FSM Holdings chief resigns after US sanctions link him to Cambodia’s Prince Group network

Singapore-based, Hong Kong-listed FSM Holdings has announced the resignation of executive Li Thet, after US authorities sanctioned him for alleged ties to Cambodia’s Prince Group transnational criminal network. FSM said it is not a sanctioned entity and is assessing compliance risks.

- FSM Holdings’ executive Li Thet (also known as Li Tian) resigned after being sanctioned by the US for alleged links to Cambodia’s Prince Group criminal network.

- FSM Holdings, headquartered in Singapore and listed in Hong Kong, stated it is not a sanctioned entity and is conducting an internal compliance review.

- Li’s resignation makes FSM the third Hong Kong-listed firm connected to Prince Group-linked individuals, following similar revelations about Khoon Group Limited.

The Singapore-headquartered company FSM Holdings, listed on the Hong Kong Stock Exchange, announced on 22 October 2025 that its executive director and chief executive, Li Thet (李添), resigned from all positions after the United States imposed sanctions linking him to a Cambodian transnational criminal group.

According to a filing with the Hong Kong Stock Exchange, Li stepped down from his roles as executive director, board chairman, and nomination committee chairman, effective 21 October.

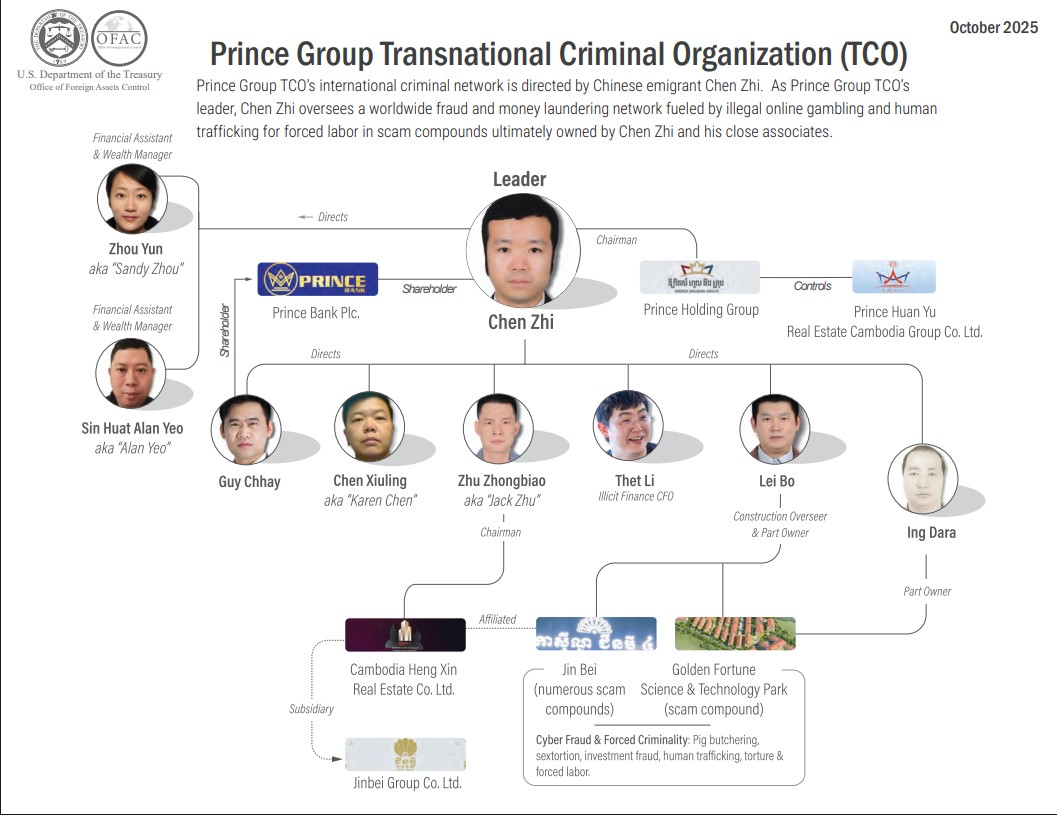

The company confirmed that the move followed the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) decision on 14 October to sanction Li for alleged involvement in criminal activities tied to the Prince Group, a conglomerate led by Chen Zhi, accused of operating large-scale online fraud and human trafficking networks.

FSM Holdings said it had immediately initiated an internal review and sought professional advice to ensure compliance with all relevant laws and regulations.

“The company is currently seeking professional advice to assess and address the situation and will make further announcements as and when appropriate,” the statement read.

FSM emphasised that it is not itself a sanctioned entity and denied any corporate link with the Prince Group.

It added that neither its subsidiaries nor any of its other directors or senior management are involved in activities related to the US sanctions.

The company was founded by late Singaporean entrepreneur Cheok Chong Fook, who passed away last year.

His widow, Wong Yet Lian, now serves as the company’s sole executive director and president.

FSM Holdings, incorporated in the Cayman Islands and listed since 2018, engages in precision sheet metal engineering and mobile game development, with a market capitalisation of approximately HK$435 million. The firm reported an unaudited first-half loss of US$3.97 million, compared to US$413,000 in the same period last year.

