CareShield Life premiums and payouts to rise from 2026; government announces S$570 million support package

Singaporeans covered under CareShield Life will face higher premiums and larger payouts from 2026, as part of the scheme’s first major review since its launch. The Ministry of Health (MOH) said payouts will grow twice as fast to keep up with rising care costs, while transitional support will help offset premium increases.

- CareShield Life payouts will grow 4% annually from 2026—double the current rate—while premiums will rise by an average of S$38 per year.

- The government will provide S$570 million in transitional support to ease costs, with subsidies of up to 30% for lower- and middle-income policyholders.

SINGAPORE: Singaporeans on the national long-term care insurance scheme, CareShield Life, will face higher premiums and higher payouts from 2026, the Ministry of Health (MOH) announced on 27 August 2025.

Between 2026 and 2030, premiums will increase by an average of S$38 annually, with some policyholders seeing rises of up to S$75 per year. MOH said the adjustments were necessary to sustain enhanced benefits and ensure the scheme’s long-term viability.

At the same time, the government will roll out transitional support to cushion the financial impact and maintain affordability for all insured individuals.

Doubling of payout growth rate

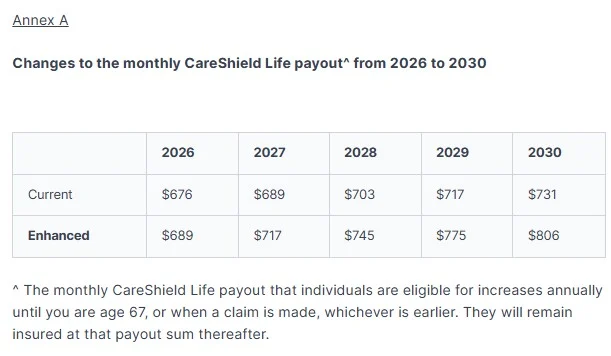

Currently, CareShield Life payouts grow at 2% per year. From 2026, this rate will double to 4%, while eligibility criteria will remain unchanged.

Under the revised structure, a policyholder making a claim in 2030 will receive S$806 per month—up from the S$731 that would have applied under the old growth rate.

“This will help payouts better keep pace with rising long-term care costs, providing Singaporeans with greater assurance for their long-term care needs,” said Jeanette Wong, chair of the CareShield Life Council, which conducted the scheme’s first review.

S$570 million in transitional assistance

To support policyholders, the government has committed S$570 million in transitional assistance. Of this, S$440 million will be used to moderate the premium increases for all affected individuals, while S$130 million will fund enhanced subsidies of up to 30% for low- to middle-income policyholders.

Without this support, annual premiums would have risen by an average of S$126 in 2026, according to MOH.

“The government is committed to helping Singaporeans manage the upcoming premium increase and will ensure that no one will lose coverage due to an inability to pay their premiums,” the ministry stated.

Background of CareShield Life

Launched in 2020, CareShield Life replaced the earlier ElderShield scheme. It provides monthly cash payouts to individuals with severe disabilities—defined as the inability to perform at least three out of six activities of daily living, such as feeding, washing, or dressing.

The scheme is mandatory for Singaporeans and permanent residents born in 1980 or later, while older individuals may opt in voluntarily.

When introduced, CareShield Life offered a starting payout of S$600 per month, growing at 2% annually. Under the current system, claimants will receive S$662 per month from 2025.

Coverage and claims data

As of June 2025, 1.93 million Singapore citizens and permanent residents aged 30 and above are covered under CareShield Life, while 535,000 remain under ElderShield. This means around eight in 10 individuals in that age group have protection under one of the two schemes.

In 2024, there were 1,821 active claimants under CareShield Life, with payouts exceeding S$26 million. Claimants ranged in age from 30 to 93, with a median age of 52.

MOH noted that about half of all CareShield Life claimants are in their 30s and 40s.

Rising long-term care costs

Singapore’s expenditure on long-term care has nearly doubled in the past five years, rising from S$1.7 billion to about S$3 billion.

The increase has been driven by the ageing population, higher care demand, and greater manpower and technology costs. Inflationary pressures have also contributed to the rise.

Among those who develop severe disabilities, half are expected to remain in that state for at least four to five years, while three in 10 could remain disabled for a decade or longer, MOH said.

Pre-funding model and financial sustainability

As of December 2024, CareShield Life had collected S$2.8 billion in premiums, including about S$800 million in government premium support.

Total claims paid under CareShield Life and ElderShield since 2020 exceeded S$100 million.

MOH explained that the current low payout ratio is expected, as the scheme operates on a pre-funding model. This means premiums collected today are intended to fund future obligations as more policyholders age and begin making claims.

Review findings and recommendations

The CareShield Life Council conducted its first full review in early 2025. Its recommendations—accepted in full by the government—included doubling the annual payout growth rate, introducing transitional premium support, and reinstating medical underwriting for new enrolments.

Changes to enrolment from 2026

When CareShield Life was launched, individuals with mild or moderate disabilities were temporarily allowed to enrol. From 2026, this option will end, and only those without pre-existing disabilities will be eligible to join.

People with chronic conditions such as diabetes may still enrol, provided they are not classified as disabled.

MOH said this change reflects the declining number of sign-ups from older cohorts and marks a return to the scheme’s original underwriting standards.

Balancing affordability and accessibility

During the review, some stakeholders proposed easing claim criteria by reducing the threshold from three to two daily living activities. However, Council chair Jeanette Wong said CareShield Life must balance accessibility with financial sustainability.

“CareShield Life is a not-for-profit scheme with limited premium collection years but lifetime payouts,” she said, adding that maintaining affordability for all Singaporeans was a key concern raised in focus groups.

MOH added that individuals seeking broader coverage can supplement CareShield Life with private insurance policies that offer lower claim thresholds at higher premiums.