Khoon Group, once involved in HDB projects, sanctioned by US for alleged links to Cambodian tycoon Chen Zhi

Khoon Group, a Singapore-based investment and electrical works company once involved in Housing Board projects, has been sanctioned by the US Treasury’s Office of Foreign Assets Control for alleged links to fugitive tycoon Chen Zhi. The firm denies wrongdoing but faces resignations and investor fallout.

- The US Treasury’s Ofac sanctioned Khoon Group for alleged links to Cambodian tycoon Chen Zhi’s cybercrime network.

- Khoon Group denies involvement, but Chen remains its controlling shareholder through a sanctioned entity.

- HDB and the Ministry of National Development said they have had no dealings with the firm for over 20 years.

SINGAPORE: Khoon Group, an investment holding and electrical engineering firm incorporated in the Cayman Islands and headquartered in Singapore, has been sanctioned by the United States Treasury Department’s Office of Foreign Assets Control (Ofac) on 14 October 2025.

The firm was among 146 individuals and entities targeted for alleged links to Cambodian tycoon Chen Zhi, who is accused of masterminding one of South-east Asia’s largest cybercrime and money-laundering networks.

Links to Chen Zhi and sanctioned entities

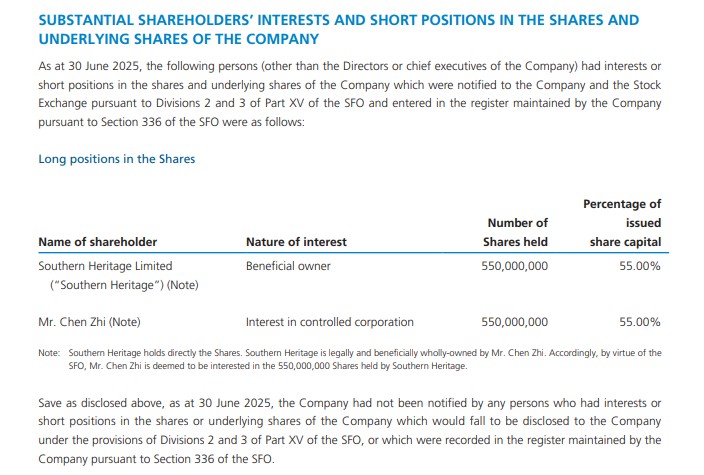

According to the firm's filings and agreements show that Chen, a Fujian-born tycoon and Cambodian resident, controls Khoon Group through Southern Heritage Limited — a British Virgin Islands-incorporated firm sanctioned in the same Ofac probe.

A share purchase agreement dated 27 January 2023 indicated that Chen acquired 550 million shares, or 55 per cent of Khoon Group, for HK$152.5 million (S$26.8 million). He was listed as Southern Heritage’s sole director.

Chen also heads Prince Group, a conglomerate with property, resort, and hotel projects in Cambodia.

Authorities in the United States and Britain have linked his network to online scams and cryptocurrency laundering activities.

The US Department of Justice described the case as its largest crypto seizure to date, confiscating at least US$15 billion (S$19.5 billion) in bitcoin.

The British government has seized UK£112 million (S$193.6 million) worth of properties in London.

Khoon Group denies involvement

In a 15 October statement following the sanctions, Khoon Group denied any connection to Chen’s alleged activities.

“None of the company or its subsidiaries, or their respective directors and members of the senior management are involved in the alleged activities which led to the sanctions,” it said.

The firm added that it “preliminarily expects that the sanctions do not have any material adverse impact on the business operations of the Group.”

However, the company’s 2024/2025 annual report revealed Chen remains its controlling shareholder through Southern Heritage.

HDB and statutory boards clarify past links

Khoon Group had previously claimed in corporate documents that it undertook multiple public housing projects awarded by the Housing and Development Board (HDB), including estates in Bukit Batok, Sengkang, Tampines, and Jurong West.

It asserted that at its peak, its projects powered one in five HDB flats.

However, HDB told state media The Straits Times that it currently has no direct contractual dealings with Khoon Group or its subsidiaries.

“Our last direct contractual dealing with Khoon Engineering Contractor Pte Ltd was more than two decades ago, and it was for electrical works undertaken at a housing development,” HDB stated.

The Ministry of National Development confirmed that its statutory boards, including the Building and Construction Authority and the Urban Redevelopment Authority, have no ongoing contracts with the group.

Rapid corporate fallout after sanctions

The sanctions announcement triggered a wave of resignations within Khoon Group.

On 22 October, the company informed the Hong Kong bourse that its registered office, registrar, and transfer agent had resigned.

The following day, its non-executive director and chair of the audit committee also stepped down.

By 24 October, its auditor, RSM Hong Kong, announced it would retire, citing a conflict with its ethical obligations.

Wider regional implications

Aside from Khoon Group, Ofac sanctioned 17 other Singapore-registered companies linked to Chen.

Corporate records show he holds direct or indirect stakes in at least nine of them, including AlphaConnect Investments, Binary Properties, Drew Properties, and Greenbay Properties.

Chen is also listed as a director and shareholder of Citylink Solutions, a Singapore-registered firm not sanctioned by Ofac, though a Cambodian firm of the same name appears on the sanctions list.

Singapore’s history of linked cases

This case follows Singapore’s 2023 money-laundering probe, in which 10 foreigners were charged with laundering more than S$3 billion through local banks and shell companies.

Investigations later revealed that several had incorporated Singapore-registered firms to conceal illicit funds.

Among them was Dubai property broker Su Jianfeng, who claimed to be the chief executive of a Singapore firm but admitted in court that he did not know its address.

Several Singaporeans were later charged with assisting in setting up these shell companies.

Khoon Group stated it operates mainly in Singapore and has no business, assets, or property in the United States or Britain.

Nonetheless, under the US sanctions, any assets or interests linked to the group within American jurisdiction will be frozen. Entities owned 50 per cent or more by sanctioned parties will also be blocked.

Founded in May 1988 as Khoon Engineering by Singaporean brothers Ang Jui Khoon and Ang Jui Heok, the company initially provided electrical engineering services to Housing Board estates.

It expanded overseas in 2015, was incorporated as Khoon Group in the Cayman Islands in 2018, and listed on the Hong Kong Stock Exchange (HKEX) a year later.

The company is now led by chief executive officer Ang Kok Kwang, the nephew of co-founder Ang Jui Heok.