Forced company liquidations in Singapore hit record 392 in 2025, up about 28% from 2024

Singapore recorded a new high of 392 forced company liquidations last year, reflecting persistent cost and debt pressures on smaller firms, particularly in the food and beverage sector, despite ongoing government support measures.

- The number of companies forced into liquidation in Singapore reached a new record of 392 last year, rising about 28% from 2024.

- Construction-related trades, retail, and food and beverage businesses were among the hardest hit, with rental and debt pressures cited as key factors.

- Despite government support schemes, structural weaknesses in smaller food and beverage firms continue to drive closures and insolvencies.

SINGAPORE: The number of companies forced into liquidation in Singapore reached a new record last year, reflecting mounting financial strain on parts of the business community despite generally stable economic conditions.

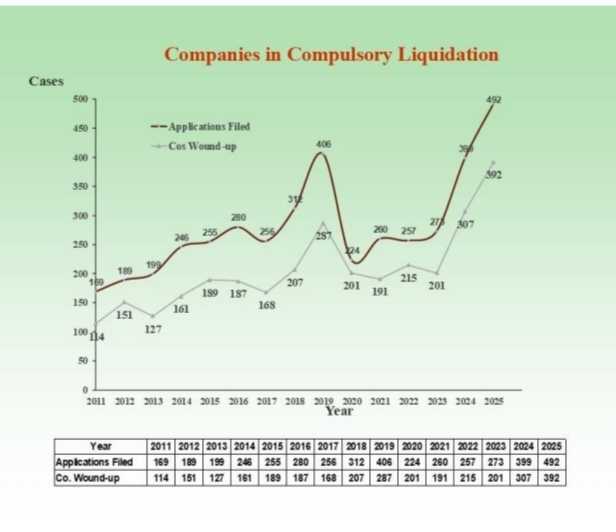

A total of 392 companies were placed under compulsory liquidation last year, an increase of about 28% from 2024, when 307 cases were recorded.

The figures exclude companies that entered voluntary liquidation.

Record number of forced liquidations for second straight year

Under Singapore law, a company is deemed insolvent if it cannot repay debts when they fall due. Creditors may then apply to the courts for compulsory liquidation.

According to data from the Insolvency Office under the Ministry of Law, 313 companies had already been forced into liquidation in the first nine months of last year, exceeding the full-year total for 2024.

The number of forced liquidations has now hit record levels for two consecutive years.

The 2024 figure was the highest since records began in 2006, and the total rose further last year, setting a new peak.

Industry practitioners said the trend highlights uneven pressures across sectors, even as Singapore’s overall economic performance remained relatively resilient.

Businesses in renovation, retail trade and the food and beverage sector were among those most affected, with many facing legal action from suppliers or landlords over unpaid debts.

Rental rigidity a key driver of F&B distress

According to a report by Lianhe Zaobao, Sean Lee, director at law firm Triangle Legal LLC, said most of the debt-distressed cases his firm handled last year involved food and beverage businesses.

Many of these cases were linked to rental issues, he noted, pointing to leases that offered little flexibility during periods of weak sales or rising costs.

Lee cited one case handled by his firm in which a tenant was bound by a lease that lacked exit or early termination clauses.

When the business became unsustainable, the tenant was unable to withdraw from the agreement.

The firm eventually represented the tenant in negotiations with the landlord to secure an early termination, averting further financial deterioration, Lee said.

Looking ahead, Lee expects pressures to persist.

He said landlords may adopt a more cautious stance on lease flexibility amid ongoing geopolitical tensions and a generally softer economic outlook.

As a result, smaller tenants may find it harder to negotiate concessions, potentially keeping forced liquidation numbers at elevated levels.

Debt recovery firms have also reported a rise in cases, reinforcing signs of tightening cash flow among smaller enterprises.

A debt collection company, Assured Debt Recovery, told Lianhe Zaobao that the number of cases it handled last year increased by about 20% compared with a year earlier.

