Wan Yang reflexology chain shuts suddenly, prompting CASE call for stronger consumer safeguards

The abrupt closure of Wan Yang Foot Reflexology's five outlets has left many customers unable to redeem prepaid sessions. CASE is pushing for regulatory reforms, citing wider concerns over rising prepayment losses in the wellness sector.

- Wan Yang Foot Reflexology shut down all five outlets without warning.

- Customers have reported S$29,000 in losses — the actual total may be much higher.

- CASE calls for a cooling-off period and stronger consumer safeguards.

Wan Yang Health Products and Foot Reflexology Centre abruptly closed all five of its outlets in Singapore last week, leaving many customers unable to redeem prepaid sessions. The full extent of the losses is unclear, but at least S$29,000 (around US$22,000) has been reported by affected customers so far.

The Consumers Association of Singapore (CASE) confirmed that 15 complaints had been received as of 23 November.

CASE president Melvin Yong, who is also a Member of Parliament (MP) for Radin Mas SMC from the People’s Action Party (PAP), said in a Facebook post on 24 November that the organisation had reached out to the company to seek clarification on potential refunds and other remedies.

Although the company claims to have been operating since 1989, records from the Accounting and Corporate Regulatory Authority (ACRA) show that Wan Yang Health Products and Foot Reflexology was registered only in 2024, under a single director. A separate holding entity, sharing the same registered address, was incorporated in 2012.

Importantly, both Wan Yang Health Products and Foot Reflexology and its holding company remain listed as live entities in ACRA’s database as of late November, despite their cessation of operations.

