Investigative report alleges Thaksin Shinawatra linked to US$3.5 billion shadow empire

Independent outlet Whale Hunting has published an investigation alleging that former Thai Prime Minister Thaksin Shinawatra built a secret financial network worth up to US$3.5 billion through offshore entities, Cambodian casino ventures, and African mining interests — with a South African-born fixer at its centre.

- Whale Hunting alleges ex-Thai PM Thaksin Shinawatra controls US$2.5–3.5B through hidden holdings in mining, casinos, and Thai corporates.

- South African-born fixer Benjamin Mauerberger, a convicted fraudster, identified as central to the network.

- Network allegedly channelled Cambodian money into Thai assets including Bangchak Corporation.

Independent investigative platform Whale Hunting has alleged that former Thai Prime Minister Thaksin Shinawatra built a hidden financial network worth between US$2.5 billion and US$3.5 billion, spanning African mining operations, Cambodian casinos, and a series of offshore shell companies.

The report, published this week, identifies South African-born businessman and convicted fraudster Benjamin Mauerberger as the fixer behind the empire.

According to Whale Hunting, Mauerberger played a key role in acquisitions, including the purchase of a US$60 million private jet, while using front companies registered in Singapore and Thailand to conceal ownership trails.

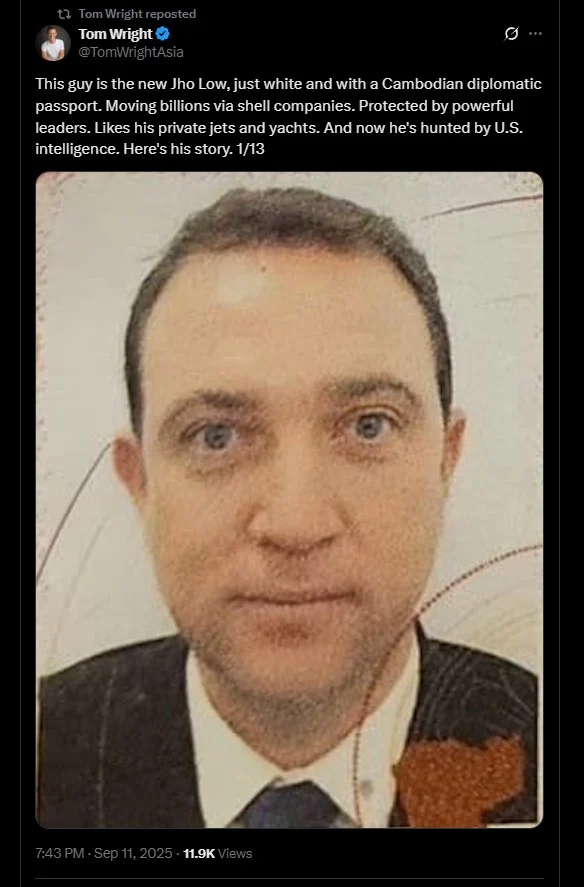

The investigative platform, part of Project Brazen and helmed by Wall Street Journal alumni Tom Wright and Bradley Hope, described Mauerberger as “the new Jho Low” — referencing the Malaysian financier at the centre of the 1MDB scandal.

In a post on X (formerly Twitter), Wright wrote that Mauerberger “moves billions through shell companies, shielded by powerful leaders, indulging in private jets and yachts, and now pursued by U.S. intelligence.”

A fixer at the heart of transnational finance

The Whale Hunting report outlines how Mauerberger and his wife Cattaliya Beevor operated Singapore-based investment funds and Thai shell entities to route Cambodian capital into Thai markets.

The pair’s business dealings allegedly connect to Yim Leak, a Cambodian tycoon whose sister is married to Hun Many, the son of former Prime Minister Hun Sen.

Sources cited in the investigation describe Mauerberger as a “silent partner” in Yim Leak’s ventures, effectively bridging Cambodian wealth with Thai political and corporate interests.

The push into Thai energy

One of the most notable acquisitions uncovered involves Bangchak Corporation, Thailand’s second-largest energy company.

By March 2025, companies linked to Mauerberger — Capital Asia Investments (CAI) in Singapore and Alpha Chartered in Thailand — reportedly controlled a combined 20 percent of Bangchak’s shares.

The Thai government, through its state investment fund and Social Security Office, holds around 35 percent. Analysts say the two blocs represent competing centres of influence within the firm.