Another Singapore-based firm, SDCS, reported a sharp rise in activity over the past two years. Its caseload grew by 30% in 2024 compared with 2023, and rose a further 50% last year.

The affected industries included wholesale trade, renovation and food-related businesses, with individual cases involving sums running into several hundred thousand Singapore dollars.

Restaurant closures extend into 2026

The financial strain has been particularly visible in the food and beverage sector, where a wave of closures that began last year has continued into this year.

Within the first month of 2026, closures were reported at several well-known outlets, including American restaurant chain Hooters and Open Farm Community.

Pizza Express and Kith Cafe have also shut multiple outlets, leaving each brand with only two operating locations.

The issue has drawn attention in Parliament, where the Government has outlined ongoing and new measures to support smaller food and beverage operators.

Government outlines support measures for smaller F&B operators

On 5 November 2025, Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong responded to a parliamentary question on whether existing policies adequately address high start-up costs, rental pressures and structural disadvantages faced by smaller operators.

In a written reply, Gan said a range of schemes has been introduced to help small and medium-sized enterprises manage costs, improve productivity and build resilience.

These include the Enterprise Financing Scheme – Working Capital Loan, which supports cash flow, and a 50% corporate income tax rebate for the 2024 and 2025 assessment years.

Eligible active firms with at least one local employee receive a minimum benefit of S$2,000 under the rebate.

Gan also highlighted productivity-focused grants such as the Productivity Solutions Grant, which supports the adoption of equipment and digital tools to reduce manpower reliance.

He cited tools such as rotary cookers and the Connected Business Suite, which streamlines front- and back-of-house operations.

To support demand, Gan pointed to Community Development Council vouchers, noting that S$1.26 billion worth had been spent at participating hawkers and merchants between December 2021 and July 2025.

Additional initiatives include Enterprise Singapore’s FoodX programme, which allows smaller firms to share resources and centralise food preparation.

The Food and Beverage Process Optimisation Programme also helps businesses engage consultants to improve manpower deployment and revenue generation.

From the second half of 2026, a redesigned SkillsFuture Enterprise Credit worth S$10,000 will be introduced, delivered via an online wallet to ease short-term cash flow pressures.

Despite these measures, structural fragility within the sector remains evident.

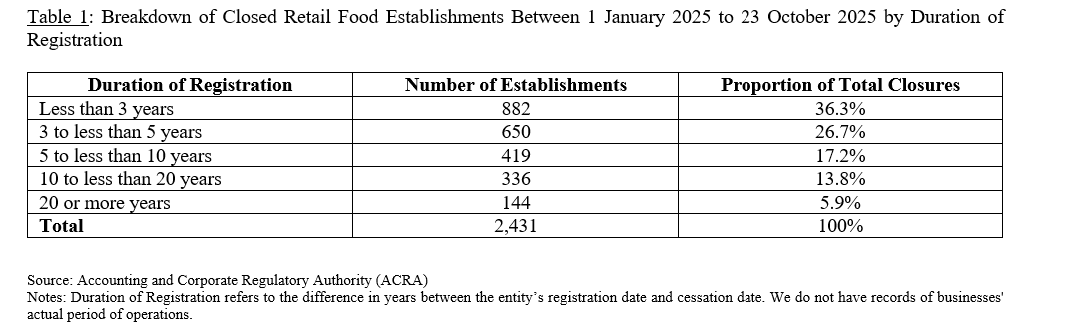

In a separate parliamentary reply, Gan revealed that more than 80% of retail food establishments registered for less than five years that closed last year had never declared a profit.

More than 2,400 food outlets shut as new openings outpace exits

Between 1 January and 23 October 2025, 2,431 retail food establishments ceased operations, while 3,357 new ones were registered, according to Ministry of Trade and Industry and ACRA data.

Of the closures, 63% involved businesses registered for five years or less, and 82% of these had never recorded a profit in any annual tax declaration.

ACRA noted that registration duration does not always reflect actual operating periods, as businesses may register well before opening or cease operations before formal deregistration.