SkyTerrace @ Dawson loft sold for S$1.66 million, over S$1 million profit for seller

A 5-room loft unit at SkyTerrace @ Dawson has sold for S$1.66 million, marking a record price for the development and netting the seller more than S$1 million in profit.

- A 5-room loft flat at SkyTerrace @ Dawson sold for S$1.66 million, generating over S$1 million in profit for the seller.

- The buyer paid an estimated S$222,888 in Cash Over Valuation, reflecting strong demand for prime HDB flats.

- Despite rising prices, the government has warned that million-dollar deals represent a small minority of transactions but risk distorting market expectations.

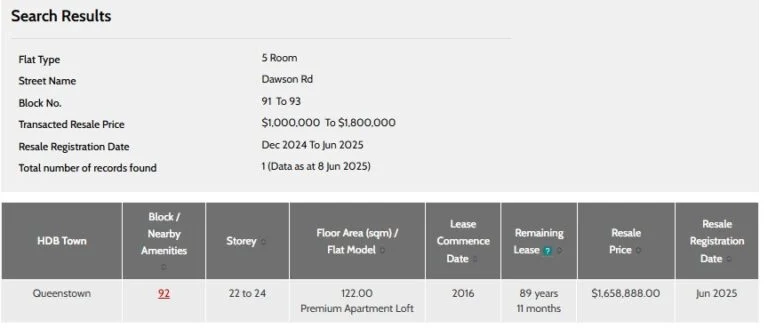

A nine-year-old 5-room loft flat at SkyTerrace @ Dawson in Queenstown has sold for S$1,658,888 in June 2025, setting a new record for the development.

The 1,313 sq ft unit, located on the 22nd to 24th floors of Block 92 Dawson Road, transacted at S$1,263 per square foot. According to HDB records, it has about 89 years and 11 months remaining on its lease, having recently reached its Minimum Occupation Period (MOP).

Over S$1 million in capital gains

SkyTerrace @ Dawson was launched as part of the Build-To-Order (BTO) exercise in December 2009, with 5-room units originally priced at around S$532,000.

The latest transaction therefore represents a capital gain of roughly S$1,126,888—or 102.9 per cent—before factoring in fees, taxes, and subsidies.

Property data from 99.co estimated the market value of the unit at around S$1.43 million. This suggests the buyer may have paid S$222,888 in Cash Over Valuation (COV), underscoring the demand for such high-rise loft apartments.

Not the most expensive resale flat on record

Despite the significant profit margin, the Dawson flat sale does not surpass Singapore’s highest HDB resale transaction—S$1.73 million for a SkyOasis @ Dawson unit in June 2024. That deal, however, does not appear in HDB’s official database.

SkyOasis is located about a nine-minute walk from SkyTerrace, indicating that Dawson’s location and design continue to command high premiums among buyers.

Minister warns of distorted expectations

At an August 2024 media briefing, then-National Development Minister Desmond Lee acknowledged concerns about surging resale prices. He noted that flats transacting above S$1 million still represented only 0.5 per cent of four-room or smaller flat sales over the past two years.

“These flats are usually in central locations, high floors, and close to MRT stations and amenities,” Lee said.

He cautioned that media reports of record-breaking transactions could skew market sentiment.

“Flat sellers who are reading such news raise their expectations, while flat buyers become anxious to secure flats before prices get higher. If we are not careful, such market dynamics can cause the resale market to run out of line with economic fundamentals and cause a bubble,” Lee said during the 5 March 2025 Budget debate.

Rising demand for premium resale flats

The Housing and Development Board (HDB) reported in January 2025 that resale flat prices climbed by 9.7 per cent in 2024. This followed a 4.9 per cent increase in 2023 and a 10.4 per cent surge in 2022.

While the last quarter of 2024 saw resale transactions fall by 21.1 per cent, the year closed with 28,986 units sold—the highest annual volume in over a decade.

A record 1,035 resale flats crossed the million-dollar mark in 2024, highlighting sustained interest in well-located, high-specification properties.

0 Comments