The report suggests that these cross-border investments coincided with renewed negotiations between Thailand and Cambodia over disputed energy resources in the Gulf of Thailand — potentially giving the network leverage in regional energy deals.

Cambodia connection and political fallout

The revelations come amid heightened political tension between Thailand and Cambodia.

Earlier this year, border clashes left more than 40 people dead. Soon after, Thai Prime Minister Paetongtarn Shinawatra, Thaksin’s daughter, was dismissed by the Constitutional Court following outrage over a leaked phone call with Hun Sen.

During his years in exile, Thaksin received refuge and an economic advisory position from Hun Sen — a relationship that investigators now suggest may have enabled the flow of Cambodian funds into Thai holdings.

Anatomy of the front companies

At the core of the alleged network is Capital Asia Investments, founded in Singapore in 2017.

CAI reportedly built a 14 percent stake in Bangchak before transferring part of its shares to Alpha Chartered, a Thai entity linked to Cattaliya Beevor.

Corporate records indicate that Alpha Chartered once shared an office with Apex Equity Ventures, the firm behind a US$20 million penthouse purchase at the Aman New York Residences.

Investigators claim that Beevor manages CAI alongside its Singaporean CEO Eugene Tang, while acting as a proxy for Mauerberger to keep his name off legal documents.

Beyond Bangchak: wider acquisitions

The investigation traces similar acquisition patterns beyond the energy sector.

Entities tied to CAI and Beevor allegedly purchased major stakes in Finansia X PCL, a Thai securities firm. Beevor reportedly acquired nine percent of the company in 2024 before selling it within months.

At the same time, Cambodia’s BIC Bank, founded by Yim Leak, mirrored those movements — suggesting coordinated financial activity.

Analysts quoted in the report said the rapid trades and opaque ownership structures raised suspicions of money laundering or market manipulation.

A long history of fraud and flight

Mauerberger’s background adds a layer of intrigue. Born in Cape Town, he first gained notoriety in Bangkok’s so-called “boiler room” scams of the late 1990s, peddling worthless stocks to foreign investors.

He was later convicted in New Zealand and accused in Thailand of unauthorised securities trading.

Despite his record, Mauerberger reportedly cultivated ties with Cambodian and Thai elites. In Cambodia, he obtained land concessions and casino stakes — allegedly taking cuts from gambling-linked money laundering operations.

By the late 2010s, his network was believed to be handling about US$1 billion annually. Cambodian sources claim he was rewarded with a diplomatic passport and an advisory role to the Senate.

U.S. authorities monitoring network

According to Whale Hunting, U.S. intelligence agencies have taken an interest in the activities of Mauerberger’s group, viewing it as a possible conduit for political influence and illicit capital.

Investigators are said to be tracking overlaps between Cambodian financial flows, Chinese-linked business networks, and Thai corporate investments.

Washington reportedly fears that Cambodia’s deepening financial interdependence with Thailand could mirror patterns of Chinese economic influence seen elsewhere in the region.

Energy, politics, and influence

The Bangchak acquisitions have also drawn scrutiny from Thai business circles.

Energy tycoon Sarath Ratanavadi, founder of Gulf Energy and once a Thaksin ally, is said to have opposed the Cambodian-backed investment bloc, fearing it could undermine his gas and LNG interests.

His rift with Thaksin, observers note, coincided with Thailand’s recent political turmoil.

Whereabouts uncertain

Following the report’s publication, Mauerberger’s whereabouts are unknown.

He is believed to be in Dubai or Cambodia, while his luxury yacht Wanderlust was last tracked off the coast of Turkey — a popular refuge for sanctioned or wanted financiers.

Yim Leak has also withdrawn from public life, deleting his social media presence. His company, BIC Group, recently edited its website, removing the names of Thai police and financial figures previously listed as advisers.

Legal and political consequences

On 9 September, Thailand’s Supreme Court ruled that Thaksin must serve a one-year prison term, revisiting his 2023 conviction for fraud and abuse of power.

Judges determined that his previous hospital stay could not count as time served.

Following the verdict, Thaksin was seen entering a prison van before posting on Facebook that he “accepted the court’s decision” and thanked the monarch for reducing his sentence from eight years to one.

Observers say the Whale Hunting revelations could intensify scrutiny of Thaksin’s remaining influence and the Shinawatra family’s financial footprint.

0 Comments