More Singaporeans living paycheck to paycheck as costs climb and wages stagnate

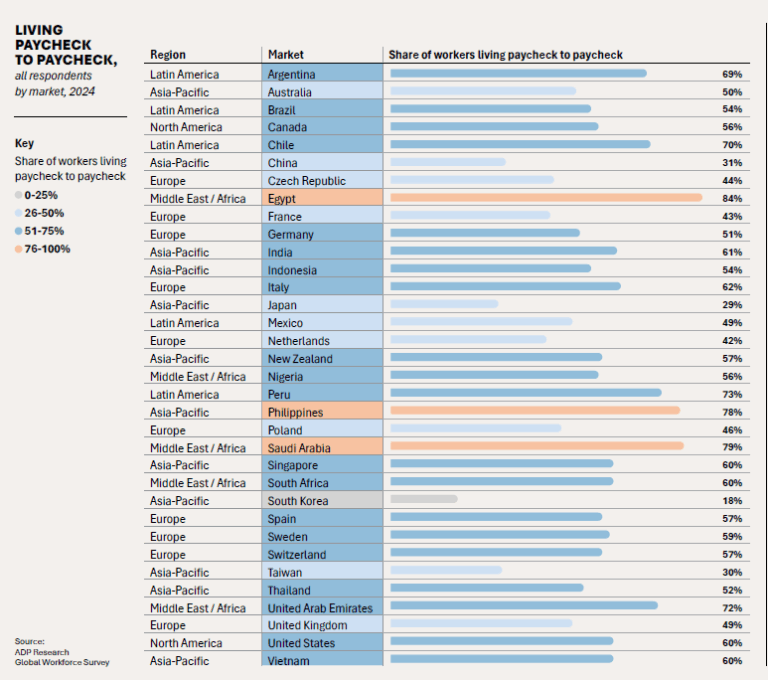

Singapore’s long-standing reputation as a nation of savers is eroding, with six in 10 workers now living paycheck to paycheck — one of the highest rates in Asia. Rising living costs, stagnant real wages, and changing lifestyle priorities have left even full-time employees struggling to build financial buffers, a new ADP report shows.

- 60% of Singaporean workers live paycheck to paycheck — above the Asia-Pacific average of 48%, and higher than Japan, China, and South Korea.

- Real median income growth has slowed sharply while housing, food, and transport costs continue to rise.

- Younger workers are prioritising lifestyle and self-care spending over traditional saving, deepening short-term financial strain.

SINGAPORE: Singapore’s standing as a nation of savers is weakening, as more workers find themselves living paycheck to paycheck despite being in full-time employment.

According to ADP’s People at Work 2025: A Global Workforce View, 60% of Singaporean workers reported living paycheck to paycheck in 2024.

This places Singapore above the Asia-Pacific average of 48%, and notably higher than Japan (29%), China (31%), and South Korea (18%).

This marks a steep rise from 2021, when a Forrester Research study placed the figure at 53%.

The ADP survey, covering nearly 38,000 workers in 34 markets — including over 1,000 from Singapore — suggests that even multiple income sources are failing to guarantee financial stability.

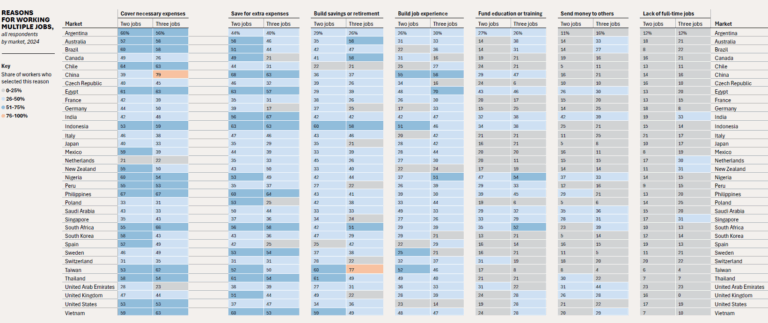

Multiple jobs fail to close the income gap

Among Singaporeans with two or more jobs, 60% still lived paycheck to paycheck, mirroring global findings that side jobs rarely offset the rising cost of living.

While inflation is a major driver, ADP’s data also points to underemployment and lifestyle factors.

About 35% of Singaporeans with two jobs and 31% with three cited the lack of full-time opportunities as a reason. Others said they worked extra to save for retirement (37%) or fund education (33%).

A quarter viewed their side jobs as ways to gain experience or diversify skills.

Living costs climb to region’s highest

Singapore topped the Asia-Pacific in Numbeo’s mid-2025 Cost of Living Index — and ranked fifth globally.

The index rose 11% year-on-year, with housing, food, and transport among the key contributors.

Resale HDB flat prices surged 9.6% in 2024, nearly doubling the previous year’s growth, while real median employment income fell by 0.4% annually between 2019 and 2024, according to Maybank Research.

Although wages slightly rebounded in 2024, analysts expect moderation in 2025, particularly in tariff-affected sectors.

Lifestyle spending shifts financial priorities

ADP’s report noted that lifestyle spending is eroding savings discipline.

Many workers — particularly in their 20s to 40s — prioritise experiences, fitness, and luxury goods over long-term savings, even as CPF contributions remain mandatory.

OCBC’s 2024 financial wellness report found that fewer Singaporeans aged 25–54 are actively planning for retirement compared to the previous year.

Credit and short-term liquidity pressures

Singapore’s reliance on credit continues to grow.

‘Buy now, pay later’ (BNPL) schemes expanded nearly fourfold from 2020 to 2021, hitting S$440 million in transactions, and are expected to make up 6% of e-commerce payments by 2028, according to the Monetary Authority of Singapore.

While flexible work arrangements have brought some freedom, ADP found that 47% of Singaporean workers feel constantly monitored by managers — among the highest rates in Asia-Pacific — adding to workplace stress.

Rising stress and social disparities

Although daily workplace stress fell from 15% to 4% in 2024, only 26% of workers described themselves as “thriving,” up from 15%.

Among minority workers, that figure dropped to just 6%, compared to 37% for non-minorities — the widest well-being gap in the region.

ADP noted that structural pressures, high costs, and shifting values are reshaping Singapore’s economic identity — where living paycheck to paycheck has become not an exception, but a new middle-class norm.