Singapore’s inflation eases in May as food and transport costs moderate

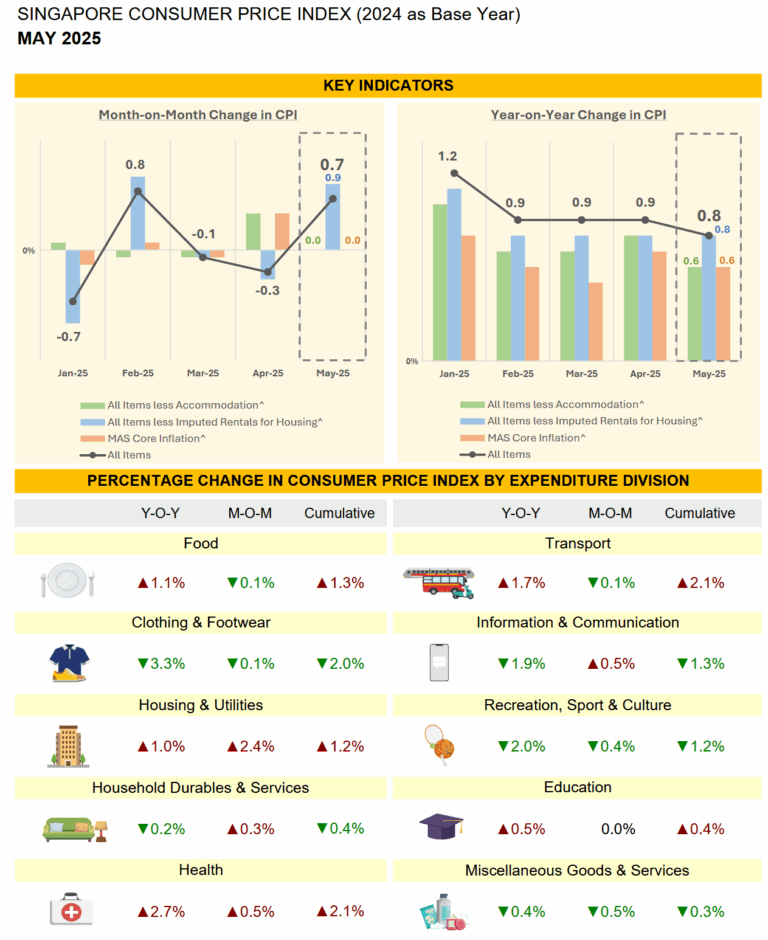

Singapore’s inflation eased in May 2025, with both core and headline figures meeting expectations. Core inflation fell to 0.6 per cent, while headline inflation dipped to 0.8 per cent, as slower food and transport cost increases offset global price pressures.

- Core inflation in Singapore eased to 0.6 per cent in May 2025, while headline inflation dipped to 0.8 per cent, both aligning with expectations.

- The moderation was driven by slower food and transport cost increases, alongside weaker global demand offsetting higher energy prices.

- MAS and MTI project core inflation to average 0.5 to 1.5 per cent in 2025, but warn of external risks from energy markets and trade tensions.

Singapore’s inflation slowed in May 2025, with both headline and core measures moderating in line with economists’ expectations, according to data released by the Department of Statistics (SingStat) on 23 June.

Core inflation, which excludes accommodation and private transport, stood at 0.6 per cent year-on-year, down slightly from 0.7 per cent in April.

Headline inflation, which includes all expenditure categories, fell to 0.8 per cent in May from 0.9 per cent in April.

On a month-on-month basis, core inflation remained unchanged, while headline inflation rose 0.7 per cent, reflecting higher transport and seasonal costs.

Official explanation of moderation

The Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) said in a joint statement that slower increases in food and private transport costs were the primary drivers of the moderation.

They added that Singapore’s imported inflation remained subdued, despite recent global oil price increases.

