U.S. indicts Prince Group chair and seizes US$15B in Bitcoin in largest-ever cyberfraud case

U.S. authorities have filed criminal charges against Prince Group chairman Chen Zhi for directing a global investment scam operation fuelled by forced labour in Cambodia. A simultaneous forfeiture action targets 127,000 Bitcoin linked to the scheme. Singapore-linked companies were cited in related Treasury documents.

- The U.S. Department of Justice has indicted Prince Group chairman Chen Zhi for directing a global fraud scheme involving forced-labour compounds in Cambodia.

- A record US$15 billion in Bitcoin linked to the scam has been seized by U.S. authorities in the largest forfeiture action in Justice Department history.

- The Treasury has previously cited Singapore-based companies linked to Prince Group as part of the laundering network used to move and conceal criminal proceeds.

The U.S. Department of Justice has filed what it describes as the largest forfeiture action in its history, alongside the unsealing of a criminal indictment against Chen Zhi, chairman and founder of Cambodia’s Prince Holding Group.

The case, brought by the U.S. Attorney’s Office for the Eastern District of New York and the Department’s National Security Division, accuses Chen — a Fujian-born, naturalised Cambodian citizen — of conspiracy to commit wire fraud and conspiracy to commit money laundering. The indictment states that Chen directed Prince Group’s operation of forced-labour scam compounds across Cambodia, which executed online cryptocurrency investment scams.

According to prosecutors, the scam networks stole billions of dollars from victims in the United States and other countries. The fraudulent operations involved trafficking and confining workers in prison-like conditions where they were forced to conduct scams known as “pig butchering”. These elaborate schemes involved cultivating false relationships with victims before stealing their funds through fake cryptocurrency platforms.

As part of the action, the Justice Department has also filed a civil forfeiture complaint against approximately 127,271 Bitcoin, valued at around US$15 billion. These assets, referred to as the “Defendant Cryptocurrency”, were held in unhosted wallets controlled by Chen. The forfeiture filing describes these funds as both the proceeds and instrumentalities of wire fraud and money laundering offences. The assets are now in the custody of the U.S. government.

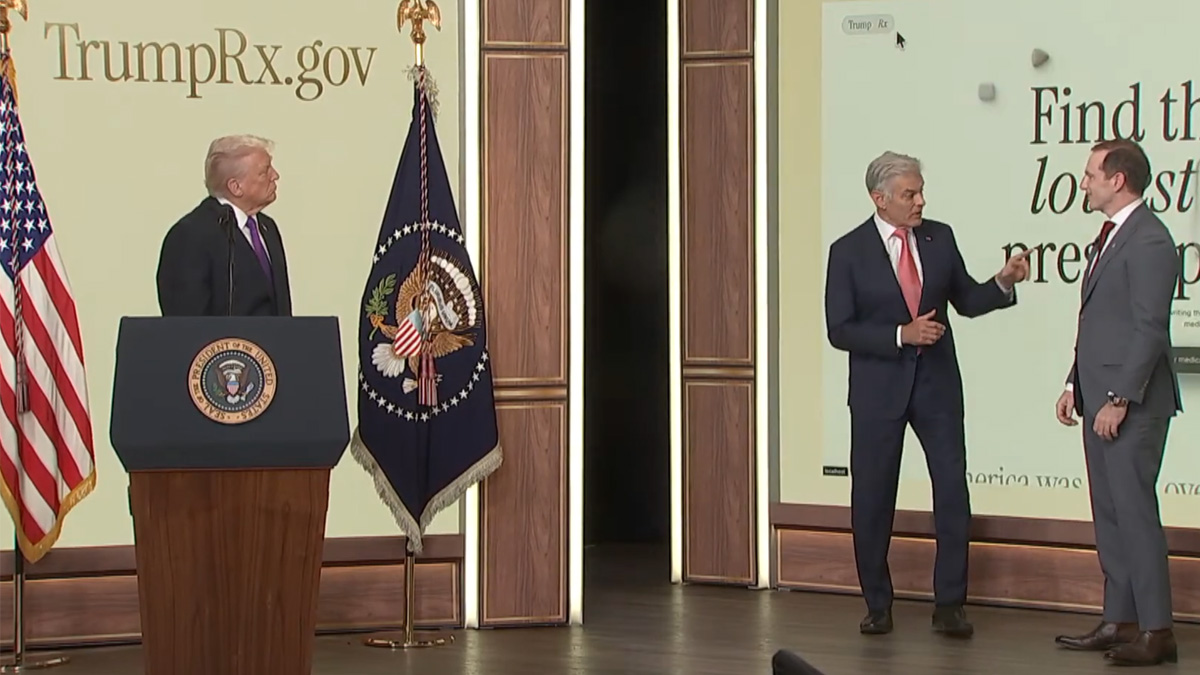

Attorney General Pamela Bondi stated that the indictment marks one of the most significant actions ever taken against human trafficking and cyber-enabled fraud. FBI Director Kash Patel added that the takedown involves one of the largest criminal operations of its kind, spanning continents and affecting millions of victims.

The indictment alleges that Chen personally oversaw the operation of scam compounds, maintained detailed ledgers on profit tracking, and was involved in violent disciplinary practices. Documents seized by investigators included internal communications about beating workers who resisted or attempted to escape, including instructions not to kill them but to use violence.

