Police arrest 24 after victim loses over S$1.1 million in week-long scam by fake MAS officials

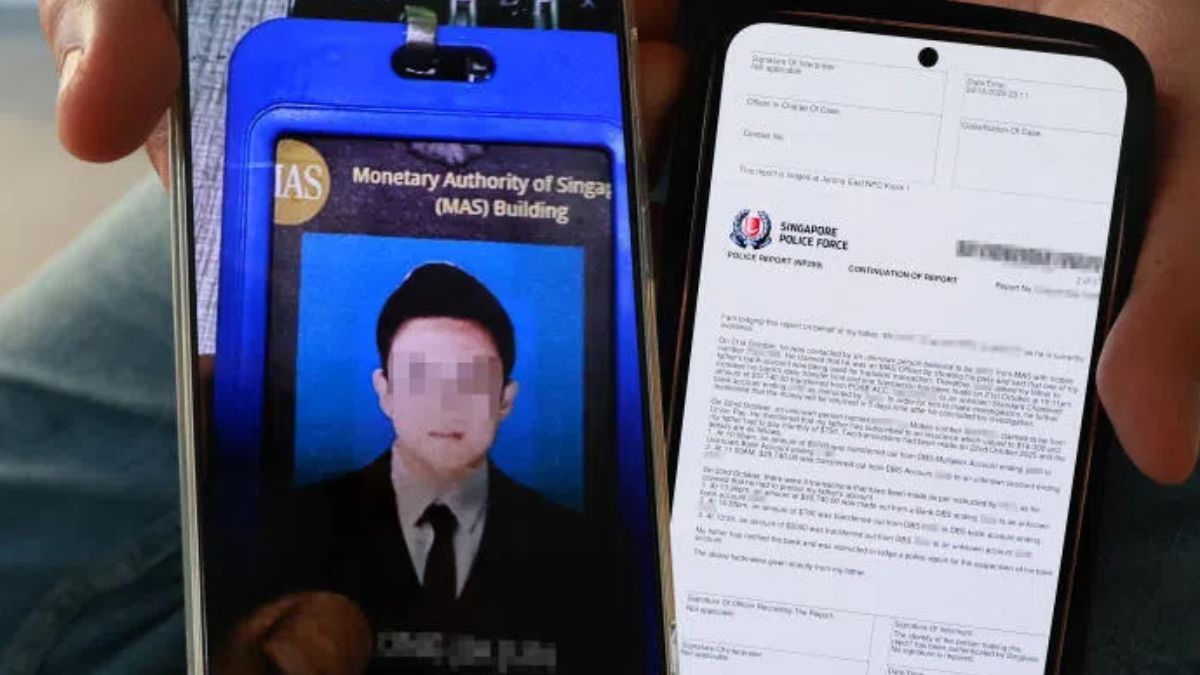

Thirty-three individuals have been arrested or are under investigation after a Singaporean lost over S$1.1 million in a scam involving fraudsters impersonating officials from the Monetary Authority of Singapore. The case highlights growing sophistication in cross-border scam operations.

- Twenty-four people aged 15 to 34 were arrested and nine others are assisting with investigations in a government official impersonation scam.

- A victim lost more than S$1.1 million within a week to scammers posing as Monetary Authority of Singapore (MAS) officers.

- Most of the stolen funds were withdrawn from overseas ATMs within hours of transfer.

SINGAPORE: Twenty-four individuals aged between 15 and 34 have been arrested after a victim was defrauded of more than S$1.1 million in a week by scammers impersonating government officials, Singapore police announced on 26 October.

Another nine people, aged 16 to 70, are currently assisting with investigations. Two among them were found to have been scam victims themselves, according to the police.

The arrests followed an islandwide anti-scam enforcement operation conducted between 23 and 24 October, after a report was lodged on 22 October concerning individuals posing as Monetary Authority of Singapore (MAS) officials.

Scammers posed as M1 and MAS officers

According to preliminary investigations, the scam began when the victim received an unsolicited call on 14 October from someone claiming to be an employee of telecommunications company M1.

The caller falsely alleged that the victim had an existing mobile plan and offered to assist in cancelling it, before claiming that the matter would be referred to MAS for further investigation into a supposed information leak.

Subsequently, the victim was contacted by individuals impersonating MAS officers, who claimed that a bank account under the victim’s name had been frozen. The victim was told to “safeguard” assets by transferring funds for “investigative purposes”.

Gold, cryptocurrency, and QR code payments

Between 14 and 22 October, the victim handed over gold bars worth about S$350,000 on two occasions to an unidentified woman.

The victim also followed instructions to create a cryptocurrency account and transferred approximately S$124,900 worth of cryptocurrency to wallet addresses provided by the scammers.

In addition, the victim was directed to make multiple payments using YouTrip and PayNow QR codes. Over S$600,000 was transferred to more than 60 YouTrip accounts, and about S$26,500 was sent to a PayNow number linked to a local bank account.

When suspicious transfers were flagged by the bank, the victim, following the scammers’ instructions, reassured the bank that the transactions were for investments or gifts.

Bank intervention prevented further losses

On 22 October, the victim was instructed to make a second PayNow transfer of S$26,500. This transaction was blocked when OCBC Bank identified the suspicious activity and alerted the Anti-Scam Centre.

Officers from the Anti-Scam Centre contacted the victim and managed to convince him that he had fallen prey to a scam.

According to police tracing efforts, most of the funds in the YouTrip accounts were withdrawn from overseas ATMs within the same day. The remainder was used for online transactions.

Arrests and ongoing investigations

Among those arrested, 23 individuals allegedly sold or rented their payment accounts—including cards and login credentials—to criminal syndicates for profit.

Another person was arrested for facilitating the sale of a payment account to a syndicate.

Two of the individuals assisting police were discovered to be scam victims themselves, having opened YouTrip accounts at the instruction of scammers.

They lost approximately S$1,600 and S$210,000 respectively.

All 33 individuals are being investigated for offences including cheating, unauthorised access to computer systems, and money laundering.

Under Singapore law, cheating and assisting another to retain criminal proceeds each carry a maximum penalty of three years’ imprisonment, a fine, or both.

The offence of unauthorised access to computer material carries a maximum sentence of two years’ imprisonment, a fine, or both, for a first conviction.

Authorities have repeatedly urged the public to be cautious when contacted by callers claiming to represent government agencies or financial institutions.

Police advised verifying any official requests directly with the agency concerned and refraining from transferring money or disclosing personal information over the phone.

0 Comments