Singaporean director quits 17Live after US sanctions over alleged Cambodian scam links

Karen Chen Xiuling has resigned as an independent director of 17Live Group after being placed on the US sanctions list for alleged links to Cambodian businessman Chen Zhi, accused of running global scam compounds. The company clarified that Karen Chen was not involved in its operations and had resigned voluntarily on 15 October.

- Singaporean director Karen Chen Xiuling resigned from 17Live Group after being sanctioned by the US.

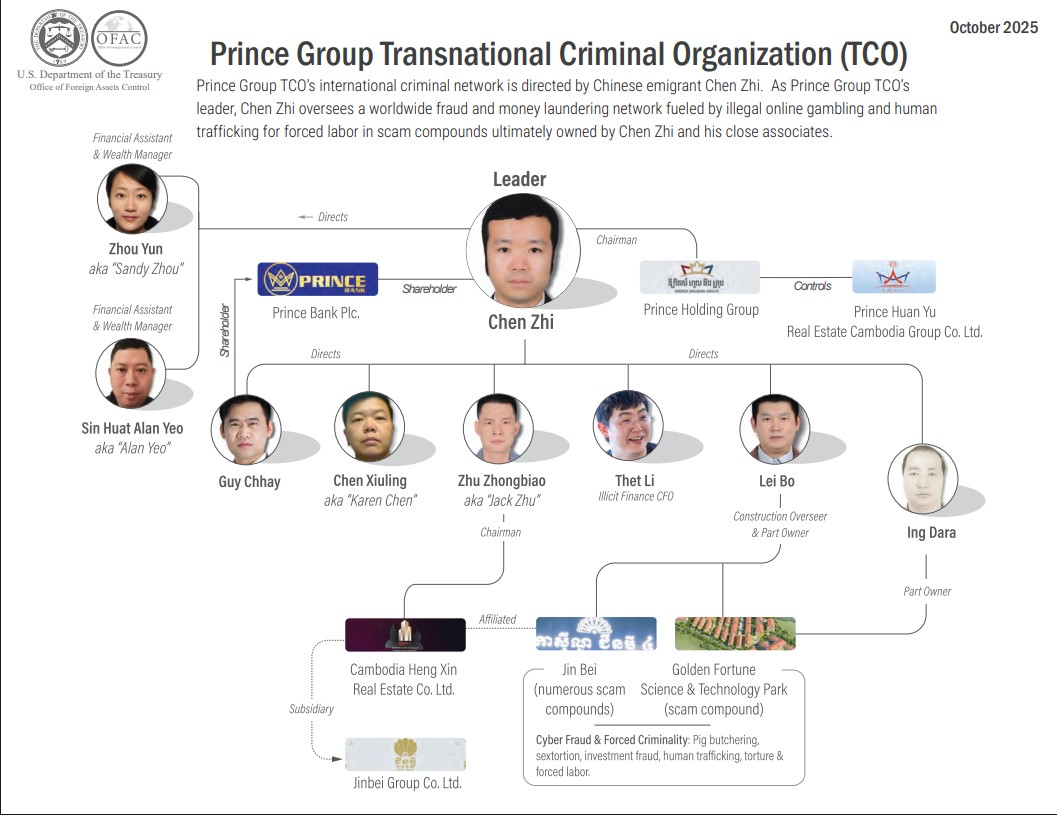

- She is among three Singaporeans and 17 entities linked to Cambodian tycoon Chen Zhi’s alleged scam network.

- The US Treasury accuses Prince Holding Group of running global forced-labour scam operations.

SINGAPORE: An independent director of Singapore-listed 17Live Group, Karen Chen Xiuling, has resigned after she was added to the United States sanctions list for alleged links with a Cambodian businessman accused of operating a global scam network involving forced labour.

According to a filing with the Singapore Exchange (SGX) on 16 October, Chen resigned voluntarily from her position as an independent director on 15 October.

