Category A COE prices rise 3.9% to S$109,501 in final tender of 2025

Category A COE prices rose 3.9 per cent to S$109,501 in the final tender of 2025, snapping a four-round decline, while premiums for larger cars and the Open category fell amid mixed year-end demand.

- Category A COE premiums rose 3.9 per cent to S$109,501 in the last tender of 2025, ending a four-round decline.

- Category B and Open category premiums fell, reflecting mixed demand amid year-end travel and sales campaigns.

- Motorcycle COEs declined, while commercial vehicle premiums edged slightly higher.

SINGAPORE: Certificate of entitlement (COE) prices for smaller cars rose in the final tender exercise of 2025, breaking a recent downward trend, while premiums for larger cars, motorcycles and the Open category declined.

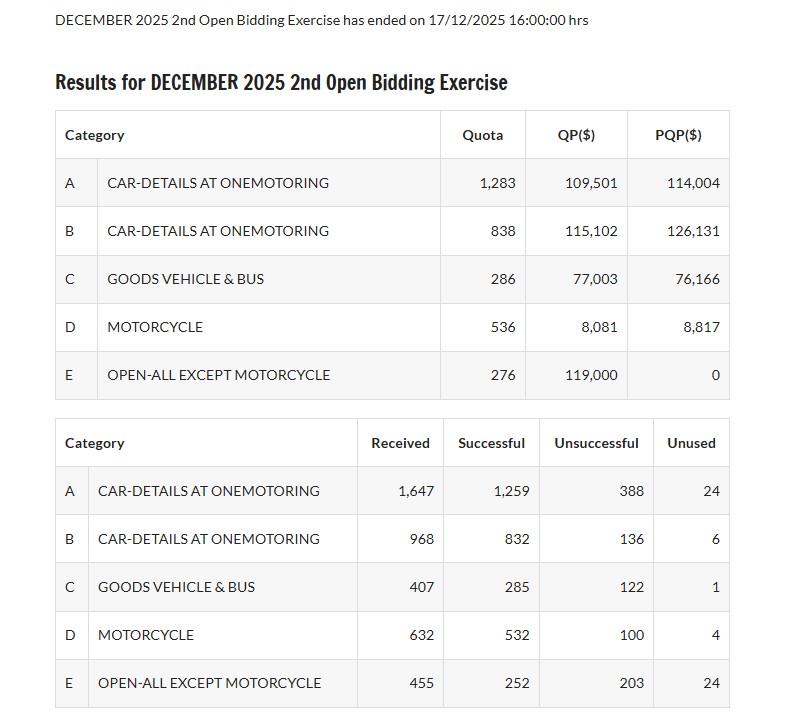

In results released after the tender closed on 17 December 2025, the Category A COE premium climbed 3.9 per cent to S$109,501, up from S$105,413 in the previous exercise.

Category A certificates apply to smaller and less powerful cars, as well as electric vehicles that meet the category’s specifications.

The increase ended a streak of four consecutive tender rounds in which Category A premiums had fallen, following a record high of S$128,105 reached in the first tender exercise in October.

In contrast, premiums for larger cars declined. The Category B COE, which covers larger and more powerful cars and electric vehicles, fell 7.1 per cent to S$115,102.

This was down from S$123,900 at the previous tender exercise held on 3 December.

A COE is required to register any vehicle in Singapore, with two tender exercises conducted each month under the quota system that regulates vehicle population growth.

Ahead of the 17 December tender, some industry participants had expected COE premiums to soften across all categories, citing quieter showroom activity during the year-end holiday period.

They noted that many potential buyers were travelling overseas, traditionally resulting in lower footfall and fewer bookings at car dealerships.

However, other industry insiders observed that certain dealers continued to pursue year-end sales targets aggressively, supported by marketing campaigns and promotional offers.

These competing factors contributed to mixed price movements across the different COE categories in the final tender of the year.

The Open category, or Category E, premium declined by 3.3 per cent, falling from S$123,000 to S$119,000.

This marked the lowest Open category premium since the first tender exercise in July, when it stood at S$118,500.

Although Open category certificates can be used to register any type of vehicle except motorcycles, they are most commonly used for larger and more powerful cars.

Because these certificates are transferable, they provide motor dealers with greater flexibility, allowing vehicles to be registered without waiting for a specific category tender.

Premiums for commercial vehicles saw a slight increase. The Category C COE ended at S$77,003, representing a 0.7 per cent rise from S$76,501 in the previous exercise two weeks earlier.

The modest increase suggested relatively stable demand for goods vehicles and buses, despite broader fluctuations in passenger vehicle categories.

Motorcycle COE premiums continued to ease. The Category D premium fell by 2.5 per cent to S$8,081, down from S$8,289 in the previous tender.

The decline followed earlier signs of softer demand in the motorcycle market, which has seen greater price stability compared with car COE categories over the past year.

The next COE tender exercise is scheduled to close on 7 January 2026, marking the first tender of the new year.