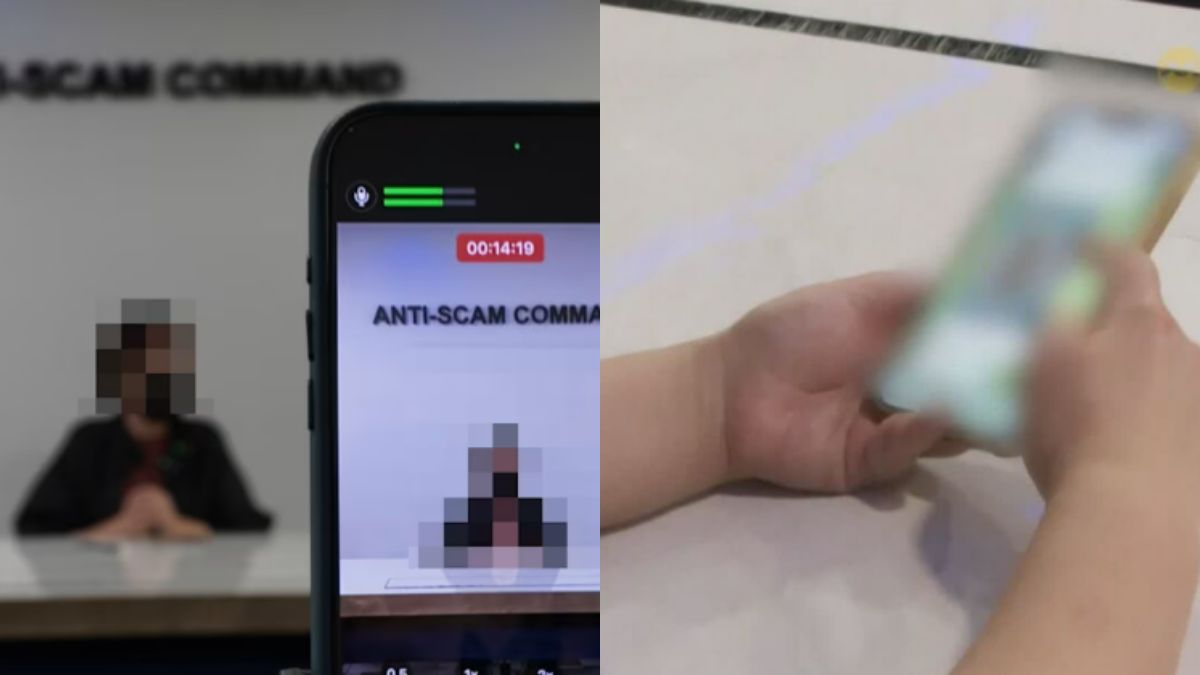

In a separate update on the same day, the police disclosed that ASC had worked with DBS Bank and the Singpass Anti-Fraud Team to thwart two significant scam attempts in April, preventing combined losses of S$820,000.

The first case, reported on 2 April, involved a 44-year-old man who received a call from someone claiming to represent Citibank.

He was then transferred to another individual impersonating an official from the Monetary Authority of Singapore (MAS).

The imposter accused the man of being under investigation for money laundering and instructed him to transfer S$200,000 to a DBS account “for investigative purposes”.

Thanks to monitoring systems implemented by ASC, DBS was able to flag and intercept the suspicious transaction, safeguarding the funds.

In the second case, also on 2 April, a 77-year-old woman visited DBS Bank’s Holland branch intending to withdraw S$200,000.

The day before, she had already taken out S$160,000.

Bank staff suspected a scam and referred the case to ASC. Investigations revealed she had been contacted by a caller claiming to be from a telecommunications provider, who then connected her to supposed Hong Kong police and MAS officials.

She was falsely told she was under investigation and had to withdraw S$620,000 for verification.

The authorities intervened before the transaction was completed, preventing the woman from losing the substantial sum.

Public urged to adopt preventive measures

The Singapore Police Force continues to urge the public to take proactive steps to protect themselves from scams.

This includes installing the ScamShield mobile application and enabling additional verification features for online banking transactions.

Further information is available at www.scamshield.gov.sg, or through the ScamShield helpline at 1799.