She is among three Singaporeans and 17 Singapore-registered entities newly added to the US Specially Designated Nationals and Blocked Persons list, which bars American individuals and corporations from conducting business with listed parties.

The list is administered by the US Department of the Treasury’s Office of Foreign Assets Control (Ofac), which oversees the enforcement of international sanctions and anti-money-laundering measures.

Links alleged to Cambodian tycoon Chen Zhi

A report by The Business Times on 15 October stated that Chen and two other Singaporeans were allegedly involved in the business dealings of Chen Zhi, the 37-year-old founder of Prince Holding Group, one of Cambodia’s largest conglomerates.

On 14 October, US and British authorities charged Chen Zhi with conspiracy to commit wire fraud and money laundering for his role in directing forced-labour scam operations across Cambodia.

According to the US Department of Justice and Treasury, individuals were detained in compounds run by Prince Holding Group and coerced into perpetrating cryptocurrency investment frauds, commonly referred to as “pig-butchering” scams.

These schemes are believed to have stolen billions of US dollars from victims worldwide.

17Live clarifies non-involvement

In its SGX filing, the board of 17Live stated it “has interacted with Chen in her role as independent director”, but emphasised that she was not involved in the company’s business or operations beyond her oversight functions.

The statement added that 17Live had never engaged in business with Chen personally, her employer DW Capital Holdings, or Chen Zhi.

Chen, 43, joined 17Live as an independent director in December 2023.

The live-streaming platform was listed on the Singapore Exchange in 2023 following its merger with Vertex Technology Acquisition Corporation, Singapore’s first special-purpose acquisition company backed by Temasek subsidiary Vertex Venture Holdings.

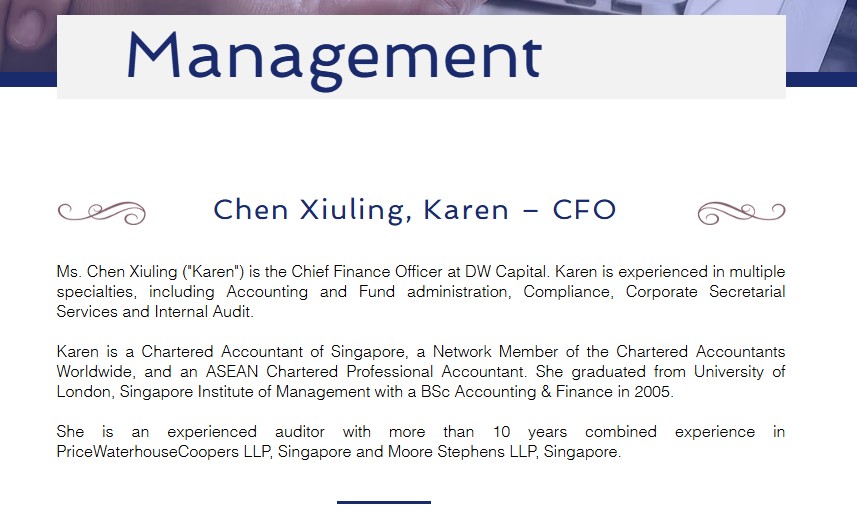

Background on DW Capital and Chen’s professional role

DW Capital Holdings, where Chen serves as chief financial officer, manages assets of about US$60 million for single-family offices in Singapore, according to its website.

She is an experienced auditor with over a decade of experience in financial oversight.

The US Treasury claims that Chen oversees Prince Holding Group’s companies in Mauritius, Taiwan, and Singapore.

Ofac also stated that she is listed as the ultimate owner of several corporate entities controlled by the group, many of which share the same Singapore business address.

The Business Times reported that Chen is a director, company secretary, or both in all 17 Singapore-registered entities included in the US sanctions.

Chen expresses surprise at sanctions listing

According to Chinese-language daily Lianhe Zaobao, Chen said she was on annual leave when contacted by reporters and was “shocked” to learn of her inclusion on the sanctions list.

