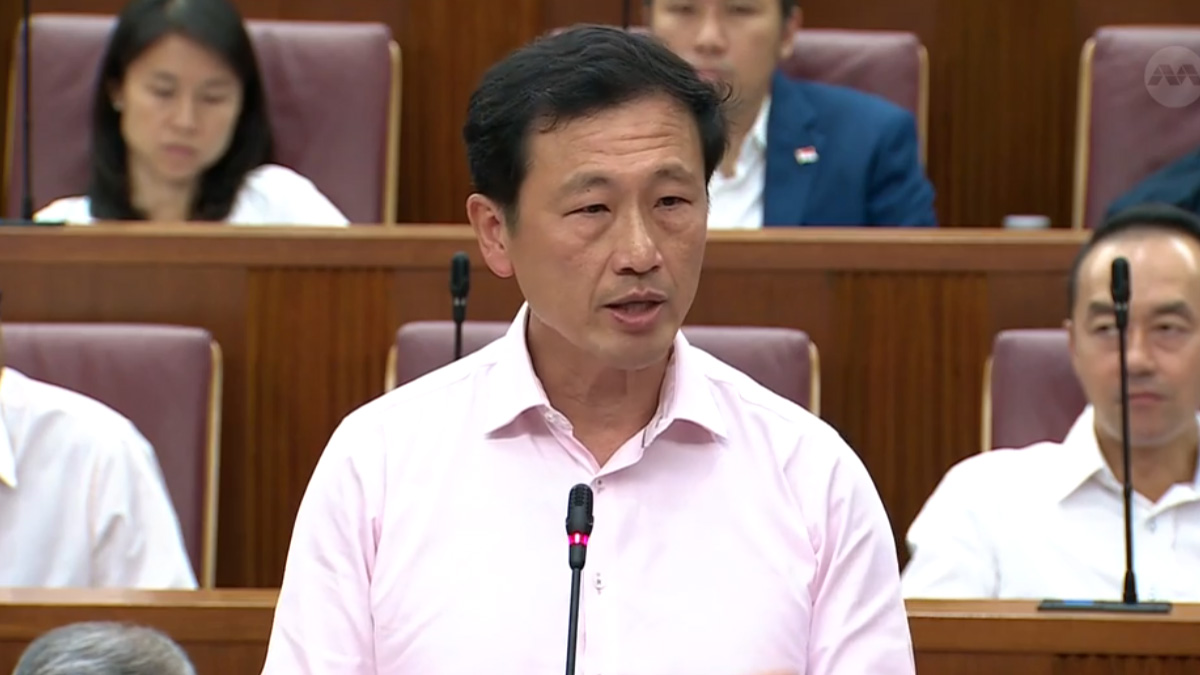

9 in 10 Singaporeans pay nothing at public hospitals, Ong tells Malaysian media

Singapore health minister Ong Ye Kung told Malaysian journalists that nine in 10 subsidised patients at public hospitals pay no cash out of pocket, as their bills are covered by government subsidies, MediSave and MediShield Life, with MediFund as a final safety net for those who still cannot afford their share.

- Health Minister Ong Ye Kung says nine in 10 subsidised public hospital patients pay zero cash after subsidies, MediSave and MediShield Life.

- He stressed that “there is no such thing as free healthcare”, arguing that whether fees are low or nominal, populations still pay through taxes, premiums or savings.

- Contrasting Singapore’s system with the UK and US, Ong framed the “S+3M” model as a middle ground between affordability and access, warning against chasing a “100% solution” on any single front.

Singapore health minister Ong Ye Kung has told Malaysian journalists that nine in 10 Singaporeans pay nothing for treatment at public hospitals, citing the city-state’s mix of subsidies, compulsory medical savings and national health insurance.

In a recent briefing reported by Malaysian media, Ong said Singapore’s healthcare financing system is designed so that, for most subsidised patients, hospital bills are fully covered after government subsidies, MediShield Life insurance and withdrawals from MediSave, the compulsory medical savings scheme.

“What is out of your pocket? Zero. For nine out of 10 subsidised patients, it becomes zero,” he was quoted as saying.

Ong explained that working Singaporeans contribute between 8% and 10.5% of their monthly salary into MediSave accounts, depending on age. These savings can be used to co-pay hospitalisation, surgery and certain outpatient treatments, alongside MediShield Life, the basic national health insurance scheme.

He also highlighted MediFund, an endowment fund parked with public healthcare institutions, as a “final safety net” for patients who still cannot afford their share of the bill even after subsidies and insurance.

Caution against “free healthcare”

In his remarks, Ong contrasted Singapore’s approach with the United Kingdom’s National Health Service and the largely private insurance-based system in the United States. He argued that both “fully free” and “fully private” models have serious drawbacks – long queues in one, unaffordable premiums in the other.

