S$9.07 billion in credit card rollover debt marks highest level on record in Singapore

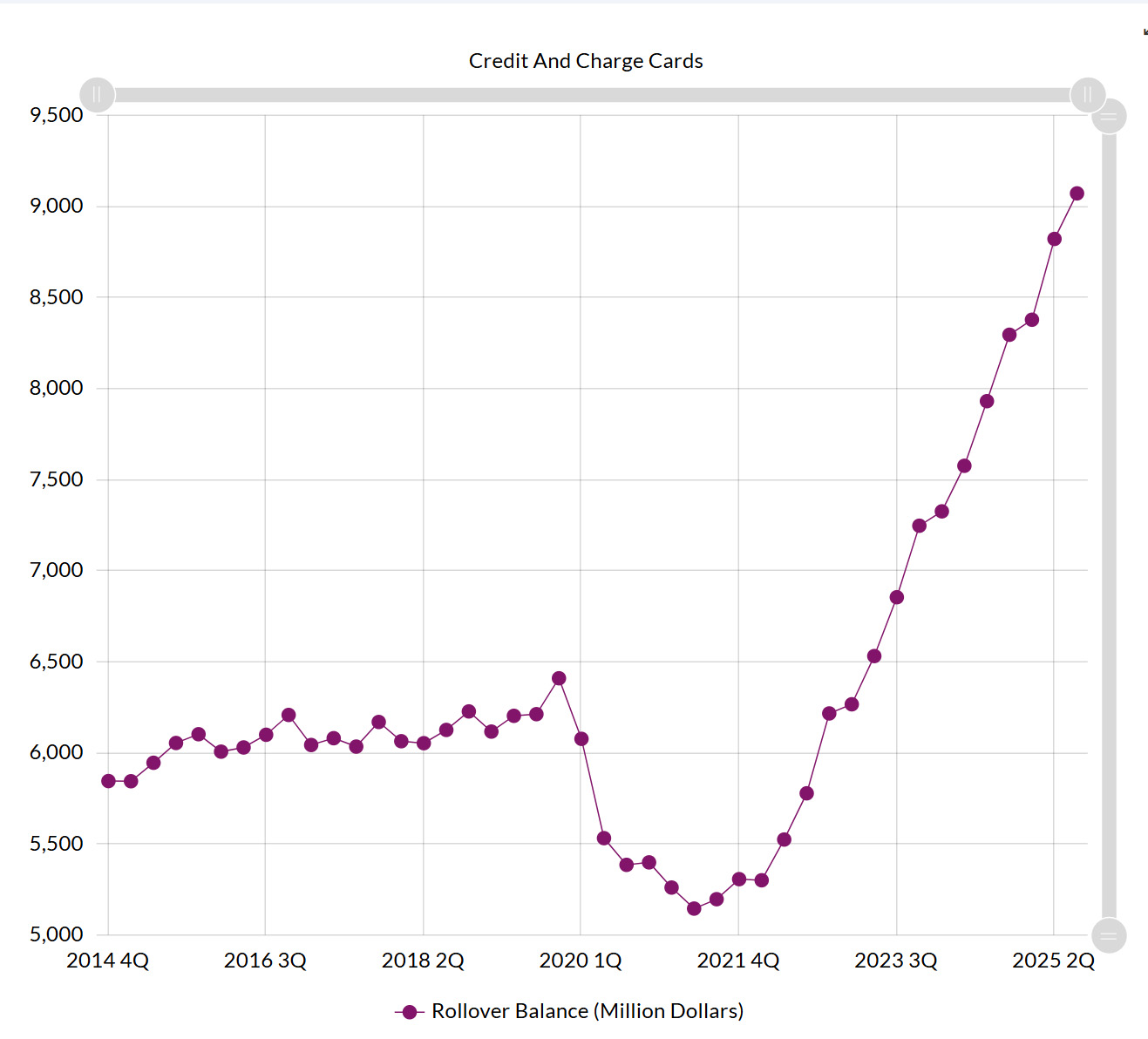

Singapore’s credit card rollover balances reached S$9.07 billion in Q3 2025 — the highest since records began in 2014. Despite fewer cardholders, average debt per person is rising sharply, raising concerns about systemic financial strain.

