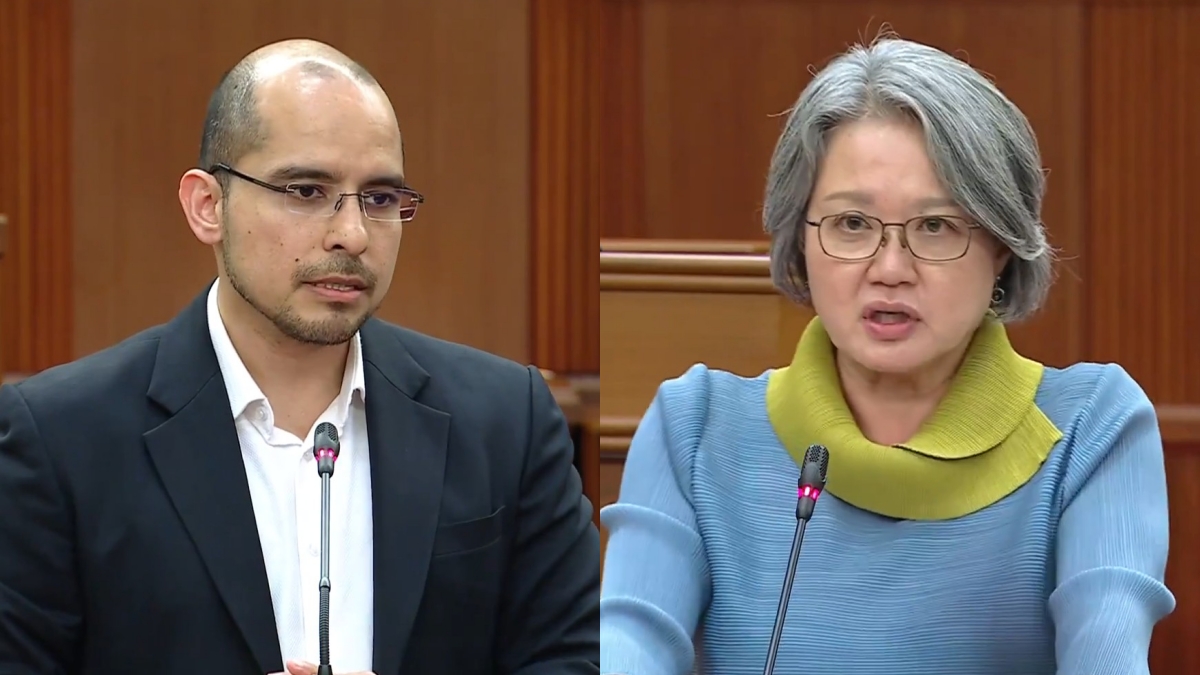

Kenneth Tiong mocks Chee Hong Tat’s ‘stupid question’ on rhetoric in financial regulation, later apologises

Kenneth Tiong’s sharp exchange with Chee Hong Tat over Singapore’s financial regulation prompted a rare parliamentary rebuke after he called the minister’s question “stupid.” Tiong later withdrew the remark and issued an apology following reminders on parliamentary decorum.

- Workers’ Party MP Kenneth Tiong called Minister Chee Hong Tat’s question “stupid” during a parliamentary exchange on 4 November 2025, later withdrawing and apologising.

- The exchange centred on financial due diligence and whether authorities should adopt a “zero-risk” or “risk-proportionate” approach.

- Minister Chee reaffirmed Singapore’s regulatory integrity and outlined measures taken against illicit activities involving family offices.

SINGAPORE: During the parliamentary sitting on 5 November 2025, Workers’ Party Member of Parliament (MP) Kenneth Tiong of Aljunied GRC clashed with Minister for National Development Chee Hong Tat over Singapore’s regulatory approach to financial due diligence.

The exchange turned contentious after Tiong described one of Chee’s questions as “stupid,” prompting an intervention from the Speaker of Parliament.

Tiong had sought clarification from the government on whether individuals sanctioned by the United States for alleged transnational crimes or those convicted in Singapore’s largest money laundering case had operated tax-exempt family offices locally.

He also asked what due diligence checks the Monetary Authority of Singapore (MAS) performs before granting such incentives, and what systemic reforms have been made to prevent abuse of Singapore’s financial regime.

In response, Chee reaffirmed Singapore’s commitment to maintaining strong regulatory standards consistent with international norms.

He said that while stringent safeguards exist, “no financial centre can entirely eliminate wrongdoing,” adding that authorities take firm enforcement action when violations occur.

Chee referred to ongoing investigations into Chen Zhi and associates, highlighting enforcement measures on 30 October 2025 involving asset seizures of properties, vehicles, bank accounts, and securities.

MAS identified 2 SFOs linked to sanctioned individuals

He disclosed that MAS had identified two Singapore single-family offices (SFOs) linked to sanctioned individuals and suspended their tax incentives, though details remain confidential due to active investigations.

On due diligence, Chee explained that MAS screens all tax incentive applicants against databases for connections to money laundering or terrorism financing.

He said SFOs must operate accounts with MAS-licensed banks, which monitor transactions for suspicious activity. Moreover, all SFOs must notify MAS upon commencing operations and file annual returns, improving oversight.

He clarified that SFOs linked to convicted money launderers account for “less than one per cent of the sector,” underscoring Singapore’s openness to legitimate investors to preserve competitiveness.

The financial services industry, he added, supports over 13,000 local jobs across wealth management, banking, and professional services. Excessive restrictions, he cautioned, could deter investment and harm employment.

Framing Singapore’s position as “risk-proportionate, not zero-risk,” Chee used an analogy: “Opening windows may let in flies, but also sunlight and fresh air.” Singapore’s policy, he said, seeks to balance vigilance with openness while cooperating internationally to combat cross-border financial crime.

MP Tiong questions MAS oversight and calls for enhanced due diligence on family offices

Following this, Tiong raised supplementary questions on whether MAS had conducted midterm reviews of DW Capital Holdings between 2018 and US actions in October 2025.

He suggested that “there are a lot of flies in the house,” referring to recent cases involving criminal networks exploiting Singapore’s family office regime.

Tiong further asked if the government would mandate enhanced due diligence for existing financial clients, and whether MAS would require all 130 and 13U tax incentive holders—not just new applicants—to undergo rescreening.

Before addressing these, Chee sought clarification on whether the Workers’ Party advocated a “zero-risk” or “risk-proportionate” approach.

He asked if Tiong agreed that Singapore should uphold high standards while maintaining financial competitiveness.

Tiong replied that “there’s a pattern of ministers and political office-holders asking rhetorical questions, which have no meaning.” Speaker Seah Kian Peng intervened to ask Tiong to respond directly.

“The answer is no, and I don’t think it is the minister’s point of view that you should in fact have a zero-risk approach because it’s impossible. So he’s asking a stupid question,” Tiong said.

Chee responded that the language was inappropriate, stating, “I respectfully ask him to withdraw that comment and to apologise.” Tiong withdrew the remark but insisted the question “was not meaningful.” Chee expressed disappointment at the tone of the exchange.

Speaker Seah later stated he was “quite disappointed” by the interaction, saying the remark was “insulting and beneath the dignity of this House.”

Citing Standing Order 50, Section 4, he reminded members that offensive or insulting language toward other MPs is prohibited.

“You have withdrawn that comment, which is correct. I would have expected an apology, but I accept that you did not,” Seah said, emphasising the need to maintain parliamentary decorum.

Following the Speaker’s remarks, Tiong rose to apologise formally. Chee accepted the apology, and proceedings resumed.