Government responds to concerns over closures of newer F&B businesses with review of support measures

Deputy Prime Minister Gan Kim Yong has outlined a suite of financial and productivity-focused measures to support smaller F&B businesses, following a parliamentary question on 5 November about structural disadvantages and startup costs in the sector.

- Deputy Prime Minister Gan Kim Yong detailed measures to support smaller F&B enterprises, including tax rebates, financing schemes, and productivity grants.

- Data shows 82% of newer F&B firms that closed in 2025 had never declared a profit.

- New initiatives such as the FoodX programme and a redesigned SkillsFuture Enterprise Credit aim to boost efficiency and resilience.

SINGAPORE: On 5 November, 2025, in response to a parliamentary question, Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong laid out the Government's ongoing and new initiatives aimed at supporting smaller food and beverage (F&B) businesses in Singapore.

The question, filed by Workers’ Party Member of Parliament He Ting Ru (Sengkang GRC), asked whether existing and newly announced policies sufficiently address high startup costs, rental pressures, and structural disadvantages faced by smaller F&B businesses compared to larger chains.

In a written parliamentary reply, Gan stated that the Government has introduced multiple schemes to help small and medium-sized enterprises (SMEs), especially in the F&B sector, manage costs, improve productivity, and build resilience.

Among these, the Enterprise Financing Scheme – Working Capital Loan helps businesses secure funding and manage cash flow. Additionally, the 50% Corporate Income Tax rebate for Assessment Years 2024 and 2025 provides a minimum benefit of S$2,000 for eligible active firms with at least one local employee.

Productivity-focused grants, such as the Productivity Solutions Grant (PSG), were highlighted for their role in enabling F&B SMEs to adopt smart equipment like rotary cookers and digital tools such as the Connected Business Suite (CBS), which streamlines both front- and back-of-house operations.

“These solutions help reduce firms’ reliance on manpower and improve efficiency,” said Gan, noting that manpower constraints remain a major challenge in the sector.

He also referenced efforts to boost consumer spending and support heartland businesses through Community Development Council (CDC) Vouchers. From December 2021 to July 2025, S$1.26 billion worth of digital vouchers have been spent at participating hawkers and merchants, helping to increase sales and foot traffic.

Newer initiatives from Enterprise Singapore, such as the FoodX programme, are designed to enable smaller F&B businesses to benefit from shared resources and centralised food preparation, leveraging economies of scale.

Additionally, the F&B Process Optimisation Programme (POP) helps businesses engage consultants to streamline operations, improve manpower deployment, and enhance revenue generation.

Gan also noted that from the second half of 2026, employers can expect a new SkillsFuture Enterprise Credit (SFEC) worth S$10,000. This redesigned credit will be delivered via an online wallet system, allowing immediate offsets for eligible workforce transformation initiatives without requiring reimbursement, thus easing short-term cash flow concerns.

The Government also works closely with trade associations like the Restaurant Association of Singapore (RAS) to address industry-wide issues such as labour shortages and evolving consumer expectations.

Gan affirmed the Government’s commitment to regularly reviewing these support measures to ensure their relevance and effectiveness, particularly for smaller SMEs in the F&B sector.

Structural fragility in F&B sector highlighted

The parliamentary discussion comes amid growing evidence of financial instability among newer F&B businesses. In a separate reply on the same day, Gan revealed that over 80% of retail food establishments registered for less than five years that closed in 2025 had never declared a profit.

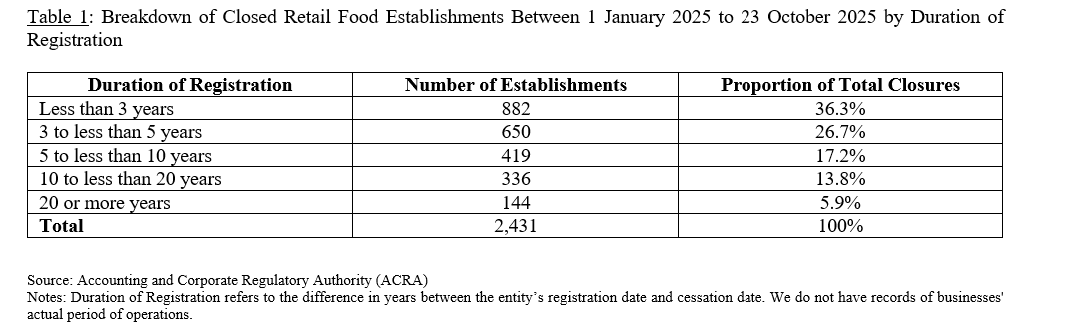

From 1 January to 23 October 2025, 2,431 retail food establishments ceased operations, while 3,357 new establishments were registered, according to data from the Ministry of Trade and Industry (MTI) and the Accounting and Corporate Regulatory Authority (ACRA).

Of the closures, 63% had been registered for five years or less, and 82% of these had never recorded a profit in any annual tax declaration. The data encompassed a broad range of F&B businesses, including restaurants, cafes, fast-food outlets, hawker stalls, food courts, pubs, and caterers.

While Gan did not elaborate on specific factors behind the unprofitability, high operating costs and intense market competition are frequently cited by industry observers as persistent challenges.

Notably, ACRA clarified that the registration duration does not necessarily reflect actual operational periods, as businesses may register long before commencing, or cease operating before formal deregistration.