Meta to acquire AI agent startup Manus, which moved from China to Singapore in mid-2025

Meta has agreed to acquire Singapore-based AI startup Manus, gaining a revenue-generating AI agent business as it seeks faster returns from heavy AI investment.

- Meta Platforms has agreed to acquire Singapore-based AI startup Manus, gaining a revenue-generating AI agent business.

- Manus sells autonomous AI agents to enterprises and reported a US$125 million annual revenue run rate earlier in 2025.

- The deal comes as Meta accelerates AI spending amid investor concerns over the pace of monetisation.

Meta Platforms has agreed to acquire Singapore-based startup Manus, adding a popular artificial intelligence agent to its portfolio as the social media company intensifies efforts to generate returns from its massive AI investment.

According to a report by Bloomberg, Manus recorded an annual revenue run rate of about US$125 million earlier this year. The startup sells AI agents to businesses through a subscription model, offering Meta a more immediate commercial pathway for its AI spending.

The acquisition underscores Meta’s strategy of complementing long-term research with products that can generate near-term revenue.

Meta has invested heavily in foundational AI models, infrastructure, and talent, while facing investor scrutiny over monetisation timelines.

From viral success to restructuring within months

Manus rose to prominence in March 2025 after going viral on X.

The company released what it described as the world’s first general AI agent, claiming it could autonomously make decisions and execute tasks with minimal human prompting.

At the time, Manus was widely compared to DeepSeek, a Chinese AI model that had attracted significant attention. The comparison helped fuel interest among developers, enterprises, and investors, rapidly elevating the startup’s profile.

However, momentum was followed by turbulence.

Just four months later, Manus’s parent company, Butterfly Effect, relocated its headquarters from China to Singapore.

The company also carried out mass layoffs, reducing its workforce from around 120 employees to about 40 core technical staff.

Butterfly Effect was founded in China before shifting operations to Singapore.

Earlier this year, it raised capital at a valuation close to US$500 million in a funding round led by US venture capital firm Benchmark, according to Bloomberg.

China-to-Singapore shift mirrors broader tech realignment

The relocation placed Manus among a growing number of Chinese-founded technology firms that have chosen Singapore as a base.

Many cite the city-state’s trade openness and regulatory stability as buffers against escalating Sino-US geopolitical tensions.

Meta confirmed in a statement on 29 December 2025 that it would continue to operate and sell Manus’s AI agent services.

The company also said it plans to integrate the agents into both its consumer and enterprise product lines.

AI agents differ from traditional chatbots by operating with little or no human supervision.

These systems can independently complete digital tasks, making them particularly attractive to businesses seeking productivity gains.

Enterprise software companies such as Salesforce and ServiceNow have heavily promoted AI agents as a more practical business application of artificial intelligence.

They argue that autonomous agents offer clearer value than generative AI chatbots, which rely on user prompts.

Meta already operates an AI chatbot, Meta AI, embedded across Facebook, Instagram, WhatsApp, and its AI-powered glasses.

The addition of Manus’s technology could broaden Meta’s AI capabilities beyond conversational interfaces.

As part of the deal, Meta is acquiring Manus’s technology and leadership team.

The companies did not disclose where the new team will be positioned within Meta’s organisational structure.

Meta’s chief AI officer, Alexandr Wang, joined the company earlier this year following a high-profile investment into his startup, Scale AI.

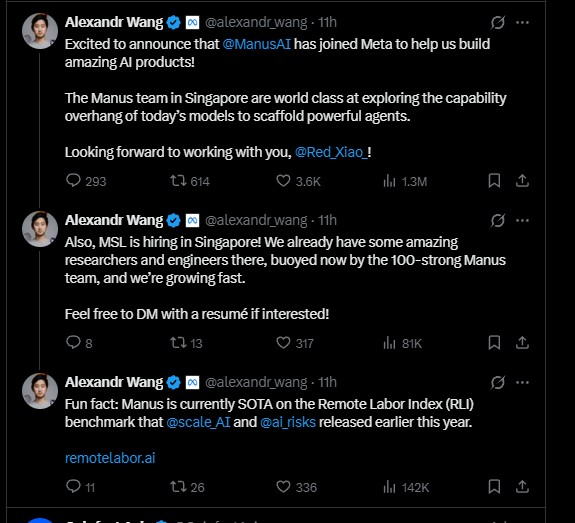

After the Manus announcement, Wang welcomed the incoming team in a post on X.

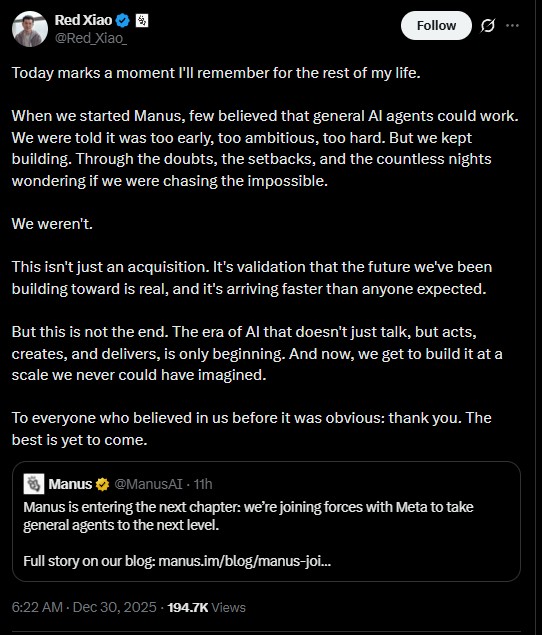

In a separate post, Manus co-founder and chief executive officer Xiao Hong said the acquisition would significantly expand the reach of the company’s AI agents.

He described the deal as an opportunity to operate at unprecedented scale.

“The era of AI that does not just talk, but acts, creates, and delivers, is only beginning,” Xiao wrote.

“And now, we get to build it at a scale we never could have imagined.”

The acquisition aligns with Meta chief executive officer Mark Zuckerberg’s stated priorities.

Zuckerberg has repeatedly emphasised that AI is Meta’s top strategic focus, spanning research, infrastructure, and consumer products.

Meta is spending aggressively to compete with rivals including OpenAI, Alphabet’s Google, and Microsoft.

Zuckerberg has pledged to spend US$600 billion on US infrastructure projects over the next three years, many of them expected to be AI-related.

The company has also assembled an expensive team of researchers to develop a new state-of-the-art AI model, which it plans to debut next spring.

Despite these efforts, some investors remain sceptical about when Meta’s AI investments will translate into substantial revenue.

The Manus acquisition may help address those concerns by adding an existing, subscription-based enterprise business to Meta’s AI portfolio.

Analysts see enterprise AI services as a potential bridge between research-heavy investment and sustainable returns.

Geopolitical scrutiny shadows investment and expansion

The deal also carries geopolitical sensitivities.

Benchmark, which led Butterfly Effect’s funding round, faced criticism earlier this year from US lawmakers and some investors for backing an AI company with Chinese roots.

US Senator John Cornyn, a Texas Republican, questioned the wisdom of such investments in a post on X in May. He argued that American capital should not support AI firms with potential links to strategic competitors.

Manus has stated that it will continue to operate from Singapore following the acquisition.

The move may help distance the company from geopolitical scrutiny while maintaining access to global markets and talent.