Khoon Group, sanctioned by US over Chen Zhi ties, led by PAP grassroots leaders

Khoon Group, a Singapore-based firm sanctioned by the US over alleged ties to Cambodian tycoon Chen Zhi, is led by PAP grassroots leaders Ang Jui Khoon and his son Jansen Ang. Incorporated in the Cayman Islands and listed in Hong Kong, the firm previously provided electrical engineering services for HDB estates across Singapore.

- The US Treasury has sanctioned Khoon Group over its alleged links to Cambodian tycoon Chen Zhi.

- The Singapore-based, Hong Kong-listed firm is led by two grassroots leaders from the ruling People’s Action Party (PAP).

- Singapore’s Housing and Development Board (HDB) clarified that it has had no recent dealings with the company.

UPDATE (31/10/25): Clarification on the Ang family's non-involvement in Khoon Group (Hong Kong)

Khoon Engineering Group in Singapore wishes to clarify that its founding Ang family no longer holds any stake in Khoon Group or Khoon Engineering in Hong Kong.

Khoon Engineering Group operates independently in Singapore and has no business affiliation with Khoon Group’s operations in Hong Kong.

The Ang family, who founded the electrical engineering business in 1988, divested its entire 55% shareholding in the publicly listed Khoon Group (Hong Kong) to Mr Chen nearly three years ago. Mr Chen is also not involved in the operations of Khoon Engineering Group in Singapore.

A Singapore-based firm listed on the Hong Kong Stock Exchange has been sanctioned by the United States Treasury Department’s Office of Foreign Assets Control (Ofac) for alleged links to Cambodian tycoon Chen Zhi.

According to the US Treasury’s statement on 14 October 2025, Khoon Group was among 146 individuals and entities targeted for their alleged roles in one of South-east Asia’s largest cybercrime and money-laundering networks.

A check on the group's official site identified Khoon Group’s senior leadership as Jansen Ang Kok Kwang, the firm’s Chief Executive Officer, and his father Ang Jui Khoon, the Chairman and Executive Director.

Both are long-time grassroots leaders affiliated with the People’s Action Party (PAP).

Checks on the Prime Minister’s Office website confirm that Jansen Ang serves as Chairman of the Fernvale Citizens’ Consultative Committee (CCC) and received The Public Service Medal (Pingat Bakti Masyarakat) in 2022.

His father, Ang Jui Khoon, is listed as Patron of the Jalan Kayu CCC, and was awarded The Public Service Star in 2025.

Following the 2025 General Election, Jansen Ang appeared in group photographs with elected PAP Member of Parliament Ng Chee Meng and other party members, according to posts on his Facebook page dated 4 May 2025.

Company background and public sector projects

Khoon Group traces its origins to Khoon Engineering, founded in May 1988 by Singaporean brothers Ang Jui Khoon and Ang Jui Heok.

The company initially provided electrical engineering services for Housing and Development Board (HDB) estates.

Corporate records show that Jansen Ang and his father became the firm’s sole owners on 2 April 2007, after Ang Jui Heok transferred his shareholdings to his nephew.

The firm embarked on its first overseas project in Myanmar in March 2015, providing electrical engineering solutions for various electrical systems within a commercial complex.

Khoon Group was subsequently incorporated in the Cayman Islands in July 2018, and by 2019, Khoon Engineering became a subsidiary of this holding company.

The firm has previously cited involvement in multiple public housing projects, including developments in Bukit Batok, Sengkang, Tampines, Jurong West, and Choa Chu Kang.

A 2019 corporate document mentioned a Bukit Batok project involving 4,186 flats, while earlier filings referred to a Choa Chu Kang project exceeding S$10 million in value. It asserted that at its peak, its projects powered one in five HDB flats.

In a 2024 social media post, Khoon Group said several of its projects received recognition at the HDB Awards 2024.

HDB and ministry clarify no current links

In response to media queries, HDB told The Straits Times that it has no current contractual dealings with Khoon Group or its subsidiaries.

“Our last direct contractual dealing with Khoon Engineering Contractor Pte Ltd was more than two decades ago, and it was for electrical works undertaken at a housing development,” HDB said in a statement.

The Ministry of National Development also confirmed that its statutory boards — including the Building and Construction Authority (BCA) and Urban Redevelopment Authority (URA) — have no ongoing contracts with the group.

US sanctions and Chen Zhi’s control

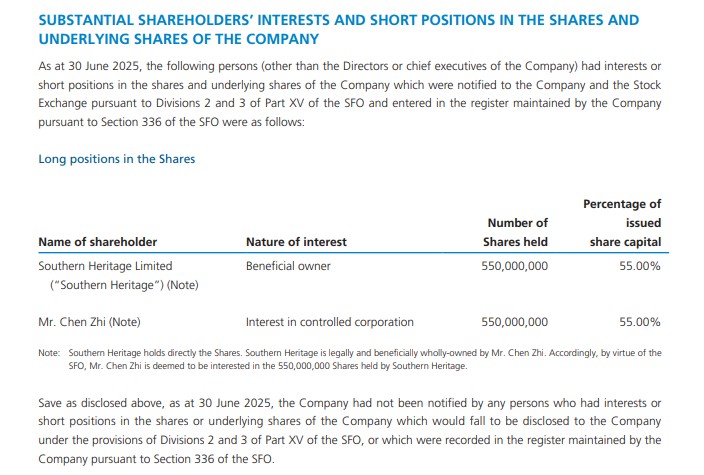

Ofac documents indicate that Khoon Group is controlled by Chen Zhi through Southern Heritage Limited, a British Virgin Islands–incorporated firm also sanctioned in the same probe.

A share purchase agreement dated 27 January 2023 shows Chen acquired 550 million shares (55%) of Khoon Group for HK$152.5 million (S$26.8 million), becoming its controlling shareholder.

Chen, a Fujian-born Cambodian resident, heads the Prince Group, a conglomerate with property, resort, and financial interests across Cambodia.

Authorities in the United States and United Kingdom have accused his network of running large-scale online scams and cryptocurrency laundering.

The US Department of Justice has described the investigation as its largest-ever cryptocurrency seizure, confiscating at least US$15 billion (S$19.5 billion) in bitcoin.

The British government has reportedly seized UK£112 million (S$193.6 million) worth of assets in London linked to the case.

Khoon Group denies wrongdoing

In a statement issued on 15 October 2025, Khoon Group denied any connection to Chen’s alleged criminal activities.

“To the best knowledge and information of the directors of the Company having made all reasonable enquiries, the Group principally operates in Singapore, and does not have any business operations or own any assets or property in the U.S. or U.K.”

“None of the company or its subsidiaries, or their respective directors and members of senior management, are involved in the alleged activities which led to the sanctions,” it said.

The firm added that it “preliminarily expects that the sanctions do not have any material adverse impact on the business operations of the Group.”

However, the company’s 2024/2025 annual report shows that Chen Zhi remains its controlling shareholder through Southern Heritage.

Following the sanctions announcement, Khoon Group experienced a series of senior departures.

On 22 October, the company informed the Hong Kong Stock Exchange that its registered office, registrar, and transfer agent had resigned.

The next day, its non-executive director and chair of the audit committee stepped down.

By 24 October, its auditor, RSM Hong Kong, announced its retirement, citing conflicts with its ethical obligations.