Bishan executive maisonette sets new record with $1.588 million sale

A rare two-storey executive maisonette in Bishan has been sold for S$1.588 million, setting a new national record for this category of HDB housing. The deal highlights ongoing demand for large, well-located flats amid Singapore’s tight resale market.

- A Bishan executive maisonette sold for S$1.588 million — a new national record.

- The 1,755 sq ft unit features a rare open rooftop terrace and drew over 50 interested buyers.

- 2024 saw more than 1,000 HDB resale flats exceed S$1 million despite cooling measures.

SINGAPORE: A rare executive maisonette unit in Bishan has been sold for S$1.588 million, marking a new record for this category of public housing in Singapore.

The transaction, involving a two-storey HDB unit at Block 194, Bishan Street 13, surpasses previous benchmarks for both the town and nationwide.

According to a report by Shin Min Daily News on 17 July 2025, the sale eclipsed Bishan’s earlier highest resale flat price of S$1.568 million and set a new record for maisonette-type flats across the island. The former national high was S$1.51 million.

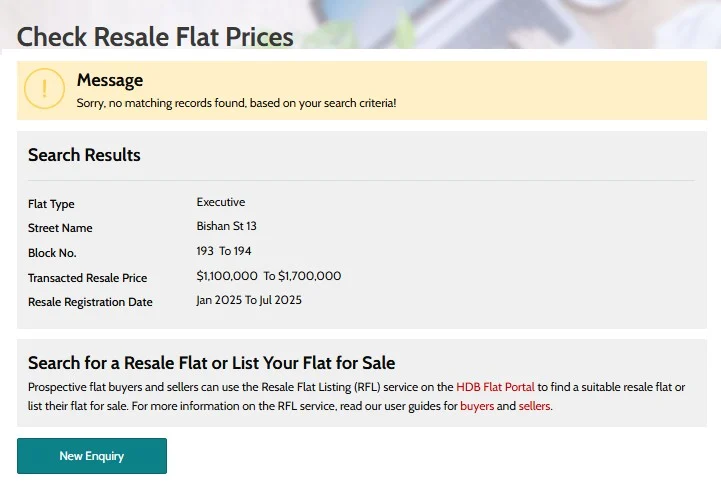

Although the deal has not yet appeared on the Housing and Development Board (HDB) website due to administrative processing, its completion has been confirmed by the marketing agent involved.

Size and design contributed to high demand

The unit was marketed by Louis Tey from Huttons Asia.

He told Shin Min that while most two-storey executive maisonettes are around 1,500 sq ft in size, this particular unit spans 1,755 sq ft.

A key feature that set the unit apart was its rare open rooftop terrace, an architectural element uncommon in HDB flats and highly sought after by buyers.

Tey noted that only a limited number of such units exist in Bishan, and even fewer are available for resale. Consequently, the unit attracted significant attention upon listing.

Within a short period, over 50 groups of potential buyers made enquiries, prompting the agent and seller to organise a two-hour open house session, during which 22 groups viewed the unit.

Multiple offers, but one stood out

Four interested groups submitted competitive offers. The final buyer, 33-year-old financial consultant Chen Jun’er, secured the deal with an offer of S$1.588 million.

Chen shared that this was the first property he and his wife purchased.

After over three years of unsuccessful attempts to acquire a Build-To-Order or Sale of Balance flat, the couple turned to the resale market six months ago.

They sought privacy and independence after living with their parents.

While initially considering newer flats in Bidadari, the couple found them too small. They were immediately drawn to the Bishan maisonette’s large rooftop terrace with sunset views and spacious layout — ideal for long-term living and their pet dog.

The location added to the appeal, being near reputable schools, MRT and bus interchanges, and shopping amenities.

2024 saw record HDB resale activity and price growth

In June, a five-room resale flat at Dawson Road in Queenstown fetched nearly S$1.659 million, marking the highest recorded resale price for an HDB flat.

The 122-sq m premium loft unit was located between the 22nd and 24th floors.

While it marks the highest five-room HDB resale transaction on public record, the most expensive flat remains a S$1.73 million unit at SkyOasis @ Dawson in June 2024.

According to HDB data released on 24 January 2025, resale flat prices increased by 9.7% in 2024, following gains of 4.9% in 2023 and 10.4% in 2022.

Despite strong demand, the number of resale transactions fell by 21.1% in the last quarter of 2024, though the full-year total reached 28,986 units.

A record 1,035 HDB resale flats crossed the S$1 million mark in 2024, highlighting continued demand for well-located, large, or premium units.

At a budget debate on 5 March 2025, then-Minister for National Development Desmond Lee cautioned that such high prices could distort market expectations.

“These flats are usually in central locations, high floors, and close to MRT stations and amenities,” Lee said, urging buyers to remain grounded in economic fundamentals.

0 Comments