HDB resale prices rise 0.9% in Q2 2025 — slowest quarterly growth in five years

HDB resale prices in Singapore rose 0.9% in the second quarter of 2025, marking the smallest quarterly increase since mid-2020. While overall price momentum has slowed, transactions of million-dollar flats continue to hit new records, reflecting strong demand for prime units.

- HDB resale prices up 0.9% quarter-on-quarter, slowest rise since Q2 2020.

- 6,981 transactions recorded — down 5% from a year earlier.

- 415 resale flats sold for S$1 million or more, a new quarterly high.

SINGAPORE: Prices for HDB resale flats in Singapore increased by 0.9% quarter-on-quarter in Q2 2025, according to flash estimates released by the Housing and Development Board (HDB) on 1 July 2025.

This marks the third consecutive quarter of slower growth, and the smallest quarterly rise in resale prices since Q2 2020.

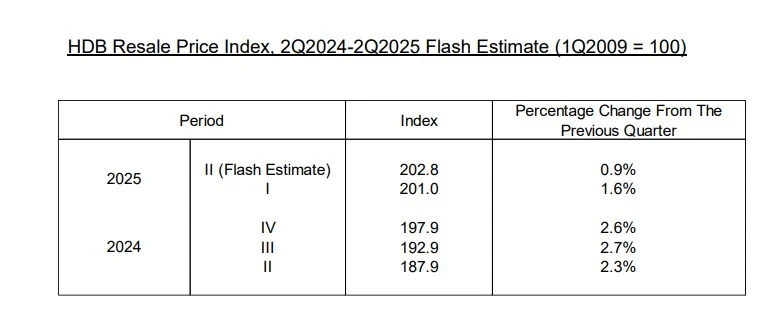

The Q2 2025 increase represents a further decline from the 1.6% rise in Q1 2025 and the 2.6% growth seen in Q4 2024.

The latest HDB resale price index suggests that momentum in the market is softening, in line with broader economic trends and recent property cooling measures.

HDB also reported that 6,981 resale transactions were recorded up to 29 June 2025 — a 5% drop compared to the 7,347 units sold during the same period last year.

HDB urged prospective buyers and sellers to be cautious, citing signs of a slowing economy and increasing external pressures, such as escalating global trade tensions and softening labour demand.

“Given the highly uncertain macroeconomic outlook, households should continue to exercise prudence when purchasing properties and taking on mortgage loans,” the agency stated.

New housing supply to be launched

In response to demand and as part of ongoing housing efforts, HDB will launch around 5,500 Build-to-Order (BTO) flats in July 2025.

These will be spread across several towns including Bukit Merah, Bukit Panjang, Clementi, Sembawang, Tampines, Toa Payoh, and Woodlands.

In parallel, a Sale of Balance Flats (SBF) exercise featuring about 3,000 units will also be conducted.

With 5,590 SBF flats launched earlier in February, total SBF supply for the year will exceed 8,500 units.

PropNex revises full-year price forecast

According to PropNex Realty’s Head of Research and Content, Wong Siew Ying, the latest figures signal a healthier pace of growth.

“Taking into account the flash estimates, resale flat prices have risen by a cumulative 2.5% in 1H 2025, and we expect the price increase ahead to likely be modest amid the injection of new flat supply and cooling measures working through the market,” said Wong.

She now anticipates HDB resale prices could rise by 4% to 5% for the full year — lower than the earlier projection of 5% to 7%.

With resale price growth easing and Q2 marking potentially the slowest quarterly increase in five years, Wong suggested it may be timely for the government to reconsider the 15-month wait-out period.

This rule affects private homeowners who wish to purchase an HDB resale flat, and revisiting it could help right-size demand in the market.

Million-dollar flats hit record highs

Despite slowing price growth, the number of HDB resale flats sold for S$1 million or more continued to surge.

According to PropNex, 415 such units were transacted in Q2 2025 — a 19% increase from the 348 units in Q1 — setting a new quarterly high.

These million-dollar flats accounted for around 6% of total resale transactions during the quarter.

By flat type, the Q2 total included 168 four-room flats, 129 five-room flats, 116 executive flats, and two multi-generational units — all record figures for their categories.

Record-breaking transactions expected for 2025

In June, a five-room resale flat at Dawson Road in Queenstown fetched nearly S$1.659 million, marking the highest recorded resale price for an HDB flat.

The 122-sq m premium loft unit was located between the 22nd and 24th floors.

While it marks the highest 5-room HDB resale transaction on public record, the most expensive flat remains a S$1.73 million unit at SkyOasis @ Dawson in June 2024.

Over the first half of 2025, the number of million-dollar HDB flats sold exceeded 100 units every month, bringing the estimated total to 763 units.

Toa Payoh led in million-dollar transactions, with 148 units sold in areas such as Bidadari Park Drive, Alkaff Crescent, Lorong 1A Toa Payoh, and Toa Payoh East.

PropNex expects over 1,300 such transactions by year-end, potentially surpassing the record of 1,035 units in 2024.