Record S$1.27 million HDB executive resale flat sold in Woodlands in October 2025

An executive HDB flat in Woodlands has set a new record after being sold for S$1.27 million in October 2025, surpassing the previous town record of S$1.19 million. The sale underscores the continued strength of Singapore’s public housing resale market, particularly for large and well-located units.

- An executive HDB flat in Woodlands sold for a record S$1.27 million in October 2025.

- The sale surpassed the previous Woodlands record of S$1.19 million set in June 2025.

- The transaction highlights the growing demand for premium resale flats even in non-mature estates.

An executive Housing and Development Board (HDB) flat in Woodlands has changed hands for S$1.27 million, setting a new record for the northern estate.

According to HDB’s official resale transaction portal, the property is located at Block 850 Woodlands Street 82.

The 1,905-square-foot unit, situated between the 10th and 12th storeys, achieved the record price in October 2025.

This sale surpassed the previous Woodlands benchmark of S$1.19 million for another executive flat at Block 816 Woodlands Street 82, which was sold in June 2025.

That earlier unit was similarly sized and located on a comparable floor level.

The record-setting flat benefits from strong connectivity and nearby amenities. It is just a four-minute walk from Woodlands North Plaza and 10 minutes from 888 Plaza.

The estate also offers convenient transport access, being about 1km from Woodlands MRT station, which serves both the North–South Line and the Thomson–East Coast Line.

Residents can also access the Woodlands bus interchange and nearby facilities such as Causeway Point and Woodlands Civic Centre, providing an array of shopping, dining, and entertainment options.

For families, the location offers proximity to several schools, including Evergreen Primary and Secondary Schools and Woodlands Primary School, all situated within 1km of the block.

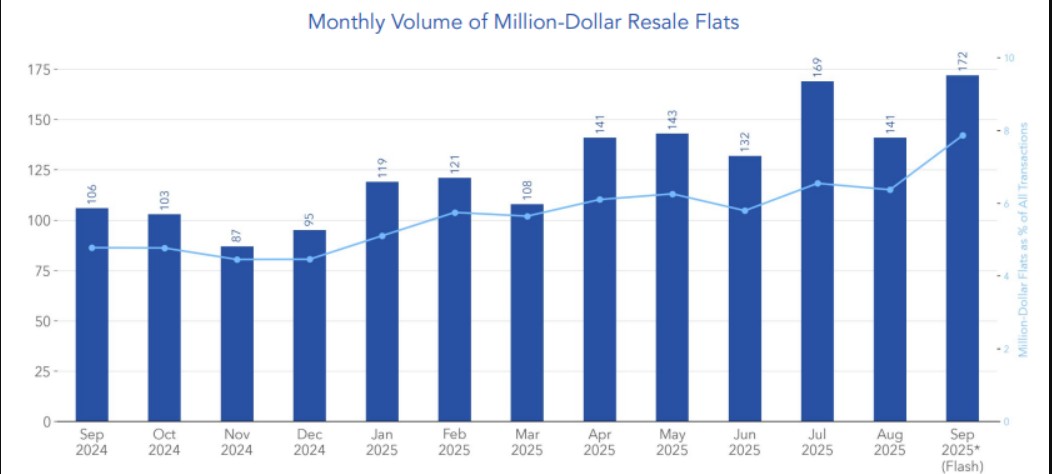

Record 172 million-dollar HDB flats sold in September 2025

The sale comes amid a surge in million-dollar HDB transactions.

In September 2025, there were 172 such deals — up from 141 in August — representing 7.9% of total resale transactions, the highest proportion ever recorded, according to data from HDB and market trackers.

The top resale transaction in September was a five-room flat in the Central Area, sold for S$1.59 million.

Even traditionally non-mature estates such as Woodlands and Yishun have begun recording million-dollar sales, indicating that buyers are increasingly valuing larger layouts and improved connectivity over centrality.

Toa Payoh recorded the highest number of million-dollar transactions in September, with 37 deals, followed by Queenstown and Bukit Merah with 18 each.

These mature estates remain popular for their central locations, established amenities, and strong transport links.

Recent months have seen several new records across the island.

In early September, a five-room flat in Kallang/Whampoa was sold for S$1.54 million.

In August, a five-room flat at 1G Cantonment Road set a Central Area record at S$1.6 million.

A month earlier, in July 2025, Clementi Avenue 3 saw a record S$1.28 million sale for a four-room flat.

Despite these figures, the all-time record for an HDB resale flat remains the S$1.73 million transaction at SkyOasis @ Dawson in June 2024.

2024 saw record HDB resale activity and price growth

According to HDB data released on 24 January 2025, resale flat prices rose by 9.7 per cent in 2024, following gains of 4.9 per cent in 2023 and 10.4 per cent in 2022.

However, transaction volume fell by 21.1 per cent in the last quarter of 2024, though the full-year total reached 28,986 units.

A record 1,035 resale flats crossed the million-dollar mark in 2024.

At the 5 March 2025 budget debate, then-Minister for National Development Desmond Lee warned that such headline-grabbing prices could distort market expectations.

Lee stressed that these premium-priced flats accounted for just 0.5 per cent of transactions for four-room or smaller units over the past two years.

He noted they were typically located in central areas, on high floors, and close to amenities.