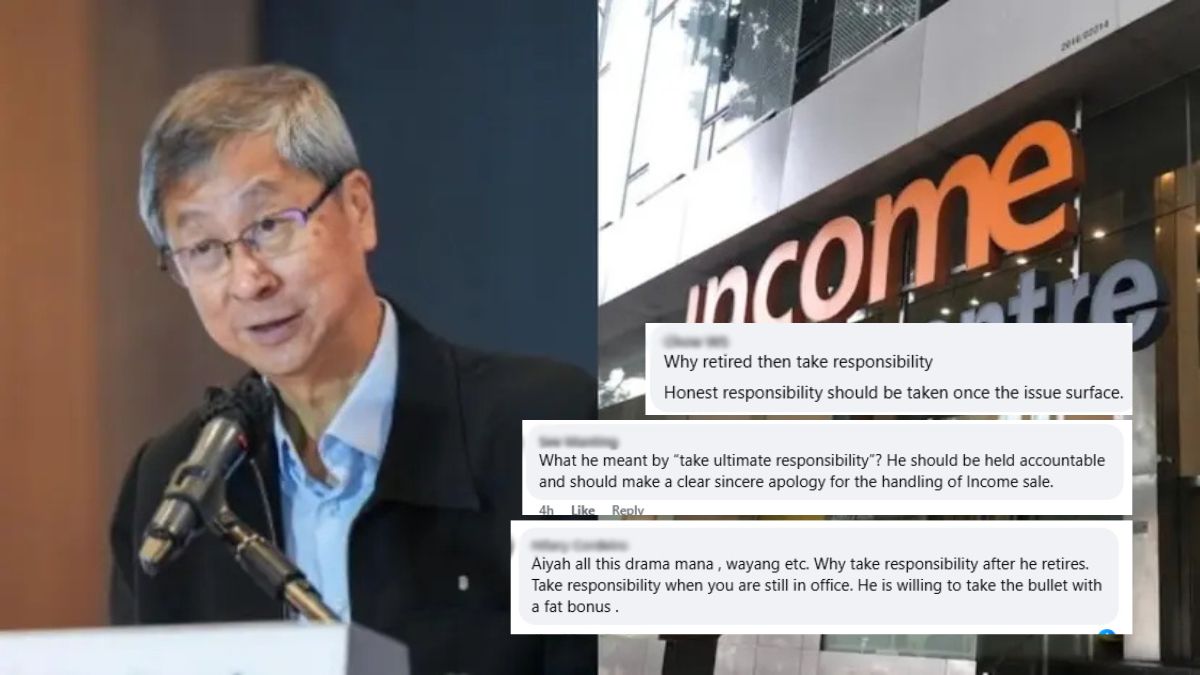

Lim Boon Heng steps down as NTUC Enterprise chairman, taking responsibility for failed Income-Allianz deal

Lim Boon Heng steps down as NTUC Enterprise chairman, taking “ultimate responsibility” for the failed Allianz-Income deal. His successor, Tan Hee Teck, will lead efforts to strengthen governance and stakeholder communication.

- Lim Boon Heng retires as chairman of NTUC Enterprise, citing responsibility for the failed Income-Allianz partnership.

- The government blocked the proposed S$2.2 billion (US$1.6 billion) deal in 2024 amid public concerns over Income’s social mission.

- Tan Hee Teck appointed as the new chairman, with the board pledging to strengthen governance and communication.

SINGAPORE: NTUC Enterprise announced on 30 October 2025 that its chairman, Lim Boon Heng, has retired, marking the end of a decade of leadership.

The announcement, made at the cooperative’s extraordinary general meeting (EGM), follows the collapse of a proposed strategic partnership between Income Insurance and Allianz.

Tan Hee Teck was elected to the NTUC Enterprise board and will assume the chairmanship from 31 October.

The board stated that it “fully supports” NTUC’s nomination of Tan, who is expected to continue efforts to enhance the portfolio’s financial resilience and social impact.

Lim, 77, expressed regret over the failure of the proposed deal, saying:

“It is with some regret that what I have invested much time and thought in securing Income’s future through a strategic partnership has not come to fruition. Unfortunately, Allianz’s proposed offer for Income was withdrawn and I take ultimate responsibility.”

Under Lim’s tenure, NTUC Enterprise’s revenue grew from S$6.5 billion (US$5 billion) in 2014 to S$8.2 billion (US$6 billion) in 2024, with a net asset value of S$4.6 billion (US$3.3 billion) across its businesses, charities and investment arms.

Background to the Allianz-Income proposal

The proposed deal would have seen Allianz acquire a 51 per cent stake in Income for approximately S$2.2 billion (US$1.6 billion). The partnership aimed to strengthen Income’s capital base and expand its regional reach.

However, the plan drew strong public criticism over whether Income, originally a cooperative founded to serve working Singaporeans, could maintain its social mission under foreign ownership.

In October 2024, the government blocked the deal, citing concerns about the cooperative’s purpose and stakeholder interests. Allianz subsequently withdrew its offer.

Internal review and findings

Lim revealed that NTUC Enterprise had commissioned legal firm Lee & Lee to review its conduct regarding both the corporatisation of Income and the Allianz proposal.

The review found no evidence of legal breaches, concluding that actions taken were consistent with the Co-operative Societies Act and Rules.

Lim emphasised that NTUC Enterprise had “always acted in good faith,” but acknowledged communication shortcomings.

“NTUC Enterprise could have been clearer and more explicit with stakeholders about opportunities to improve capital resilience and efficiency through the Allianz offer,” he said.

“We could also have been more proactive in public communications.”

The board stated that lessons from the episode would inform future governance and stakeholder engagement practices.

Legacy and succession

Reflecting on his retirement, Lim said: “It has been a privilege to serve and lead NTUC Enterprise alongside directors and managements across the portfolio with wide experience, deep expertise, and strong alignment to the purpose and social mission of the NTUC.”

He added confidence that the organisation would continue to grow “in market competitiveness and financial resilience, anchored on purpose.”

NTUC Secretary-General Ng Chee Meng praised Lim as “a giant of the labour movement” whose career embodied dedication and integrity.

“From his time as NTUC secretary-general to his leadership of NTUC Enterprise, his impact is immeasurable,” Ng said.

“The foundation he built, based on a deep sense of mission and integrity, will continue to guide our efforts forward.”