Singapore’s core inflation climbs to 1.2% in October, highest in 2025

Core inflation in Singapore surged to 1.2% in October 2025, up from 0.4% in September, driven by increased costs in services, food, and retail sectors. This marks the highest core inflation figure this year, according to the Monetary Authority of Singapore and the Ministry of Trade and Industry.

- Core inflation in Singapore rose to 1.2% year-on-year in October 2025, its highest level this year.

- The increase was driven by services, food, and retail price rises, along with a slower decline in energy costs.

- Authorities project inflation to stay moderate in 2025 but caution on global uncertainties.

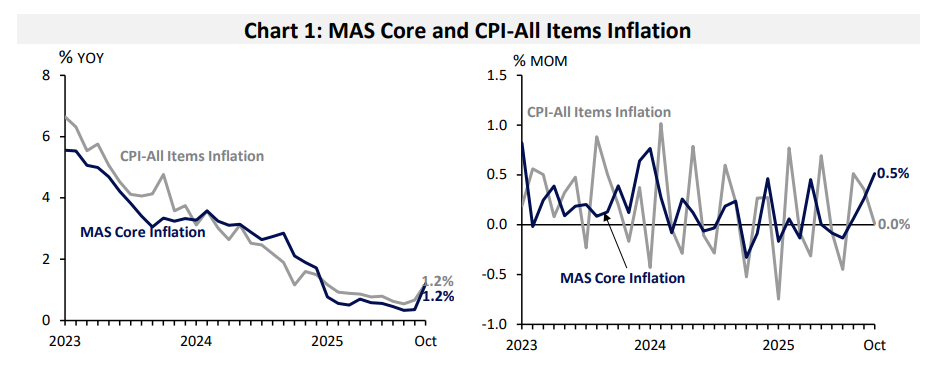

Singapore's core inflation accelerated significantly to 1.2% year-on-year in October 2025, rising from 0.4% in September. This represents the highest core inflation rate recorded this year, according to a joint report by the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) released on 24 November 2025.

The core inflation measure, which excludes private transport and accommodation, saw a monthly increase of 0.5%. This uptick was largely attributed to higher prices in the services, food, and retail sectors, as well as a more modest decline in electricity and gas prices.

Overall inflation, measured by the Consumer Price Index-All Items (CPI-All Items), also rose to 1.2% year-on-year in October, up from 0.7% in September. On a month-on-month basis, however, CPI-All Items inflation was flat at 0%.

Sectoral inflation breakdown

Services inflation increased sharply from 0.3% in September to 1.8% in October. This was mainly due to faster increases in health insurance premiums, higher healthcare service costs, and increased holiday expenses.

Electricity and gas prices continued to decline but at a slower rate, with the year-on-year fall narrowing from -5.8% in September to -4.0% in October. The change was due to a smaller drop in electricity prices.

Food inflation edged up slightly from 1.1% to 1.2%, driven by faster increases in non-cooked food items.

Retail and other goods saw inflation tick up from 0.3% to 0.4%, largely due to higher prices for clothing, footwear, and personal effects.

Private transport inflation rose to 3.8% in October, up from 3.7% the month before, reflecting a steeper increase in car prices.

In contrast, accommodation inflation fell marginally from 0.4% to 0.3%, attributed to a slower pace of rental increases.

Inflation outlook

MAS and MTI maintained their previous outlook, stating that imported costs are expected to continue declining, though at a more gradual pace. Global crude oil prices are projected to ease further in 2026 compared to 2025, while regional inflation may recover modestly following weak performances this year.

Domestically, inflation will also be affected by the tapering off of administrative cost dampeners. Unit labour cost growth is expected to rise in line with normalising productivity, and steady private consumption will also exert upward price pressure.

MAS and MTI project core inflation to average around 0.5% in 2025, increasing to between 0.5% and 1.5% in 2026. Similarly, CPI-All Items inflation is forecast to average between 0.5% and 1% in 2025 and rise slightly to 0.5% to 1.5% in 2026.

Despite these projections, authorities warned that the inflation outlook remains susceptible to external shocks. Geopolitical developments could cause sudden increases in imported costs. Conversely, a sharper-than-expected global demand slowdown or significant drops in oil prices may suppress inflation more than anticipated.

0 Comments