Agritrade founder, deported from China after over five years on the run, arrested in Singapore

Agritrade founder Ng Say Peck has been arrested and charged in Singapore after more than five years on the run. He faces 10 cheating charges linked to alleged fraudulent trade-financing arrangements that contributed to the commodities firm’s collapse.

- Agritrade founder Ng Say Peck was arrested in Singapore on 1 December 2025 after deportation from China.

- He faces 10 cheating charges linked to alleged trade-financing fraud involving US$8 million.

- The case is connected to Agritrade’s 2020 collapse, which exposed lenders to more than US$1.5 billion in liabilities.

SINGAPORE: The founder of commodity firm Agritrade, Ng Say Peck, has been arrested and charged after more than five years evading authorities.

According to the police on 2 December 2025, Ng was detained upon arrival in Singapore on 1 December following his deportation from China.

His return to face charges was made possible with assistance from China’s Ministry of Public Security, the police said.

Ng, aged 72, is the second Agritrade figure charged over a cheating case involving banks and financial institutions worldwide.

Former chief financial officer Lulu Lim Beng Kim was sentenced to 20 years’ imprisonment in 2023 for her role in the scheme.

Police investigations into Ng and several individuals began in January 2020, when Agritrade, a trader of coal and palm oil, came under scrutiny.

Between January and August 2020, multiple banks and finance companies lodged reports after extending trade-financing credit to Agritrade.

Ng left Singapore shortly before probes commenced and was later the subject of a warrant of arrest and an Interpol red notice.

He now faces 10 counts of cheating and is accused of deceiving Funding Societies, a digital financing platform.

According to investigators, Funding Societies entered into a credit-facility arrangement after being shown finance invoices allegedly assigned to Agritrade.

These invoices were later found to be fictitious, leading the platform to disburse a total of US$8 million across 10 transactions between August and November 2019.

According to the Accounting and Corporate Regulatory Authority’s Bizfile portal, Agritrade is now in insolvency.

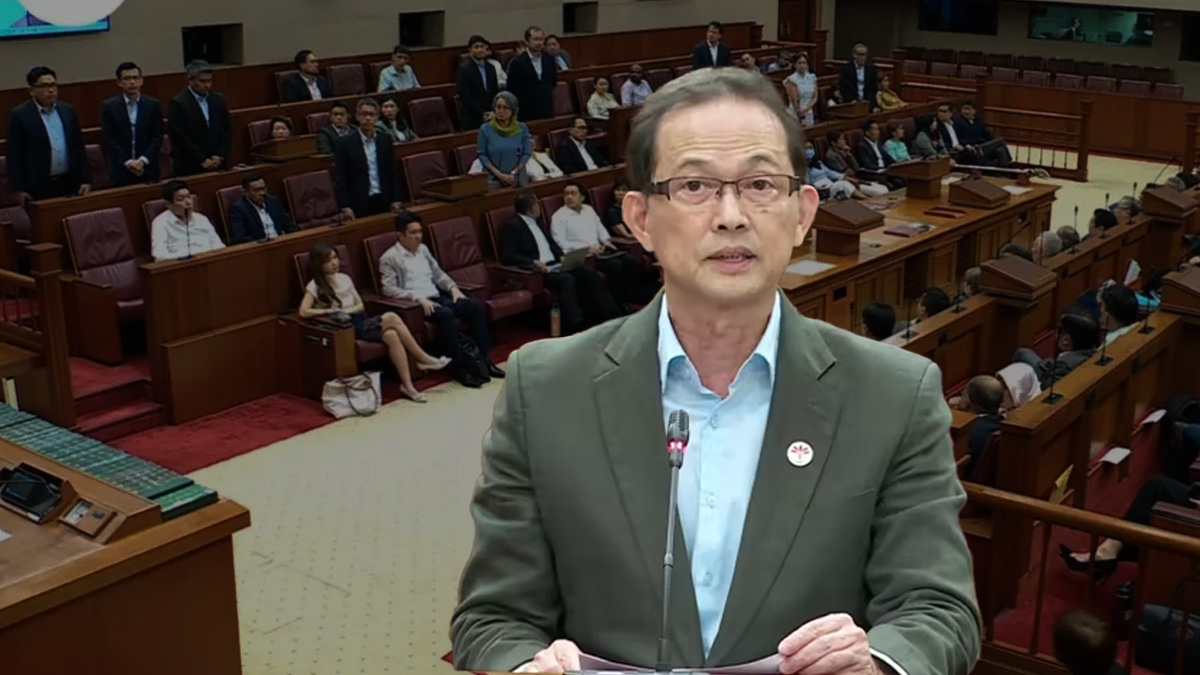

David Chew, director of the Commercial Affairs Department, said the police “will spare no effort” in bringing fugitives overseas to justice.

He noted that cooperation with Interpol and foreign counterparts is critical to detecting and deporting individuals who flee Singapore.

Chew also expressed appreciation for the support provided by China’s Ministry of Public Security in facilitating Ng’s deportation.

Those convicted of cheating face up to 10 years’ imprisonment and a fine.

Agritrade International collapsed in early 2020 after major lenders, including ING, MUFG, Maybank, Natixis and Commerzbank, accused it of trade-financing fraud.

Court filings alleged overlapping or fictitious bills of lading and misrepresentation of the company’s financial position, exposing banks to more than US$1.5 billion in liabilities.

Filings also alleged that chief executive Ng Xinwei and founder Ng Say Peck were involved in the misrepresentation.

Ng Xinwei denied wrongdoing, stating that trading operations were overseen by his father, who had travelled to China when investigations began.

The Commercial Affairs Department raided Agritrade’s office in January 2020, as the firm sought court protection from creditors.

Its moratorium application was rejected, and interim judicial managers were appointed shortly afterwards.

0 Comments