“Although the trade conflicts and the increase in global energy prices could be inflationary for some economies, their impact on Singapore’s import prices is likely to be offset by the disinflationary drags exerted by weaker global demand,” MAS and MTI said.

Food inflation slows, seafood prices fall

Food inflation declined to 1.1 per cent in May from 1.4 per cent in April.

The slowdown was mainly due to weaker price increases for non-cooked food. Seafood prices saw a notable 3.1 per cent year-on-year drop, while fruits and nuts recorded a 2.9 per cent annual increase but fell 3.8 per cent month-on-month.

The moderation in fresh produce costs helped offset broader price pressures in dining and other food categories.

Energy costs ease further

Electricity and gas inflation also eased, falling 3.7 per cent year-on-year in May, compared with April’s 3.5 per cent decline.

The sharper drop was largely due to lower electricity tariffs, which provided relief for households and businesses facing rising global energy prices.

Retail prices and household goods

Prices for retail and other goods continued to decline, though the rate of fall narrowed to 1.0 per cent in May, from 1.2 per cent in April.

Within the category, household appliances recorded modest price increases, which helped offset a sharper decline in personal effects.

The figures suggest retailers are adjusting to shifting consumer demand while balancing cost pressures.

Transport and services inflation

Private transport inflation rose at a slower pace of 1.1 per cent in May, compared with 1.3 per cent in April.

The moderation was linked to more modest increases in car prices, following earlier surges in certificate of entitlement (COE) premiums.

Services inflation remained stable at 1.1 per cent, while accommodation costs also registered a steady 1.1 per cent increase.

Domestic labour costs are expected to rise gradually, though government subsidies for essential services are projected to dampen services inflation in the near term.

Health costs surge amid higher insurance premiums

The health sector was one of the main contributors to inflationary pressure. Overall health-related costs rose 2.7 per cent year-on-year, driven largely by a 13.8 per cent increase in health insurance premiums.

The rise reflects global insurance trends as providers adjust premiums to cover higher claims and structural healthcare costs.

Clothing and footwear costs fell 3.3 per cent, while recreation and culture-related expenses dropped 2.0 per cent, reflecting weaker consumer demand in discretionary categories.

Inflation outlook for 2025

MAS and MTI maintained their projection that core inflation will average between 0.5 and 1.5 per cent for the full year 2025.

They noted, however, that risks remain due to external uncertainties, including volatile energy markets, ongoing trade disputes, and shifts in global demand.

Domestically, the authorities expect labour costs to rise but reiterated that subsidies for essential services should keep inflationary pressures contained.

CPI methodology updated

The May data reflect the use of a new base year, 2024, following the results of the 2023 Household Expenditure Survey.

The updated Consumer Price Index (CPI) basket covers 6,800 items across 10 main categories, priced at 4,500 retail outlets islandwide.

The government publishes three key inflation measures:

-

Headline CPI, covering all expenditure categories.

-

CPI excluding accommodation, which removes imputed rental costs.

-

MAS Core Inflation, which excludes both accommodation and private transport.

Authorities emphasise that imputed rental costs, while forming a significant part of headline CPI, do not directly impact most households’ cash expenditures and are thus excluded from core measures.

Economic significance

Economists note that Singapore’s inflation trajectory provides insight into both domestic cost dynamics and external pressures.

The easing in May suggests that global disinflationary trends are continuing to offset energy-related risks, while local subsidies and structural policies remain effective in keeping prices contained.

However, the persistence of elevated healthcare costs, alongside potential shocks in oil and food markets, underscores the fragile balance facing policymakers.

Longer-term considerations

Analysts highlight that Singapore’s inflation path will also depend on broader trends in global trade and demand.

If global economic growth slows further, imported inflation could remain muted. Conversely, sharper energy price spikes or intensified trade conflicts could reintroduce volatility.

For households, the key drivers will continue to be food, healthcare, and transport costs—categories that directly affect daily living expenses.