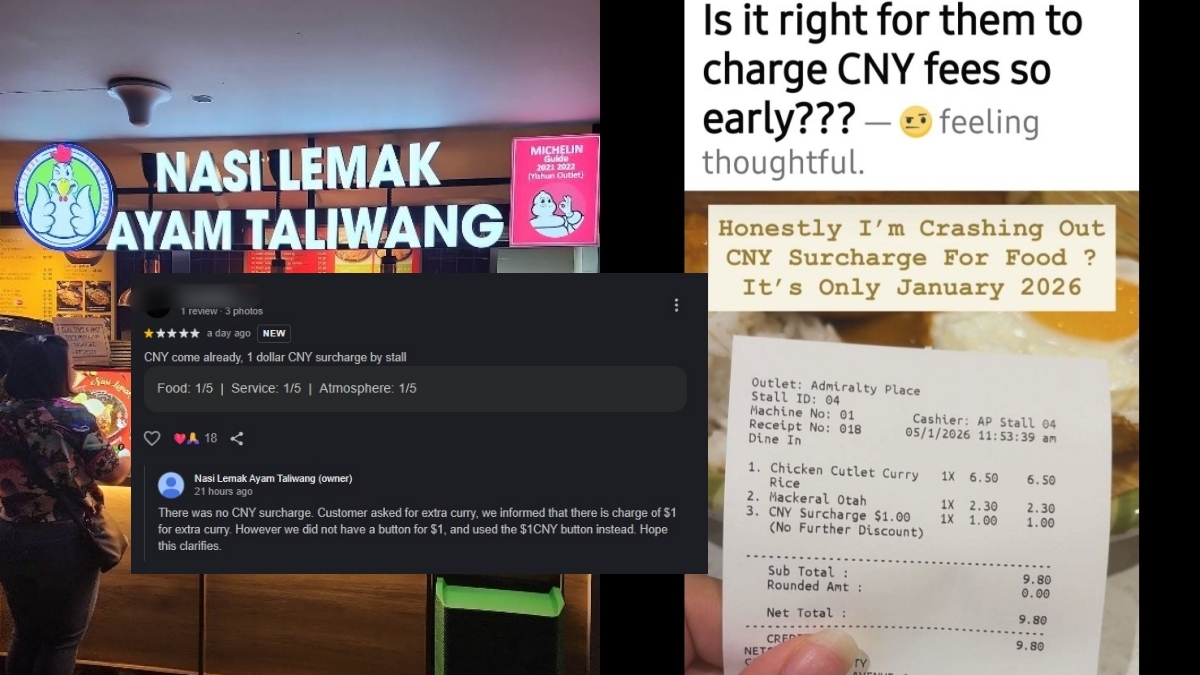

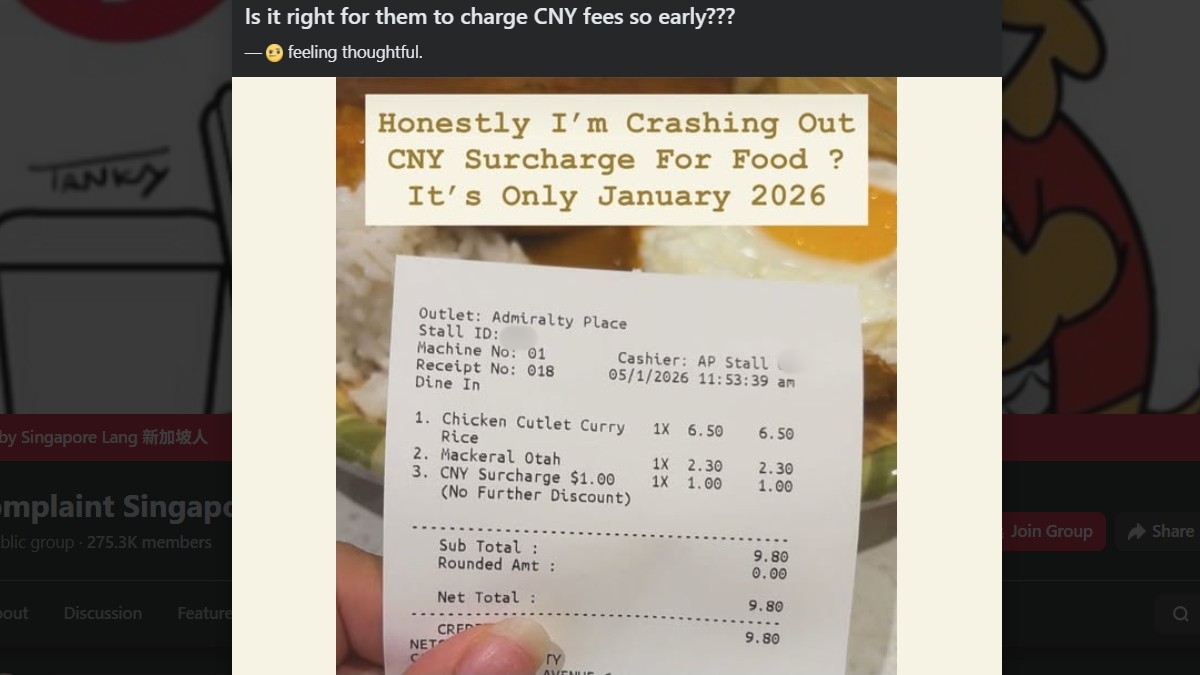

Following the closure, the company marked all its outlets as “Temporarily Closed” on Google Maps, where it also posted a bilingual closure notice in English and Chinese:

“本公司已立即停止运营,并将启动正式清算程序。如有任何未尽事宜,请联系即将任命的清算人。”

“This company has ceased operations effective immediately and will commence formal liquidation proceedings. For any outstanding matters, please contact the liquidators who will be appointed in due course.”

Customers, however, had little prior warning. Mun Wai Ping, 50, said she was encouraged to renew her foot reflexology package during a session at the Thomson Plaza outlet on 14 November, despite only having one session left. She also had five unused back massage sessions from another package, each priced at more than S$400 for 13 sessions.

“Luckily I didn’t sign it. If not, I don’t think I would see that money ever again,” she told CNA.

Another customer, Daniel, had about S$1,500 worth of prepaid sessions remaining when he found the outlet shuttered on 22 November. “The staff were still taking bookings just days before. There was no indication of closure,” he said.

The company had five outlets, including at AMK Hub, HarbourFront Centre, and Thomson Plaza. When CNA visited on 24 November, signs announcing the cessation of operations were displayed, and units were dark or boarded up.