OFAC stated that Li, born in Beijing in 1987, holds Chinese and Cambodian citizenship, and a Vanuatu passport.

Records reviewed by Bloomberg indicate he purchased a Boulevard Vue apartment in Singapore for S$18.2 million, neighbouring a residence owned by Chen Zhi at Gramercy Park.

The sanction of Li comes amid the United States and United Kingdom’s largest joint law enforcement operation targeting cybercriminal networks in Southeast Asia.

The Prince Group is accused of running vast operations involving cyber fraud, human trafficking, forced labour, and money laundering through an international web of shell companies.

Authorities have frozen more than US$14 billion in bitcoin and assets linked to Chen and his associates, and Chen himself faces wire fraud and money-laundering conspiracy charges in a US federal court.

FSM Holdings is now the third Hong Kong-listed company identified as connected to individuals associated with the Prince Group.

According to Lianhe Zaobao, Khoon Group Limited, another Singaporean engineering firm listed in Hong Kong, was also sanctioned after investigators found Chen held 55 per cent of its shares through offshore vehicles.

Among those sanctioned with Chen are several high-ranking associates, including Guy Chhay, Lei Bo, Ing Dara, Zhu Zhongbiao (Jack Zhu), Sin Huat Alan Yeo, Zhou Yun (Sandy Zhou), Wei Qianjiang, and Thet Li.

OFAC documents show that three of these individuals — Karen Chen, Alan Yeo, and Nigel Tang Wan Bao Nabil — are Singapore-born.

Business records reviewed by The Business Times and Handshakes reveal that Karen Chen controls multiple Singapore-registered firms, including Warpcapital Yacht Management and Cloud Xero Management, both sanctioned entities.

These companies share an address with over 20 other Chen-linked businesses under Capital Zone Warehousing, which stores luxury goods such as wines, whiskies, and cigars.

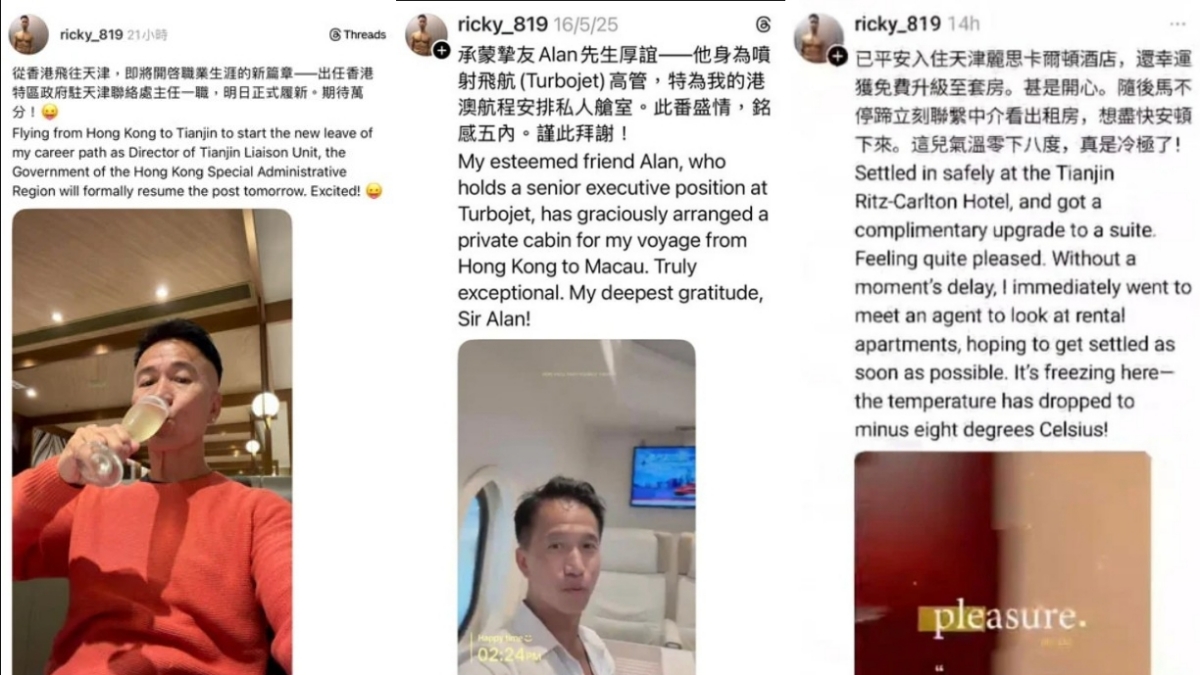

Nigel Tang, 32, is the operations head of Capital Zone Warehousing and is listed as a director of several sanctioned entities, while Alan Yeo, 53, is described by the US Department of Justice as Chen Zhi’s “financial assistant and wealth manager,” managing accounts and helping conceal illicit transactions.

The developments have heightened scrutiny of Singapore-linked companies and Hong Kong-listed entities with exposure to Cambodian business networks, as authorities intensify global efforts to dismantle alleged Southeast Asian cyber scam operations.