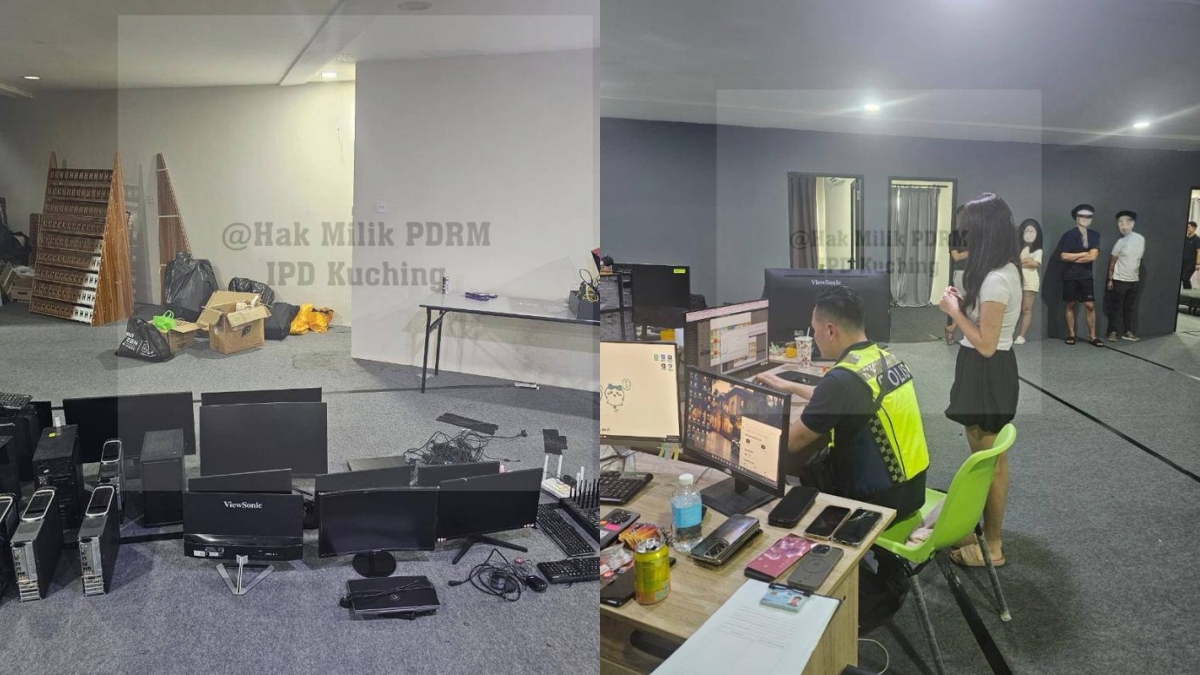

Photographic evidence recovered from Chen allegedly depicts torture, confinement, and the infrastructure of fraud — including diagrams of so-called “phone farms”, automated centres using thousands of phones to execute scams on an industrial scale.

Prosecutors also claim that Chen and his top executives used their influence in multiple jurisdictions to bribe public officials and obstruct law enforcement. The proceeds from these crimes were laundered through sophisticated techniques, including disaggregation and reconsolidation of cryptocurrency transactions, also known as “spraying” and “funnelling”.

The laundered assets were routed through Prince Group’s own commercial network, which includes banking, real estate, online gambling, and crypto mining operations. The indictment notes that Chen once boasted the profit margins were unmatched because “there is no cost” — the capital came from defrauded victims.

Proceeds from the scam network were allegedly used to finance luxury travel, entertainment, and high-end purchases, including yachts, private jets, art, and rare collectables. The Department states that one of the criminal proceeds was a Picasso painting, bought through an auction house in New York.

Since 2015, Prince Group has grown into a multinational conglomerate with operations in over 30 countries. The group publicly describes itself as a real estate, financial services, and consumer business empire, but the indictment claims it is in fact one of Asia’s largest transnational criminal organisations.

The U.S. Treasury had already designated Prince Group as a transnational criminal organisation on the same day and imposed sanctions on 146 affiliated individuals and entities.

A concurrent measure from FinCEN cut Huione Group off from the U.S. financial system for laundering proceeds tied to Prince Group and other criminal actors.

Within those materials, the Treasury cited entities registered in Singapore and controlled by Karen Chen, a Prince Group executive. The companies shared a single Singapore address and included a holding company for Chen Zhi’s luxury yacht. While these entities are not named in the Justice Department indictment, they remain part of the broader network under scrutiny.

Prince Group’s operations extended into New York through a local network that facilitated money transfers from over 250 victims. Prosecutors say this underscores the domestic financial impact of what was structured as a foreign operation.

U.S. Attorney Joseph Nocella Jr. described the fraud as one of the largest investment scams in history, executed with the use of trafficked labour and extreme violence. He stressed that enforcement agencies would pursue such actors globally, regardless of jurisdiction or political protection.

If convicted, Chen faces a maximum sentence of 40 years in prison. He remains at large at the time of publication.

The Department of Justice has committed to pursuing additional assets and co-conspirators. The forfeiture action represents a landmark in the use of cryptocurrency seizure powers and is expected to prompt further global cooperation in tracing illicit digital assets.