Wan Yang’s official website is no longer accessible, and customers have turned to its outdated Facebook page to seek answers and lodge complaints. Several users had previously posted about poor customer service and hard-sell tactics, long before the shutdown.

Although the company claims a long operating history, the current registration trail raises questions about corporate continuity. Daniel noted that familiar staff had gradually left in recent months. Mun observed appointment delays despite empty-looking outlets, suggesting manpower shortages.

The Singapore Manual & Mercantile Workers’ Union (SMMWU) confirmed that some affected staff were union members. While the company is not unionised, Secretary-General Andy Lim said NTUC’s affiliated unions will extend support to individual members.

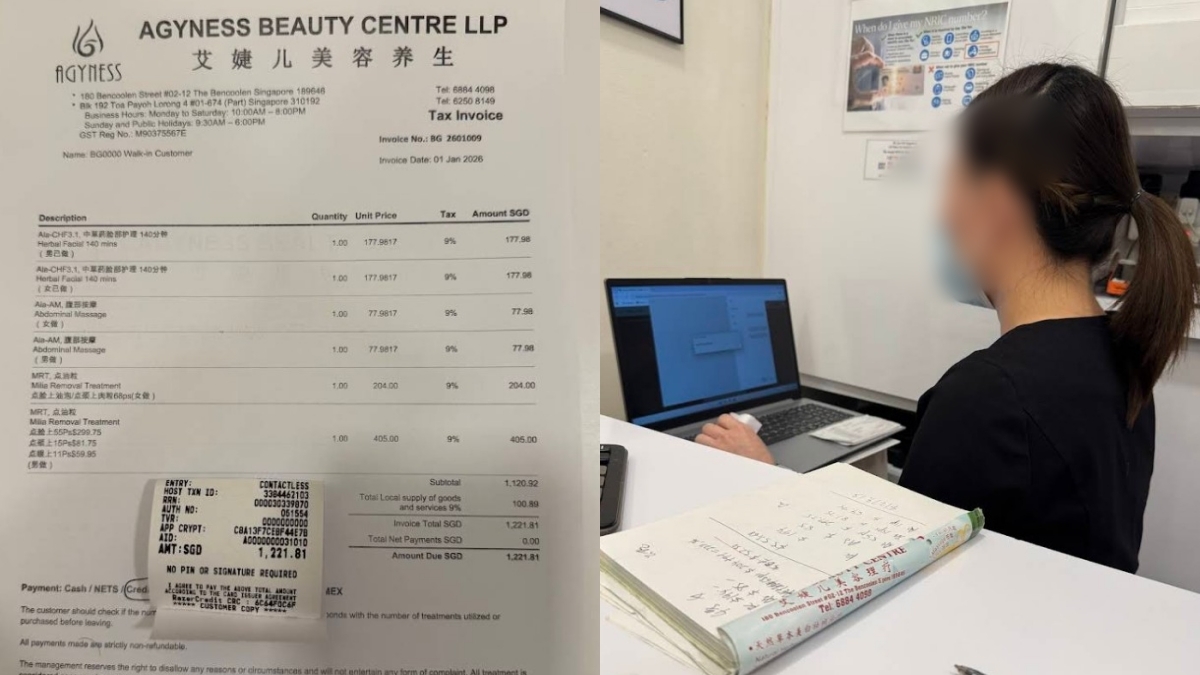

Beyond Wan Yang’s case, CASE raised wider concerns over the rise in prepayment losses in the beauty and wellness sector. In the first half of 2025, such losses totalled S$108,000, a 464 per cent jump from S$19,000 in the same period in 2024.

Yong said CASE is pushing for a mandatory five-day cooling-off period for prepaid packages across the industry. Currently, this protection is offered only by CaseTrust-accredited businesses.

CASE also proposes that businesses be required to keep customer prepayments in escrow, to safeguard funds if operations fail.

“CASE will continue to engage the government and the industry on stronger prepayment measures,” Yong said.

Affected customers can contact CASE at 6277-5100 or visit www.case.org.sg for assistance.

As of now, no liquidators have been formally named, and there is no confirmed timeline for the company’s liquidation proceedings.

1 Comment