MPs scrutinise safeguards against illicit finance; Minister says Singapore ‘do not have many flies'

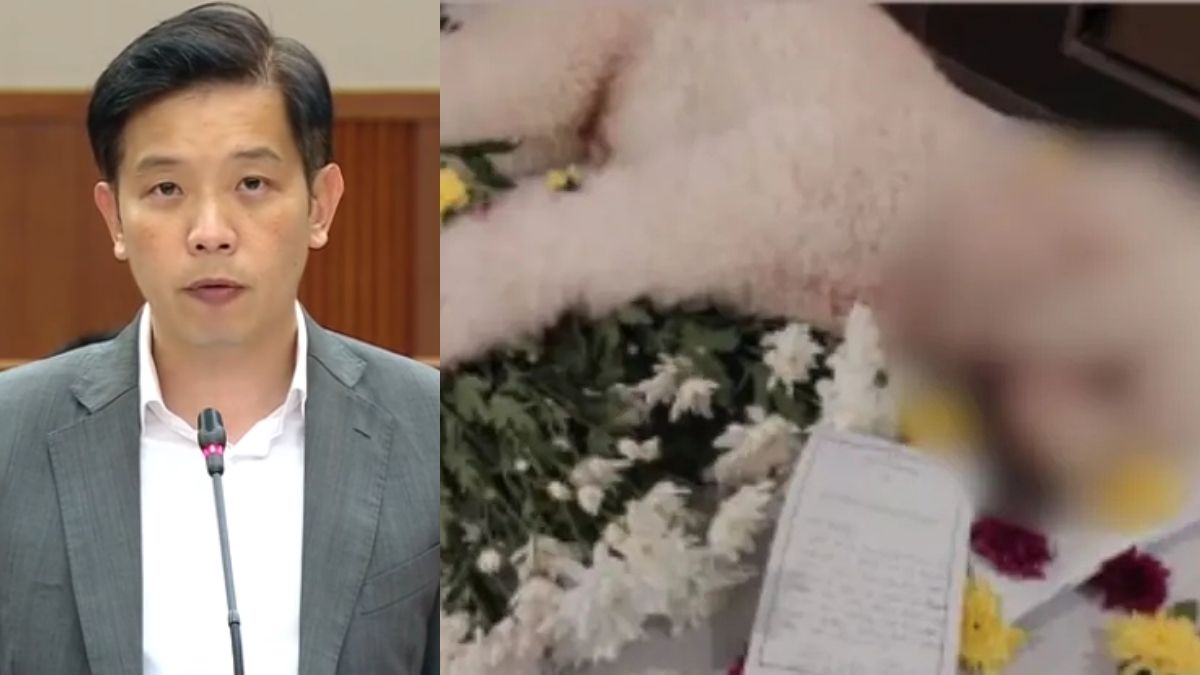

During a 5 November 2025 Parliament sitting, Minister Chee Hong Tat defended Singapore’s family office framework, saying only “a few flies” exist within a well-guarded system. He emphasised that while zero risk is impossible, strong enforcement ensures the city-state remains a trusted financial hub.

- Minister for National Development Chee Hong Tat reaffirmed Singapore’s commitment to stringent anti-money laundering (AML) standards, citing a “less than 1%” incidence rate of wrongdoing among family offices.

- Workers’ Party MPs raised concerns over due diligence, possible regulatory gaps, and whether process streamlining could weaken safeguards.

- The Government clarified that efficiency measures will not compromise standards and that international cooperation remains key to tackling transnational financial crimes.

SINGAPORE: During the 5 November 2025 Parliamentary sitting, Minister for National Development Chee Hong Tat reaffirmed that Singapore’s financial system adheres to high regulatory standards aligned with international norms. He noted that while isolated cases of wrongdoing may occur, the authorities investigate thoroughly and take decisive enforcement action.

