CPF Basic Healthcare Sum to rise to S$79,000 from 2026; interest rates unchanged

From 1 January 2026, the Basic Healthcare Sum will rise to S$79,000 for CPF members under 65, while interest rates across CPF accounts will remain unchanged in the first quarter of 2026, according to a joint statement by the CPF Board, MOH and HDB.

- Basic Healthcare Sum (BHS) for CPF members under 65 will increase to S$79,000 from 1 January 2026.

- CPF interest rates for all accounts remain unchanged for the first quarter of 2026.

- Higher interest benefits continue to support retirement savings, particularly for older members.

The Basic Healthcare Sum (BHS) for Central Provident Fund (CPF) members below 65 years of age will be raised from S$75,500 to S$79,000 starting 1 January 2026, according to a joint announcement by the CPF Board, Ministry of Health (MOH), and Housing & Development Board (HDB) on 15 December 2025.

Members turning 65 in 2026 will have their BHS fixed at S$79,000, a value that will remain unchanged for the rest of their lives. For individuals aged 66 and above in 2026, their BHS remains unaffected, as it was already fixed when they turned 65.

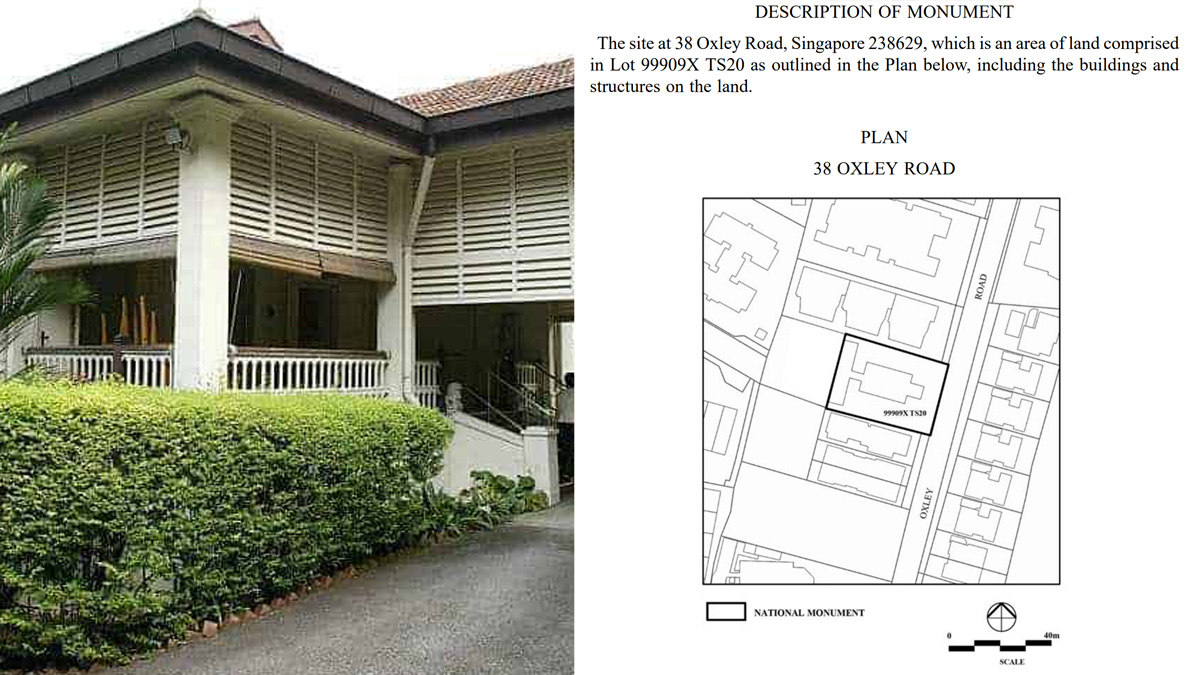

The BHS represents the estimated MediSave savings a person is expected to need for basic subsidised healthcare expenses in old age. It is reviewed annually for those under 65 to reflect evolving healthcare needs and costs.

Interest rates for CPF accounts will remain at their current floor levels for the period from 1 January to 31 March 2026. The Special, MediSave and Retirement Accounts will continue to earn an annual interest of 4 per cent, while the Ordinary Account (OA) will yield 2.5 per cent.

The concessionary interest rate for HDB housing loans, which is pegged at 0.1 per cent above the OA rate, will also remain unchanged at 2.6 per cent per annum for the first quarter of 2026.

To further support retirement adequacy, CPF members will continue to receive additional interest on their balances. Members below 55 years of age will earn an extra 1 per cent on the first S$60,000 of their combined balances, capped at S$20,000 for the OA.

For those aged 55 and above, the Government will pay an extra 2 per cent interest on the first S$30,000 of combined balances, and an additional 1 per cent on the next S$30,000. The OA component of this extra interest is credited to the member’s Special or Retirement Account.

Members who participate in CPF Life—a lifelong monthly payout scheme commencing at age 65—will continue to earn the extra interest on the savings allocated to CPF Life, as part of their combined balances.

The CPF Board also clarified that members can continue to make MediSave contributions up to the prevailing BHS. Contributions exceeding the BHS limit will be automatically transferred to other CPF accounts. Importantly, members with balances below the BHS can still make withdrawals from their MediSave Accounts to pay for approved medical expenses and are not required to top up the account first.

More details on the BHS and CPF interest rates are available on the CPF website at cpf.gov.sg/BHS.

0 Comments