Singapore Airlines posts record S$2.78 billion profit boosted by Air India merger gain

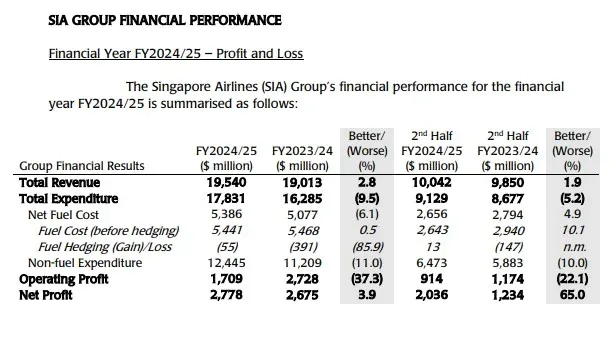

Singapore Airlines (SIA) reported a record net profit of S$2.78 billion for the year ending 31 March 2025, up 3.9% from the previous year, largely driven by a one-off S$1.1 billion gain from the Air India-Vistara merger. Operating profit, however, declined sharply by 37.3%.

- SIA posted a record S$2.78 billion net profit, boosted by a S$1.1 billion one-off gain from the Air India-Vistara merger.

- Operating profit fell 37.3% to S$1.71 billion due to weaker passenger yields and rising costs.

- Employees will receive a 7.45-month bonus, while dividends totalled 40 cents per share, down from 48 cents.

- The airline now holds a 25.1% stake in Air India, giving it exposure to India’s expanding aviation sector.

Singapore Airlines (SIA) has announced a record net profit of S$2.78 billion (US$2.14 billion) for the financial year ending 31 March 2025. This represents a 3.9 per cent increase over the S$2.68 billion recorded in the previous year.

The strong result was mainly attributed to a one-off non-cash accounting gain of S$1.1 billion, arising from the completion of the Air India-Vistara merger in November 2024.

Excluding this extraordinary item, underlying performance reflected tougher market conditions, with operating profit falling sharply.

Operating profit down amid weaker yields

SIA reported an operating profit of S$1.71 billion, down 37.3 per cent from S$2.73 billion a year earlier.

The decline was driven by a 5.5 per cent fall in passenger yields, a measure often used as a proxy for airfares. The reduction reflects intensifying competition as global airlines ramped up capacity following the post-pandemic travel surge.

SIA carried a record 39.4 million passengers, up 8.1 per cent year-on-year. However, its passenger load factor slipped 1.4 percentage points to 86.6 per cent, as the airline’s capacity growth outpaced demand.

Cargo performance mixed

Cargo revenue grew 4.4 per cent, supported by robust demand for e-commerce shipments, perishables, and supply chain disruptions in the maritime sector.

However, cargo yields dropped 7.8 per cent compared to the previous year, due to rising competition as airlines globally expanded cargo services.

Group revenue and rising costs

Total group revenue reached a record S$19.54 billion, a 2.8 per cent increase from the prior year.

Expenditure, however, rose significantly to S$17.83 billion, up 9.5 per cent year-on-year. Non-fuel expenditure rose 11 per cent, reflecting higher capacity deployment and general cost escalation pressures.

Rewards for staff and shareholders

Despite pressures on operating margins, SIA announced a profit-sharing bonus of 7.45 months for its employees, based on a long-standing agreement with staff unions.

The payout is slightly below the previous year’s record 7.94 months, but remains among the highest in the industry.

For shareholders, the airline declared a final dividend of 30 Singapore cents per share, bringing the total dividend for the year to 40 cents per share, down from 48 cents the previous year.

Strategic gain from Air India merger

A major milestone for the year was the completion of the Air India-Vistara merger, which resulted in SIA securing a 25.1 per cent stake in the enlarged Air India group.

The expanded airline now operates more than 5,600 weekly flights across 90 destinations with a fleet of 208 aircraft. This strategic investment allows SIA to participate directly in India’s fast-growing aviation market, widely considered one of the world’s most promising.

SIA described the stake as a platform for long-term growth, enabling closer alignment with Tata Group, Air India’s majority shareholder.

Outlook: challenges and opportunities

Looking ahead, SIA warned of a challenging operating environment, citing:

-

changing tariff and regulatory policies,

-

trade tensions and geopolitical risks, and

-

persistent supply chain constraints.

Despite these headwinds, the airline highlighted opportunities from shifts in global passenger and trade flows, which may benefit its diversified network strategy.

The group pledged to maintain a focus on profitability, growth opportunities, and shareholder value creation, while remaining flexible in response to market conditions.