Singapore raises seller’s stamp duty rates and extends holding period to four years

The Singapore Government has announced new property cooling measures that extend the holding period for seller’s stamp duty (SSD) on residential properties and raise the payable rates — a move aimed at curbing speculative activity in the housing market.

- SSD holding period extended from three to four years, effective 4 July 2025.

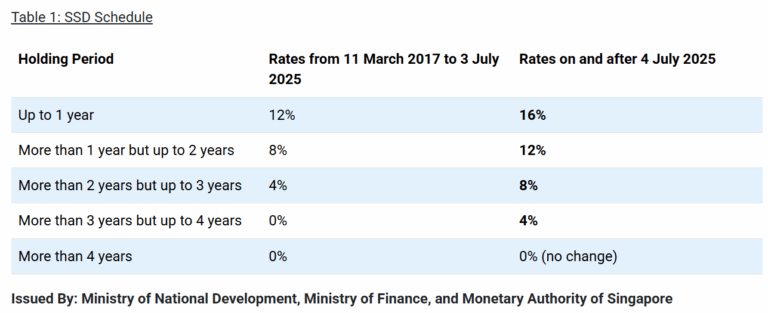

- SSD rates increased by four percentage points across all tiers, with a maximum of 16% for properties sold within the first year.

- Changes target rising short-term property sales and will not affect HDB flat owners.

The Singapore Government announced on 3 July 2025 that the holding period for seller’s stamp duty (SSD) on residential properties will be extended from three to four years.

In addition, SSD rates will be increased by four percentage points for each tier of the holding period.

These changes will take effect for all residential properties purchased on or after 4 July 2025 at 12.00am, according to a press release issued by the Ministry of National Development (MND).

SSD is payable by owners who sell their residential property within a certain period after purchase.

Return to pre-2017 policy levels

In 2017, the holding period was reduced from four to three years, and SSD rates were also reduced by four percentage points for each tier.

However, the Government observed that the number of private residential property transactions with short holding periods has increased sharply in recent years.

According to MND, there has been a significant rise in the sub-sale of uncompleted units — where buyers sell their properties before completion to profit from rising prices.

To address this trend, the Government decided to revert to the pre-2017 SSD holding period of four years and raise the SSD rates.

New rate structure and impact

Under the revised structure, the maximum SSD payable will be 16 per cent for residential properties sold within the first year after purchase.

The rates will decrease gradually for properties sold in subsequent years.

The revised SSD rates will not affect Housing and Development Board (HDB) flat owners, who are subject to a Minimum Occupation Period before they are eligible to sell.

Ensuring long-term market stability

The changes are reportedly part of ongoing efforts to ensure a stable and sustainable residential property market in Singapore.

MND stated that it will continue to monitor the property market closely and adjust policies as necessary to promote prudent property purchases.

The Government last introduced significant property market measures in April 2023. At that time, the Additional Buyer’s Stamp Duty (ABSD) for foreigners buying residential properties was increased to 60 per cent.

Singaporeans purchasing a second residential property saw their ABSD rise to 20 per cent, up from 17 per cent.

Further details of the revised SSD rates are set out in an official table released by MND.