Resale HDB flat prices inched up by 0.4% in Q3 2025; 482 million-dollar HDB flats sold

Resale HDB flat prices in Singapore rose marginally by 0.4% in the third quarter of 2025, marking the smallest quarterly increase in over five years. Despite slower price growth, a record 482 million-dollar flats were transacted, reflecting continued demand for rare and well-located units.

- HDB resale prices rose by 0.4% in the third quarter of 2025, the smallest increase since mid-2020.

- Despite moderating growth, a record 482 resale flats crossed the S$1 million mark.

- Rental activity and private property prices both saw modest increases over the same period.

SINGAPORE: Resale Housing and Development Board (HDB) flat prices in Singapore rose by 0.4 per cent in the third quarter of 2025, according to the latest HDB resale price index released on 24 October.

This increase, which aligns with earlier flash estimates, marks the smallest quarterly gain since the second quarter of 2020, when prices climbed by 0.3 per cent.

HDB stated that the 0.4 per cent rise in the July to September period followed a 0.9 per cent increase in the second quarter and 1.6 per cent in the first quarter, continuing a trend of moderated growth over the past year.

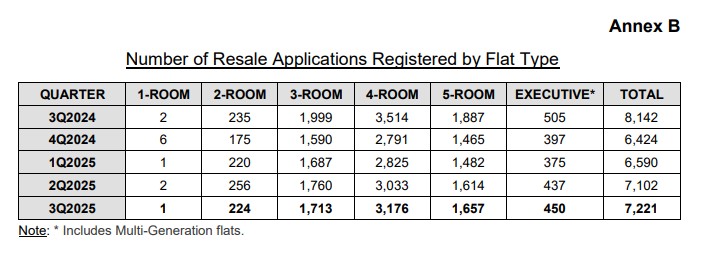

Resale activity picked up slightly, with 7,221 transactions recorded in the third quarter — 1.7 per cent higher than the 7,102 in the previous quarter.

However, transaction volume was still 11.3 per cent lower than the same period in 2024, according to HDB data.

Record number of million-dollar HDB flats

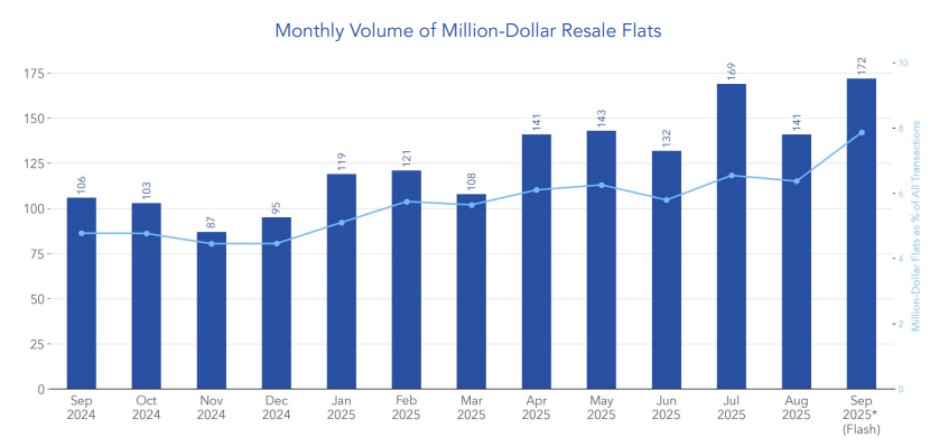

Despite the slower pace of overall price growth, the number of million-dollar transactions reached an all-time high.

About 482 resale flats were sold for seven-figure sums in Q3 2025, up 15.9 per cent from the previous quarter.

According to earlier figures from the Singapore Real Estate Exchange (SRX) and 99.co released on 6 October, 172 resale flats crossed the S$1 million mark in September alone, up from 141 in August.

The most expensive flat sold in the quarter was a five-room unit in the Central Area, which fetched S$1.59 million.

Analysts noted that the continued appetite for rare, centrally located flats reflects a sustained premium for convenience and limited supply.

Interestingly, non-mature estates such as Woodlands also saw million-dollar deals, with one executive flat selling for S$1.12 million — a sign that buyers are extending their search beyond traditional hotspots.

Regional trends in median prices

HDB data showed notable differences in resale prices across towns.

The highest median resale price for three-room flats was recorded in Sengkang at S$550,000, while the lowest was in Geylang at S$368,000.

For four-room flats, the median price peaked at around S$1.3 million in the central region, compared with the lowest in Jurong West at S$548,500.

Among five-room and executive flats, Hougang led with a median resale price of S$997,000, while Jurong West had the lowest at S$645,000.

Stable rental market, modest private sector growth

The HDB rental market remained stable.

Approved applications to rent out flats rose by 0.6 per cent to 10,123 cases in the third quarter.

Year-on-year, rental approvals were up 11 per cent, with 59,001 flats rented out as of September — a 0.5 per cent increase from the previous quarter.

In contrast, the private property market saw stronger activity.

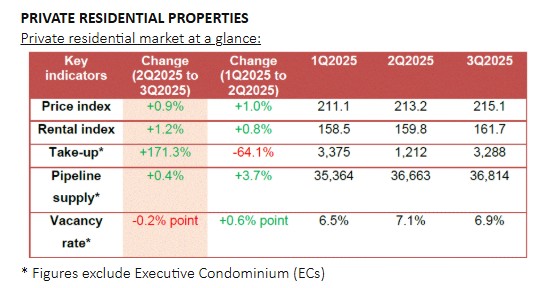

According to the Urban Redevelopment Authority (URA), the private residential property price index rose 0.9 per cent quarter-on-quarter, following a 1 per cent gain in Q2.

Prices of landed properties increased by 1.4 per cent, while non-landed homes rose 0.8 per cent, with gains across all regions — 1.7 per cent in the Core Central Region, 0.3 per cent in the Rest of Central Region, and 0.8 per cent in the Outside Central Region.

Private housing sales also surged as developers accelerated project launches.

A total of 4,191 new private units were launched between July and September, with 3,288 units sold, up sharply from 1,212 units in the previous quarter.

URA recorded 3,881 private resale transactions and 235 sub-sales, with resale activity making up 52.4 per cent of all deals in the quarter, compared with 71.1 per cent in the second quarter.