He reiterated a long-standing government line that “there is no such thing as free healthcare”, saying populations ultimately pay through taxes, premiums or savings:

“You can make it RM1, but somebody is paying the taxes to pay for that RM1 healthcare,” he said, referring to Malaysia’s nominal fees at public clinics and hospitals.

Ong framed Singapore’s system – often described as “S+3Ms” (subsidies, MediSave, MediShield Life and MediFund) – as a middle ground balancing affordability, access and sustainability.

He told the journalists that policymakers should avoid chasing a “100% solution” on any single dimension such as affordability or access, warning that “you pay a huge price somewhere else” if the system is pushed too far in one direction.

Ong’s earlier “seven in 10” and “nine in 10” claims

Ong’s latest comments to Malaysian media build on a series of similar assurances he has given in Parliament and policy speeches since 2023.

May 2023: Majority of subsidised inpatients “pay nothing”

On 10 May 2023, during a parliamentary debate on healthcare spending, Ong responded to opposition calls for higher government outlays by pointing to low cash payments among subsidised ward patients.

He said that in public hospitals:

-

Around seven in 10 Singaporeans in subsidised wards paid no out-of-pocket expenses,

-

Most of the remainder paid under S$500 in cash after subsidies, MediShield Life and MediSave.

Ong argued then that further reducing out-of-pocket spending would largely mean directing more resources to unsubsidised patients in A-class wards or private hospitals, pushing Singapore towards the much higher healthcare spending levels seen in many OECD countries.

March 2025: S+3Ms and “seven in 10 pay nothing” repeated

At the Ministry of Health’s Committee of Supply debate on 7 March 2025, Ong again emphasised that the S+3Ms framework was cushioning Singaporeans from rising costs.

In that speech, he updated the figures and said that “today, seven in 10 patients in subsidised hospital wards pay nothing out-of-pocket… while eight in 10 pay less than $100.”

The minister presented these numbers as evidence that the Government was keeping basic healthcare affordable even as the national health budget climbed to S$21 billion in 2025, with projections that it could exceed S$30 billion by 2030.

2024–2025: MediShield Life designed to cover “nine in 10 subsidised bills”

Separately, in a 2024 update on MediShield Life, Ong and the Ministry of Health stated that the scheme was calibrated so that about nine in 10 subsidised hospital bills would be “adequately covered” by the insurance, after applying deductibles and co-insurance.

This design principle was reiterated in 2024–2025 communications about raising MediShield Life claim limits and expanding outpatient coverage, with the Government saying it wanted to maintain that “nine in 10” coverage target for subsidised bills.

New rider rules: ending “full coverage” to curb overconsumption

Ong’s remarks also come as the Ministry of Health moves to tighten private insurance coverage in order to curb overconsumption and rising premiums.

In late November 2025, MOH announced that new Integrated Shield Plan (IP) riders sold from 1 April 2026 will no longer be allowed to cover the minimum deductible that patients must pay before insurance kicks in. At the same time, the mandatory co-payment cap for riders will be raised from at least S$3,000 to at least S$6,000 a year, although the minimum five per cent co-payment requirement remains unchanged.

The move builds on earlier reforms in 2018, when the Government first banned “full riders” that covered 100 per cent of a patient’s bill and required all new riders to include at least a five per cent co-pay, specifically to discourage unnecessary tests and procedures and keep premiums in check.

MOH has argued that such “first-dollar” coverage dulls price sensitivity and encourages both over-servicing and over-consumption, driving up costs for everyone. By ensuring that patients continue to bear deductibles and a share of their bills – even when they buy private IP riders – the ministry says it is reinforcing the same principle Ong outlined to the Malaysian journalists: there is no truly free healthcare, and some degree of co-payment is necessary to keep the system sustainable.

Reality check: most still delay care, many fear the bill

Yet Ong’s assurance that “nine in 10” subsidised patients pay nothing out of pocket sits uneasily with how people say they experience the system.

A recent study, Patient Voices Singapore: Towards More Informed and Seamless Care – conducted by Economist Impact and commissioned by Prudential – found that 83 per cent of respondents had delayed seeking necessary medical treatment in the past year.

The survey of 1,024 adults, conducted between April and May 2025, cited work and family obligations as key reasons, alongside people underestimating their symptoms and negative past experiences with the healthcare system.

Crucially, cost remains a significant deterrent despite subsidies and insurance. Among those who postponed care, 23 per cent cited cost as a reason. More than six in 10 said they worried about being able to afford the care they needed, and about half reported that their medical bills were higher than expected over the past year.

The same report found that 61 per cent of respondents felt they lacked sufficient information to make informed treatment decisions, while 60 per cent often did not know where to go when they needed medical attention.

Many said they would feel more confident seeking care if it caused less disruption to daily life and if they had clearer guidance through the system, from the first consultation to follow-up.