Citing ongoing probes involving Chinese businessman Chen Zhi and related associates, Chee highlighted measures such as asset seizures and prohibition-of-disposal orders as examples of rigorous follow-up.

He remarked that Singapore’s system is not risk-free, but the occurrence of offences among single family offices (SFOs) is extremely rare—“less than 1%”.

Chee employed a metaphor to illustrate Singapore’s position:

“If we accept that when we open the windows to let in sunlight and fresh air there will be some flies, I think less than 1% does not mean there are many flies in this house. When we detect those flies, we deal with them firmly.”

He added that Singapore’s approach must not be about eliminating all risk, but about swift detection, decisive enforcement, and maintaining trust.

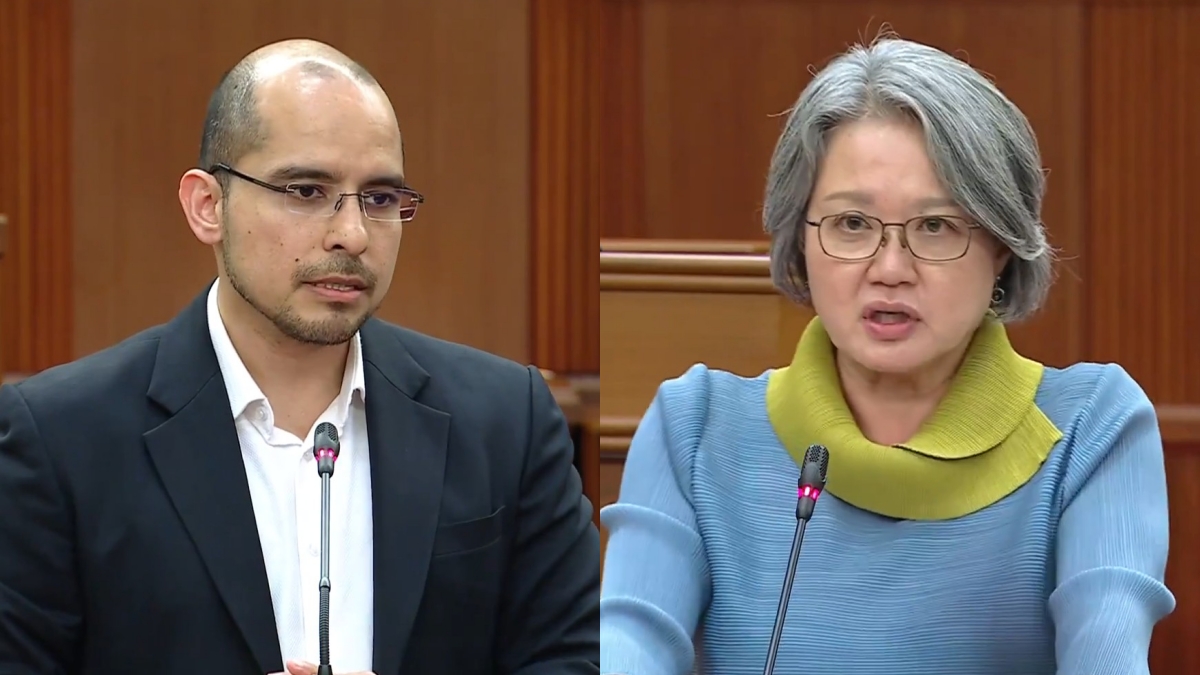

Workers’ Party questions on oversight and due diligence

Workers’ Party Members of Parliament Kenneth Tiong, Sylvia Lim, Louis Chua, He Ting Ru, and Dennis Tan raised a series of questions on the safeguards surrounding family offices and the potential misuse of the regime for money laundering.

Tiong and Lim asked whether any sanctioned or convicted individuals had operated family offices in Singapore, and what due diligence the Monetary Authority of Singapore (MAS) performs to prevent criminal exploitation.

