Core inflation in Singapore holds steady at 1.2% in November 2025

Singapore’s core inflation remained at 1.2% year-on-year in November 2025, as rising services costs were offset by falling energy and retail prices. The overall inflation outlook remains subdued, though officials warn of global uncertainties.

- Core inflation remained unchanged at 1.2% year-on-year in November, below economists’ forecast.

- Higher services inflation was offset by a sharper fall in electricity and gas prices, and lower retail inflation.

- Authorities maintained projections for inflation to ease further in 2025, with uncertainties ahead.

Singapore’s core inflation rate remained unchanged at 1.2 per cent year-on-year in November 2025, according to data released on 23 December by the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI).

The rate was slightly below the 1.3 per cent median forecast from a Reuters poll of economists, marking a steady trend from October’s figures.

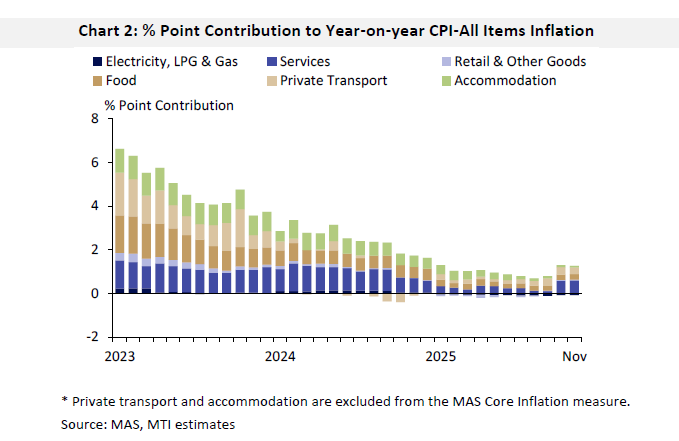

On a month-on-month basis, core inflation — which excludes private transport and accommodation — edged down by 0.1 per cent in November. Overall inflation, as measured by the Consumer Price Index-All Items (CPI-All Items), also remained at 1.2 per cent year-on-year, and rose 0.2 per cent from October on a monthly basis.

Sectoral developments show mixed trends

The stable core inflation figure reflects offsetting sectoral movements. Services inflation rose to 1.9 per cent year-on-year in November, up from 1.8 per cent in October. This increase was driven by higher costs in point-to-point (P2P) transport services and health insurance.

Meanwhile, electricity and gas prices declined more steeply, falling 4.1 per cent year-on-year in November, compared to a 4.0 per cent decline in October. This was attributed to a larger drop in electricity costs.

Retail and other goods inflation also fell, easing to 0.3 per cent in November from 0.4 per cent in October. The decline was due to lower prices of clothing, footwear, and personal care appliances.

Food inflation held steady at 1.2 per cent, with both food services and non-cooked food prices increasing at a pace similar to October. Private transport inflation eased slightly to 3.5 per cent from 3.8 per cent, largely due to a smaller increase in car prices. Accommodation inflation remained stable at 0.3 per cent year-on-year.

Outlook for 2025–2026: Gradual easing expected

MAS and MTI maintained their outlook that imported cost pressures would continue to ease, albeit more gradually. Global crude oil prices are expected to decline at a slower rate in 2026 than in 2025. At the same time, regional inflation is anticipated to rise modestly after remaining subdued this year.

On the domestic front, the agencies noted that administrative factors temporarily suppressing inflation are expected to diminish in the coming quarters. They also forecast that unit labour cost growth would begin to rise as productivity growth stabilises, while private consumption demand is expected to remain steady.

As a result, MAS Core Inflation is projected to be around 0.5 per cent in 2025, before rising to between 0.5 and 1.5 per cent in 2026. Overall inflation (CPI-All Items) is forecast to average 0.5 to 1 per cent in 2025, and between 0.5 and 1.5 per cent in 2026.

Risks and uncertainties remain

Despite the anticipated easing, authorities cautioned that inflation risks are not fully abated. MAS and MTI warned that potential supply shocks — particularly those arising from geopolitical tensions — could push up imported costs unexpectedly.

Conversely, a sharper-than-expected downturn in global demand could keep core inflation lower for a longer period. A substantial drop in global oil prices may also temporarily moderate the pace of inflation, though such effects would depend on the scale and persistence of the decline.

Broader economic context

The MAS Core Inflation measure excludes accommodation and private transport as these categories are often influenced by volatile and policy-driven factors. This makes core inflation a more stable indicator of underlying inflationary trends relevant for medium-term monetary policy.

Singapore’s consumer price data continues to reflect a complex balancing act between external disinflationary pressures and domestic sector-specific cost increases. The overall subdued inflation outlook provides some policy flexibility, but vigilance is expected amid persistent global uncertainties.