Tan Kin Lian questions NTUC Income payout cuts amid strong markets; Tan Suee Chieh concurs

Former NTUC Income chief Tan Kin Lian has questioned a sharp reduction in policy payouts for long-term participating plans, describing it as unjustified amid favourable investment conditions. He cited a 25% cut in a policy’s maturity value and urged Income Insurance to explain or reverse the decision, with former NTUC Enterprise & NTUC Income CEO Tan Suee Chieh echoing his concerns.

- Former NTUC Income CEO Tan Kin Lian criticised a more than 25% cut in a 1991 endowment policy’s payout, calling it unjustified given strong investment conditions and contrary to fair treatment expectations for policyholders.

- Tan argued the 2009 shift from annual to special bonuses should have led to higher special payouts, not reductions, citing Income’s earlier assurances.

- Former NTUC Enterprise and NTUC Income CEO Tan Suee Chieh backed the criticism, saying the 25% terminal bonus scale seemed unwarranted and urged Income Insurance to explain or rectify the decision.

SINGAPORE: Former NTUC Income chief executive Tan Kin Lian has voiced serious concern over what he described as an “unjustified” reduction in maturity payouts for long-term participating policies, questioning whether policyholders are being treated equitably in the distribution of surplus from Income Insurance’s life fund.

In a letter shared on Facebook on 28 October 2025, Tan said he had been contacted by an Income policyholder who highlighted a substantial reduction in his policy’s payout.

The policyholder had bought a foundation endowment plan in 1991, which was initially illustrated to mature at S$73,150 in 2025.

However, the projected payout was reportedly revised down to S$53,430 — a drop of more than 25 per cent.

Tan, who led NTUC Income from 1977 to 2007, said such a sharp revision appeared inconsistent with the investment performance of the fund over the past three decades.

“This large reduction in the actual maturity payout appears to be unjustified considering the favourable investment environment over the past 34 years and at the current time,” he wrote.

He added that there was a long-standing expectation for life insurance policyholders to be treated “fairly and equitably” in the distribution of any surplus.

“This expectation should be more strongly upheld in the case of Income Insurance, which has operated as a cooperative institution for the larger part of its history,” Tan said.

Details of the affected policy

According to the letter, the policy in question originally consisted of a sum assured of S$22,000, an annual bonus of S$40,926, and a special bonus of S$10,232. The revised payout now stands at S$22,000, S$24,376, and S$7,054 respectively.

Tan explained that NTUC Income restructured its bonus scheme in 2009, shifting a larger proportion of annual bonuses into special or terminal bonuses.

This change was intended to provide greater investment flexibility and strengthen the fund’s long-term resilience.

At the time, Income had stated that the adjustment was aimed at enhancing financial strength and “increasing the flexibility of investment policy with the potential to translate into better benefits for policyholders in the long term.”

Tan noted that Income’s 2009 Consolidated Financial Statements also pledged that special bonuses would be “increased to compensate for reduced annual bonuses.”

He argued that the current 25 per cent special bonus rate appears inconsistent with that commitment.

While acknowledging that special bonuses are technically non-guaranteed and subject to market performance, Tan said there was an “implicit understanding” that they should reflect the overall returns of the life fund fairly.

“As the investment environment appears to have been favourable over the years, there does not appear to be any reason for the special bonus to be kept at 25 per cent, when there was a promise that it would be increased to compensate for the reduction in the yearly bonus made in 2009,” he wrote.

