MTI raises Singapore’s 2025 GDP growth forecast to around 4.0%, projects 1.0–3.0% growth in 2026

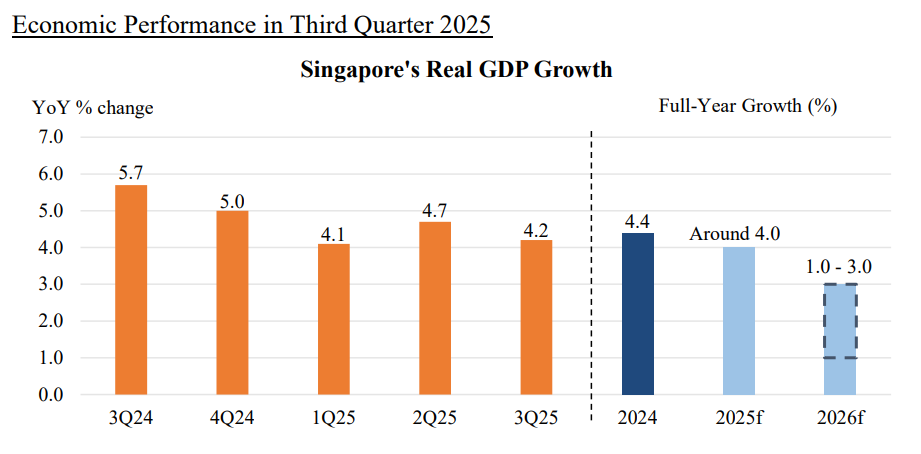

The Ministry of Trade and Industry (MTI) has revised Singapore’s GDP growth forecast for 2025 to around 4.0 per cent, citing stronger-than-expected economic performance in the third quarter. Growth in 2026 is forecast to moderate to between 1.0 and 3.0 per cent.

- Singapore's MTI upgraded 2025 GDP growth forecast to around 4.0% following Q3 outperformance.

- Manufacturing, wholesale trade, and finance sectors led the Q3 economic expansion.

- Growth for 2026 is projected to slow to between 1.0 and 3.0%, amid external headwinds.

The Ministry of Trade and Industry (MTI) has revised Singapore’s full-year gross domestic product (GDP) growth forecast for 2025 upward to around 4.0 per cent, a significant adjustment from its earlier estimate of 1.5 to 2.5 per cent.

This revision comes in light of better-than-expected economic performance in the third quarter of 2025, during which Singapore’s economy expanded by 4.2 per cent year-on-year, following 4.7 per cent growth in the second quarter.

For 2026, MTI expects GDP growth to moderate, forecasting a range of 1.0 to 3.0 per cent.

Robust Q3 performance drives revised 2025 outlook

In the third quarter of 2025, Singapore’s economy posted strong gains across several key sectors.

On a quarter-on-quarter seasonally-adjusted basis, the economy grew by 2.4 per cent, accelerating from 1.7 per cent in the previous quarter. The average GDP growth for the first three quarters of 2025 stood at 4.3 per cent.

The manufacturing sector was a primary growth driver, expanding by 5.0 per cent year-on-year in Q3. This was led by notable output from the electronics, transport engineering, and biomedical manufacturing clusters.

Electronics output increased by 6.1 per cent, underpinned by global demand for artificial intelligence (AI)-related semiconductors, servers, and associated components. The biomedical manufacturing cluster posted a robust 8.9 per cent growth, buoyed by higher-than-expected production of a key high-value pharmaceutical ingredient.

Trade and finance sectors support growth

The wholesale trade sector grew by 3.9 per cent year-on-year, primarily due to strong sales volumes in the machinery, equipment and supplies segment, driven by AI-related demand.

Finance and insurance expanded by 4.6 per cent, supported by higher banking net fees, commissions, and credit intermediation activity. Payment transaction volumes also saw regional growth.

Other sectors contributing to economic momentum included the information and communications sector (4.7 per cent growth), professional services (3.4 per cent), and real estate (5.2 per cent).

Meanwhile, the accommodation sector recorded 4.9 per cent growth, led by increased hotel lettings, particularly in the luxury segment.

Global factors underpin resilience

MTI highlighted several external developments supporting Singapore’s improved outlook.

Most of Singapore’s key trading partners recorded stronger-than-anticipated growth in the third quarter, including China and Vietnam, where exports were boosted by ongoing trade diversion and supply chain shifts.

Additionally, the global AI boom has continued to stimulate demand for technology-related exports, particularly benefiting regional producers of semiconductors and server components.

There has also been a further easing in trade tensions. The US-China trade truce has been extended until November 2026, with a reduction in US tariffs on Chinese goods. Planned sectoral tariffs on semiconductors and pharmaceuticals have been rolled out more slowly than previously expected.

2026 growth to moderate amid global headwinds

While 2025 appears on track for a strong finish, growth in 2026 is expected to slow.

MTI projects Singapore’s GDP to expand by between 1.0 and 3.0 per cent in 2026, reflecting external pressures including renewed US tariffs and a cooling in global growth momentum.

In particular, China is expected to see weaker growth due to slower exports and a fading boost from its consumer goods trade-in programme. The Eurozone is forecast to experience slower industrial activity, further weighed down by trade frictions.

Although the US economy is projected to remain resilient, supported by sustained AI-related investments, broader global demand may ease.

Sector-specific outlook for 2026

Within Singapore, manufacturing and trade-related services are expected to continue expanding but at a slower pace.

AI-driven demand is likely to support the electronics cluster, which in turn will sustain momentum in the machinery and equipment segment of the wholesale trade sector.

Transport engineering will be bolstered by higher-value maintenance, repair and overhaul (MRO) activities in aerospace and strong order books in the marine and offshore engineering segments.

However, the precision engineering cluster may face challenges. Semiconductor equipment makers may delay new investments pending clarity on future US tariffs. Similarly, biomedical manufacturing output is expected to ease from 2025 highs.

Among outward-oriented services, information and communications and finance and insurance are forecast to see steady growth. These sectors are supported by resilient enterprise demand for digital solutions and positive financial conditions.

Domestically-oriented sectors present a mixed picture. Construction is projected to grow, led by public housing and infrastructure works.

However, consumer-facing industries such as retail trade and food and beverage services may remain subdued, reflecting cautious consumer sentiment.

Risks remain for 2026 outlook

Despite current stability, MTI cautioned that global economic uncertainty remains elevated.

Renewed trade tensions or geopolitical flare-ups could dampen business and consumer confidence, while adverse financial market developments could spill over into the broader economy.

As a result, the forecast range for 2026 reflects both upside and downside risks, hinging on external developments and domestic resilience.