Gemini plans job cuts and exits Europe and Australia to accelerate profitability

Gemini plans to cut up to 200 jobs and exit Europe and Australia, focusing on the US and Singapore, as the crypto exchange seeks to cut costs and accelerate a return to profitability amid weak markets.

- Gemini Space Station plans to cut up to 200 jobs globally, about a quarter of its workforce, as part of a cost-cutting strategy.

- The exchange will wind down operations in the UK, the European Union, other European jurisdictions, and Australia, focusing on the US and Singapore.

- The restructuring is aimed at accelerating a return to profitability after heavy losses and a prolonged crypto market downturn.

Gemini Space Station, the cryptocurrency exchange founded by Cameron Winklevoss and Tyler Winklevoss, announced on 5 February 2026 that it plans to cut up to 200 jobs globally and narrow its operations to the US and Singapore.

The company said the measures are designed to “support a path to profitability” following sustained financial strain and weaker trading conditions across the cryptocurrency market.

The planned layoffs represent about 25 per cent of Gemini’s workforce and will affect employees in Europe, the US and Singapore, according to a company statement.

Gemini also confirmed it has approved a plan to wind down operations in the UK, the European Union, other European jurisdictions and Australia, leaving the exchange operating solely in the US and Singapore.

The announcement comes as the year opens with widespread layoffs across US companies, as firms seek to trim costs and sharpen operational focus amid uncertain economic and market conditions.

In a blog post accompanying the announcement, the Winklevoss twins said the restructuring would significantly reduce expenses and improve the company’s financial trajectory.

“We expect this will help reduce our total expenses in line with our headcount reduction and meaningfully accelerate our path to profitability even in the backdrop of the current crypto market,” they said.

Gemini said it expects to substantially complete the layoffs and the wind-down of overseas operations by the first half of 2026, subject to local legal and consultation requirements.

The exchange estimates it will incur approximately US$11 million in pre-tax restructuring and related charges, with most of these costs expected to be recorded in the first quarter of 2026.

According to its latest financial report, Gemini posted a US$159.5 million loss for the quarter ended 3 September 2025, underscoring the scale of the financial pressure facing the company.

During the initial phase of the wind-down, existing customers in affected regions can continue using their accounts, though new account creation and incentive programmes have already been suspended.

From 5 March 2026, those accounts will move to a withdrawal-only mode, disabling trading and deposits while allowing customers to remove their assets.

Gemini has urged users in impacted regions to withdraw all cryptocurrency and fiat balances before 6 April and to unstake any staked assets early to avoid delays caused by long unbonding periods.

After that date, users will no longer be able to access their accounts or download transaction histories, and any remaining balances must be withdrawn prior to closure.

To assist with the transition, Gemini said it has partnered with eToro to provide transfer support and bonus incentives for customers choosing to move their funds to the platform.

The company emphasised, however, that customers are free to transfer their assets to any exchange or service of their choosing.

Gemini confirmed it will maintain and concentrate operations in the US and Singapore, markets it views as core to its long-term strategy and regulatory engagement.

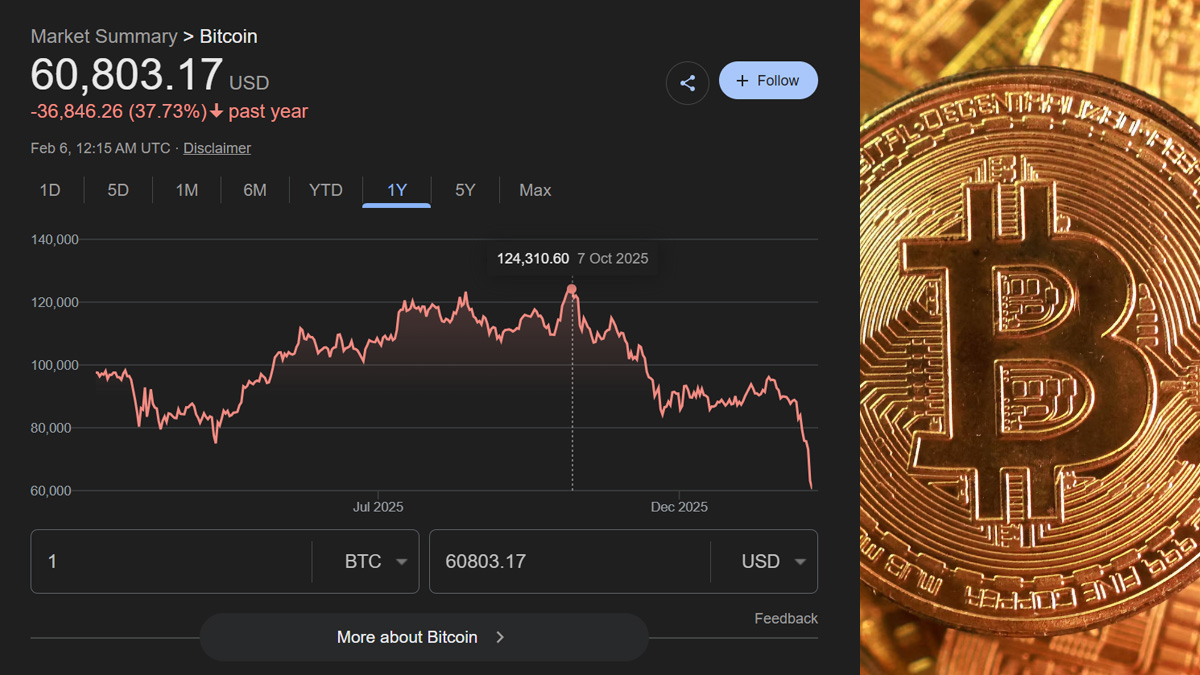

The restructuring follows a challenging 2025 for the cryptocurrency sector, marked by lower trading volumes, falling asset prices and ongoing regulatory tightening.

The workforce reduction was announced amid renewed volatility in digital asset markets, with Bitcoin falling towards the US$60,000 psychological level.

Other major cryptocurrencies have also weakened, with Ethereum sliding towards US$1,850 and XRP dropping sharply to around US$1.18 during the same period.

The Winklevoss twins, who rose to prominence after settling a high-profile lawsuit against Facebook and Mark Zuckerberg in 2008, have positioned Gemini as a regulated and compliance-focused exchange.

The latest cost-cutting measures highlight the mounting pressure on even established crypto firms to adapt their business models as the industry navigates a prolonged downturn.