Echoed by former NTUC Enterprise CEO

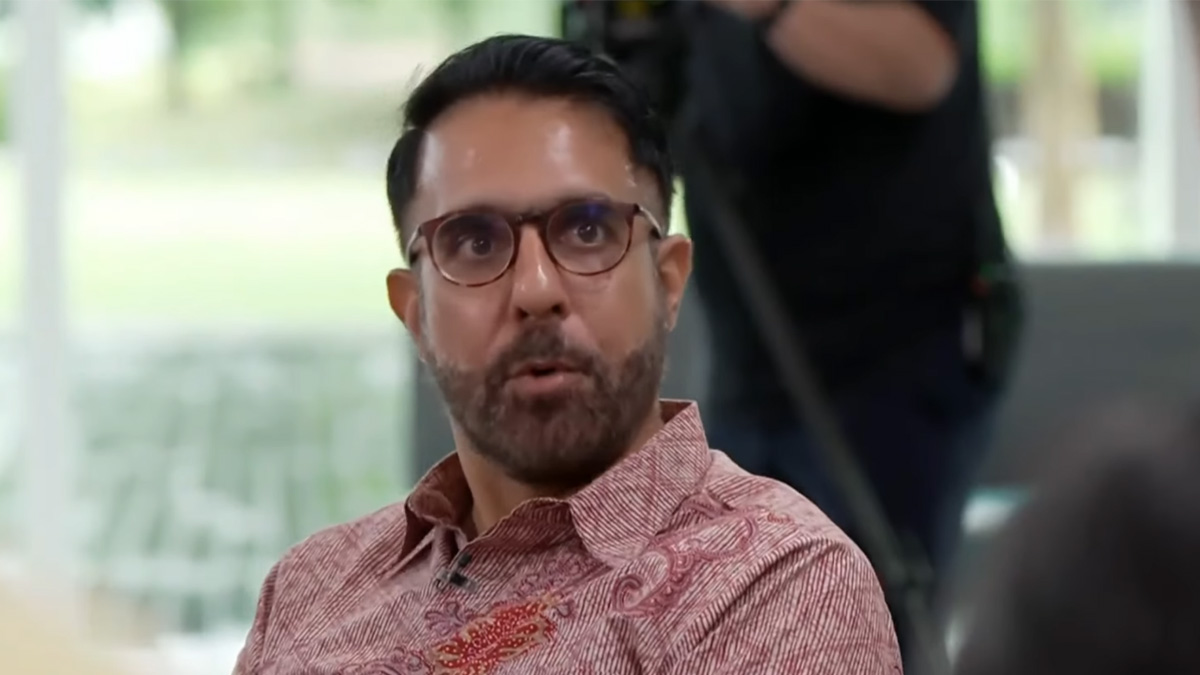

Tan’s concerns were echoed by Tan Suee Chieh, who previously served as NTUC Enterprise and NTUC Income CEO.

In a Facebook comment, Tan Suee Chieh said he recalled the 2009 bonus restructuring was implemented to reduce contractual liabilities and increase investment flexibility, not to reduce actual payouts.

“The actual payouts should be maintained unless there is an investment crisis,” he said.

“On the face of this, the simple application of a 25 per cent terminal bonus scale is unwarranted. Unless there are data or background we are not privy to, it would appear this is a violation of actuarial principles and policyholders’ reasonable expectations.”

He added that if the new bonus scale applied to all policies of a similar type, Income Insurance should explain the rationale or rectify the decision.

Broader implications for policyholders

Tan Kin Lian said he believed the same issue likely affects “many thousands of policies” maturing this year and in the years ahead.

He said he would be sending his letter to the chair of Income Insurance’s board, NTUC, and the Monetary Authority of Singapore (MAS) for further scrutiny.

He also invited policyholders to attend a talk on 1 November 2025 at Jo Hotel in Johor Bahru, Malaysia, to discuss whether they might be affected.

Policyholders recall stronger returns in earlier years

Comments on Tan’s Facebook post showed frustration and nostalgia among long-time policyholders. Some recalled that earlier policies under Tan Kin Lian’s leadership offered strong returns and upheld a cooperative spirit.

A former agent said returns used to exceed projections, but felt the focus shifted after Tan left.

Others cited recent products where benefits were cut during low interest periods but not improved when conditions recovered.

Several questioned whether policyholders are being treated fairly, noting that personal investments often outperform life insurance funds.

0 Comments