She confirmed her financial role in companies associated with Chen Zhi, including payroll management, but declined to comment on the sources of company funds.

She added that she intends to seek legal advice before issuing any further statement.

Prince Group and its alleged criminal operations

Prince Holding Group, led by Chen Zhi, has expanded since 2015 into what it describes as a multinational conglomerate spanning real estate, finance, and consumer sectors across more than 30 countries.

However, according to Ofac’s statement, the organisation operates as a transnational criminal network.

The group is accused of controlling scam compounds in Cambodia, using trafficked labour to execute investment frauds.

Several senior associates of Chen Zhi were also sanctioned, including Guy Chhay, Lei Bo, Ing Dara, Zhu Zhongbiao (also known as Jack Zhu), Sin Huat Alan Yeo, Zhou Yun (also known as Sandy Zhou), Wei Qianjiang, and Thet Li.

These individuals allegedly managed properties, financial operations, or illicit finance networks connected to the Prince Group.

Among them, Karen Chen, Alan Yeo, and Tang Nigel Wan Bao Nabil are listed as Singapore-born.

Notably, Ofac records indicate that Alan Yeo also holds a Chinese passport, despite Singapore prohibiting dual citizenship for adults.

Business Times reported that Karen Chen is linked to a portfolio of Singapore-registered entities, including the leisure craft firms Warpcapital Yacht Management and Cloud Xero Management, both of which were among the sanctioned entities.

Handshakes data further shows that these two companies share a Jalan Kilang Barat address with at least 20 other Karen Chen-linked businesses, such as Capital Zone Warehousing.

Warpcapital Yacht Management, Cloud Xero Management and Capital Zone Warehousing (旭昊集团有限公司) also list Nigel Tang Wan Bao Nabil – the second Singaporean sanctioned for his association with Chen Zhi – as a director.

The 32-year-old is head of operations at Capital Zone Warehousing, which provides storage solutions for luxury items such as wines, whiskies, fine teas and cigars, and distributes premium handmade cigars in Singapore.

He is also the sole director and a shareholder of Quantum Yacht Asia, a luxury yacht brokerage and management company, and is listed as a partner in the food business Lauuk House.

The third Singaporean sanctioned over links to Chen Zhi is Alan Yeo.

According to the US Department of Justice, The 53-year-old acts as Chen Zhi’s financial assistant and wealth manager, handling large wire transfers, liaising with banks, managing accounts and helping conceal the group’s corrupt activities.

Regulatory filings cited by Handshakes indicate that Yeo previously owned several companies, including the management consultancy Redog Global Services, computer hardware retailer Nagami Asia and general wholesaler Summer Stream Impex.

Scope of US action against Prince Group network

The US Treasury designated Prince Holding Group as a transnational criminal organisation under Executive Order 13581.

Ofac’s sanctions extended to 146 affiliated individuals and entities across multiple jurisdictions.

A concurrent order by the Financial Crimes Enforcement Network (FinCEN) severed Huione Group’s access to the US financial system, citing its role in laundering proceeds linked to Prince Group’s criminal activities.

Among the targeted assets were companies registered in Singapore and controlled by Chen, including entities that managed Chen Zhi’s luxury yacht.

Global financial and legal implications

Prosecutors allege that Prince Group’s network extended into New York through local intermediaries that channelled funds from over 250 victims.

US Attorney Joseph Nocella Jr. described the case as one of the largest investment frauds in history, carried out using forced labour and extreme violence.

He emphasised that enforcement agencies will pursue transnational criminal actors “regardless of jurisdiction or political protection”.

If convicted, Chen Zhi faces a maximum sentence of 40 years’ imprisonment. Authorities confirmed he remains at large.

The Department of Justice said it will continue pursuing associated assets and individuals, calling the sanctions and asset seizures a landmark step in international financial enforcement.