- Rollover credit card balances reached S$9.07 billion in Q3 2025 — a record since tracking began in 2014

- Number of principal cardholders is falling, but average debt per user has increased over 50% since 2019

- Rising debt signals structural cashflow stress and inadequate income growth, not merely discretionary spending

Credit card balances rolled over to the next billing cycle in Singapore totalled S$9.07 billion (US$6.7 billion) in the third quarter of 2025, according to the Singapore Department of Statistics. This marks the highest level since such data began in 2014.

The figure represents a 75 per cent increase from Q2 2021, when rollover balances stood at S$5.19 billion. The rise has occurred even as the number of principal credit cardholders has fallen steadily — from around 6.6 million in 2019 to 6.1 million in 2025.

Higher debt concentration among fewer cardholders

With fewer individuals holding credit cards, the debt load per person has grown significantly. In 2019, average rollover debt per cardholder was estimated at around S$985. By 2025, that figure had risen to approximately S$1,490 — an increase of more than 50 per cent.

This trend indicates that debt is becoming increasingly concentrated among a smaller group of users. Rather than a broad-based increase in borrowing, it reflects mounting financial pressure on specific segments of the population.

Financial advisor and activist Leong Sze Hian has described this as a shift from mass participation to stress concentration, where fewer borrowers are absorbing more of the system's debt burden.

Rollover balances signal structural stress, not lifestyle excess

Credit card rollover debt refers to unpaid balances carried into the next billing cycle and incurring high interest — often around 26 per cent per annum.

While some narratives attribute this to lifestyle choices or lack of budgeting, the rising balances more likely reflect structural cashflow issues.

Credit cards are increasingly being used to manage essential costs such as daily necessities, medical bills, transport, and children's education — not just discretionary spending.

Leong has noted that such usage patterns suggest households are relying on unsecured debt to bridge gaps in income and cover recurring obligations.

Interest compounding and long-term risk

A balance of S$5,000 on a credit card, if only minimum payments are made, could result in over S$1,300 in annual interest and take nearly a decade to repay. Larger balances can extend repayment periods to 15 years or more.

This has been described by Leong as a “reverse CPF” effect — where interest works against the borrower instead of compounding in their favour. The long-term implications include erosion of disposable income, reduced savings capacity, and growing exposure to financial shocks.

More seeking help, and at younger ages

Adullam Life Counselling has reported a 13 per cent increase in financial counselling enquiries in December 2025 compared with the previous year.

What is more concerning is the shift in age profile. Individuals in their 30s and 40s now form the largest group seeking assistance — compared to previous years when most clients were in their 50s or older.

Earlier accumulation of debt has implications for retirement planning, asset ownership, and long-term financial independence.

Low delinquency rates may mask deeper risks

Despite the rise in debt, credit card delinquency rates have remained below 1 per cent — a figure well below historical averages.

However, Leong and other analysts have pointed out that low defaults do not necessarily reflect financial health. Instead, they may indicate delayed distress. Many borrowers rely on credit limits, asset drawdowns, or informal family support to remain afloat.

Such coping strategies may mask underlying vulnerability until limits are breached, potentially leading to a sudden rise in defaults or insolvencies.

Employment data does not capture financial insecurity

Singapore's low unemployment rate may give the impression of economic stability. But the headline figure does not account for gig workers, part-time caregivers, or freelancers with unstable incomes.

These individuals are officially “employed” but may face unpredictable earnings, making them more likely to rely on credit to meet essential expenses.

Leong has criticised the binary framing of employment statistics, arguing that it fails to capture the lived reality of households managing financial volatility.

High household assets do not equal resilience

Singapore’s households are often described as “asset-rich” due to high home ownership and compulsory CPF savings. But these assets are largely illiquid.

When everyday liquidity is insufficient, credit cards — designed for convenience — become substitutes for short-term income support.

Rollover debt at record highs is not just a statistical milestone. It is a structural indicator that many Singaporeans are struggling to sustain their living standards using high-interest consumer credit.

This challenges the narrative of fiscal prudence and highlights a growing imbalance between the country’s national surpluses and household-level stress.