Singapore pawnshop loans hit record S$884 million in June 2025 amid rising financial strain

Singapore’s pawnshop sector has reached an all-time high in lending, with total loans surging to S$884 million in June 2025. Analysts link the spike to soaring gold prices and increasing financial stress among households and small business owners.

- Pawnshop loan values jumped 29% year-on-year to a record S$884 million in June 2025.

- Rising gold prices and tighter cash flow are driving larger individual loans.

- Increasing unemployment and household debt point to mounting financial stress.

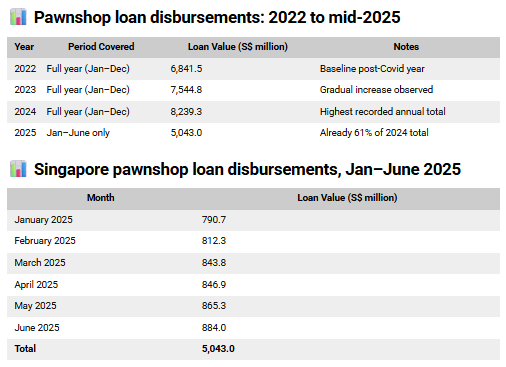

SINGAPORE — Pawnshop loans across Singapore have reached a record high, signalling mounting financial pressure among households and small business owners. According to data from the Singapore Department of Statistics, the total value of loans disbursed by pawnshops hit S$884 million in June 2025 — a 29 per cent increase compared with S$686.4 million in June 2024.

This figure is nearly double the S$467 million recorded during the pandemic in June 2020, marking the strongest activity in at least five years. The number of pledges rose by 8 per cent year-on-year, from 316,916 in June 2024 to 341,490 in June 2025.

While both indicators have increased, the growth in loan value far outpaces the rise in pledges, suggesting that average borrowing per transaction has climbed sharply — a sign that individuals are pawning higher-value items or borrowing more heavily against the same collateral.

Gold prices drive up loan values

Industry observers attribute the surge in loan value largely to gold’s record-breaking rally. The Straits Times cited MoneyMax Financial Services Group General Manager Lim Chun Seng, who said: “The rising price of gold is one key factor driving the increase in pawnshop loans.”

Spot gold prices rose from just over US$2,300 per ounce in June 2024 to above US$3,200 by June 2025, before exceeding US$3,500 on 2 September 2025. As gold prices climb, customers can borrow larger amounts using the same jewellery or gold items as collateral.

Fund Express spokesperson Brian Lan noted that the rising cost of living and business expenses have also pushed many small operators to seek quick liquidity. “They tell us that the business environment is tough now, with high rentals and more businesses shutting down. The market sentiment is quite bad,” he said.

Lan added that many of his customers — such as hawkers, shop owners and contractors — rely on pawn loans to cover daily expenses or bridge temporary cash flow gaps. He recounted the case of a mini-mart owner who pawned about S$40,000 worth of gold jewellery to support his business.

More luxury goods and high-value pledges

ValueMax and MoneyMax, which each operate over 50 pawnshop outlets across Singapore, remain among the industry’s biggest players. According to the Registry of Pawnbrokers, there were 241 registered pawnshops as of 1 September 2025.

Yeah Lee Ching, Managing Director of Retail and Trading at ValueMax Group, observed that more customers are pawning high-end items. “We have seen a steady increase in the number of clients pawning luxury watches from brands such as Rolex, Patek Philippe and Audemars Piguet,” she said.

ValueMax also accepts silver bars, old currency notes and luxury handbags from brands like Hermès and Chanel, provided they are in near-new condition.

Yeah explained that pawnbroking offers a fast, accessible source of short-term funds. “Unlike other forms of borrowing, pawn loans come with no late fees or administrative charges, making them cost-effective for smaller sums,” she said.

For example, a S$1,000 pawn loan typically incurs a maximum monthly interest of S$15. The Pawnbrokers Act 2015 caps monthly interest rates at 1.5 per cent.

Signs of deepening financial pressure

Economists view the surge in pawn loans as a reflection of tightening household budgets and increasing financial insecurity. Based on government data, the average loan per pledge rose from S$2,165 in June 2024 to S$2,589 in June 2025 — an increase of nearly 20 per cent.

This suggests that borrowers are pawning more valuable items or taking larger loans per transaction, consistent with reports of a tough economic environment and limited access to traditional credit.

The Ministry of Manpower’s March 2025 labour market report shows that the resident unemployment rate edged up to 2.9 per cent, while long-term unemployment increased to 0.9 per cent. Older workers aged 50 and above saw the largest increases in joblessness.

While these rates remain moderate by historical standards, the composition of job growth raises concerns. Between 2022 and the first quarter of 2025, 91.1 per cent of total employment gains — or 322,080 out of 353,500 new jobs — went to non-residents. Only about 30,700 positions were filled by Singapore citizens or permanent residents.

The resident workforce also fell from 2.46 million in March 2025 to 2.37 million in June, suggesting a contraction or reclassification in employment data. Economists note that these trends may be contributing to a sense of job insecurity and income fragility among local workers.

Household debt and credit reliance rise

Financial stress is also evident in consumer debt data. Figures from the Monetary Authority of Singapore show that credit card rollover balances — amounts not repaid in full each month — climbed from S$5.91 billion in June 2024 to S$6.49 billion in June 2025, an increase of nearly 10 per cent.

This growth came despite stable overall spending, indicating that more consumers are relying on high-interest revolving credit to manage cash flow.

Together with rising pawn loan values, these figures point to deepening short-term financial pressure among households.

Interviews reported by The Straits Times reveal that many individuals turn to pawnshops not for luxury purchases but to meet essential expenses or cover emergencies. A 35-year-old domestic helper said she pawned jewellery to send money home urgently, while a 65-year-old retiree, Mr Chong, shared that he uses pawning as a last resort: “It is not easy to borrow money from your own family, much less your friends… So when my finances are very tight, I would go to the pawnshop.”

Broader economic signals

Data from the first half of 2025 shows that pawnshop loan disbursements have already reached 61 per cent of 2024’s full-year total. Monthly figures climbed steadily from S$790.7 million in January to S$884 million in June.

Analysts say that unless economic conditions improve — particularly in the labour market and small business sectors — demand for pawn loans is likely to remain strong through the rest of 2025.

While the rising value of gold has boosted collateral potential, it has also masked deeper financial fragility across parts of the population. The continued growth of the pawnshop sector, they warn, should be read as a sign of stress rather than prosperity.

0 Comments