Louis Chua sought clarification on MAS’s awareness of a Cambodia-based transnational criminal network—linked to Chen Zhi and the Prince Group—and whether Singapore entities affiliated with it were investigated before United States sanctions were announced.

He Ting Ru requested data on applications and approvals for tax incentives under sections 13U and 13X of the Income Tax Act over the past decade.

Sylvia Lim further asked whether MAS would consider reducing transaction friction for low-risk, “whitelisted” cases.

In response, Chee revealed that MAS had identified two family offices linked to sanctioned individuals and subsequently revoked their tax incentives.

He explained that all SFOs must undergo screening, maintain Singapore-based bank accounts, and submit annual returns. MAS, he said, continues to refine its regulatory and surveillance frameworks to address evolving risks.

Chee emphasised that the cases of wrongdoing remain minimal, under 1% of the total, and argued for a “risk-proportionate” regulatory stance that preserves Singapore’s competitiveness and reputation as a trusted international financial centre.

Concerns over faster registration process

Sylvia Lim raised a supplementary question referencing Chee’s earlier announcement to shorten the family office registration process—from 12 months to three months—to speed up bank account openings and access to tax incentives.

She questioned whether such acceleration could compromise due diligence and raise money laundering risks.

Chee clarified that streamlining aims to enhance efficiency, not weaken safeguards.

“Singapore is not competing to be the quickest or easiest. Our competitive advantage is being a trusted financial centre,” he said.

He explained that the shorter registration process focuses on reducing administrative back-and-forth and improving clarity through technology and better information sharing, while maintaining rigorous AML checks.

Applicants will still be required to open and maintain bank accounts in Singapore, which remain subject to financial institutions’ due diligence and ongoing monitoring.

Chee stressed that the Government’s goal is to simplify legitimate procedures without eroding standards or compromising enforcement.

He added that the financial services and wealth management sectors support around 13,000 local jobs, and that balanced regulation is essential to sustaining both employment and investor confidence.

Questions on enforcement timing and collaboration

Louis Chua asked why enforcement action against the Chen Zhi-linked network appeared to follow the United States’ sanctions announcement, suggesting the timing could create a perception of reactive rather than proactive action.

Chee responded that Singapore’s authorities had received Suspicious Transaction Reports (STRs) before the US press release and that these were already being assessed by relevant agencies. However, he explained that STRs alone do not constitute evidence of wrongdoing and require corroboration through investigation.

“STRs are early risk signals that must be verified through additional information, including cooperation with international counterparts,” he said.

Chee underscored the need for cross-border collaboration, pointing out that enforcement actions had also been taken in Hong Kong, Taiwan, and the United Kingdom in connection with the same network.

“This is the nature of such operations—it requires global cooperation, intelligence sharing, and coordination,” he added.

Discussion on enhanced AML checks

Dennis Tan sought clarification on whether SFO applications are subject to anti-money laundering checks similar to those conducted by financial institutions and law firms when onboarding new clients. He suggested that the MAS should ensure such checks are embedded at the first point of contact.

Chee replied that the MAS had already proposed a new regulatory framework for SFOs under a “class exemption licensing regime”, which would require SFOs to notify MAS of their presence and comply with specific obligations.

These include maintaining Singapore-based bank accounts, thereby subjecting them to AML controls.

He confirmed that checks occur at two levels: first by the banks during account opening, and again by MAS when assessing tax exemption applications.

“These dual layers ensure that SFOs are screened thoroughly, both by financial institutions and by regulators,” he said.

Chee added that further details of the framework would be released upon implementation, alongside any necessary legislative changes.

Balancing vigilance and openness

Throughout the session, Chee reiterated that Singapore’s AML regime remains strong and internationally respected, but must evolve continuously to address new challenges in global finance.

He emphasised the principle of “risk calibration”, arguing that a zero-risk stance would stifle legitimate economic activity and discourage genuine investors.

“We do not aim for zero risk. The key is to detect wrongdoing early and respond firmly,” he said.