Bringing Pokémon cards into Malaysia? Anything above RM1,000 gets taxed

Malaysia’s Customs Department says goods brought into the country are only exempted up to RM1,000, and items above that — including Pokémon trading cards — will be taxed. The reminder follows a Changi Airport case involving cards worth over S$30,000 (RM105,000), which sparked debate among travellers about what must be declared.

- Malaysia allows tax exemptions only up to RM1,000 for goods brought in by air travellers.

- Trading cards, including Pokémon, fall under “playing cards” and are taxable once they exceed the limit.

- The reminder follows a Changi Airport seizure of Pokémon cards worth over RM105,000.

MALAYSIA: A recent seizure of Pokémon trading cards at Singapore’s Changi Airport has renewed discussions among travellers about what goods are taxable when entering Malaysia.

Malaysia’s Customs Department director-general Datuk Anis Rizana Mohd Zainudin said confusion over import rules remains widespread and costly.

She stressed that nearly all goods brought into the country are taxable, except those covered under very specific exemptions.

“Personal belongings are not a magic spell for duty-free immunity,” she told the New Straits Times.

Singapore Seizure Worth Over S$30,000

The issue gained traction after Singapore authorities found hundreds of Pokémon cards worth over S$30,000 (RM105,000) in the luggage of a 25-year-old Singaporean during a routine screening on 10 Oct.

The items, believed intended for collection and resale, were referred to Singapore Customs for investigation under the Customs Act and GST regulations.

What Malaysians Need to Know: The RM1,000 Rule

Under Malaysia’s regulations, air travellers are allowed limited duty-free items.

Beyond that, all other goods are only exempted up to RM1,000 (or approx. S$315) in total value.

Anything above this limit becomes taxable, typically at 10% import duty, based on the declared value.

Trading Cards Fall Under ‘Playing Cards’ Tariff

According to Anis, trading cards — including Pokémon and sports cards — are categorised as “playing cards”.

If their value exceeds RM1,000, the excess is subject to import duty, sales tax and excise duty, each at 10%.

She said duty applies even if travellers consider the cards “personal items”.

“New purchases abroad above the permitted limit must be declared,” she said.

Declaration Is Mandatory

Anis reminded travellers that declarations are compulsory under the Customs Act 1967 and the Customs Regulations 2019.

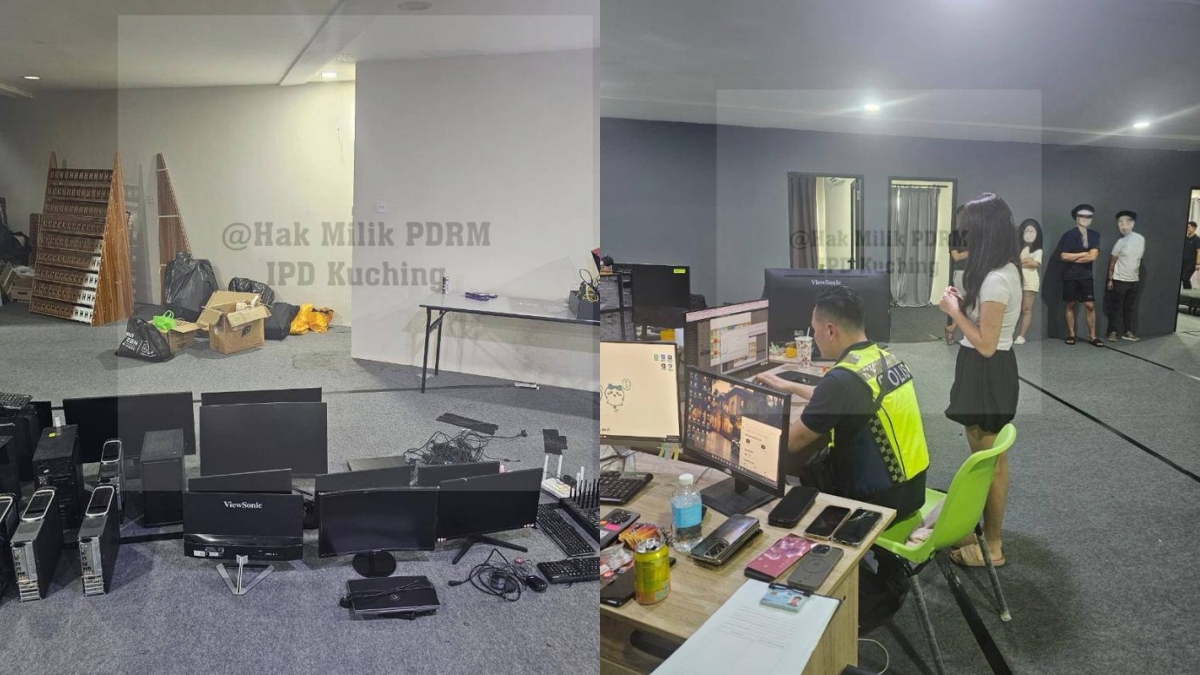

Failure to declare taxable goods may lead to seizure and further investigation.

Common undeclared items include electronics, branded apparel, handbags, cosmetics, watches, jewellery, gifts, alcohol and food items.

Misconception on ‘Low-Value Goods’

She attributed the ongoing confusion to assumptions that lower-priced items are automatically exempt- — a misconception not supported by law.

“There is no loophole. Any item above the traveller-exemption cap is taxable at the border,” she said.

Anis encouraged travellers to consult the official Customs guide before arriving in Malaysia.

Green lanes are designed for travellers within the duty-free allowance but inspections may still occur.

The department is also developing an eCustoms traveller system, a digital declaration platform to streamline declarations and tax payments.