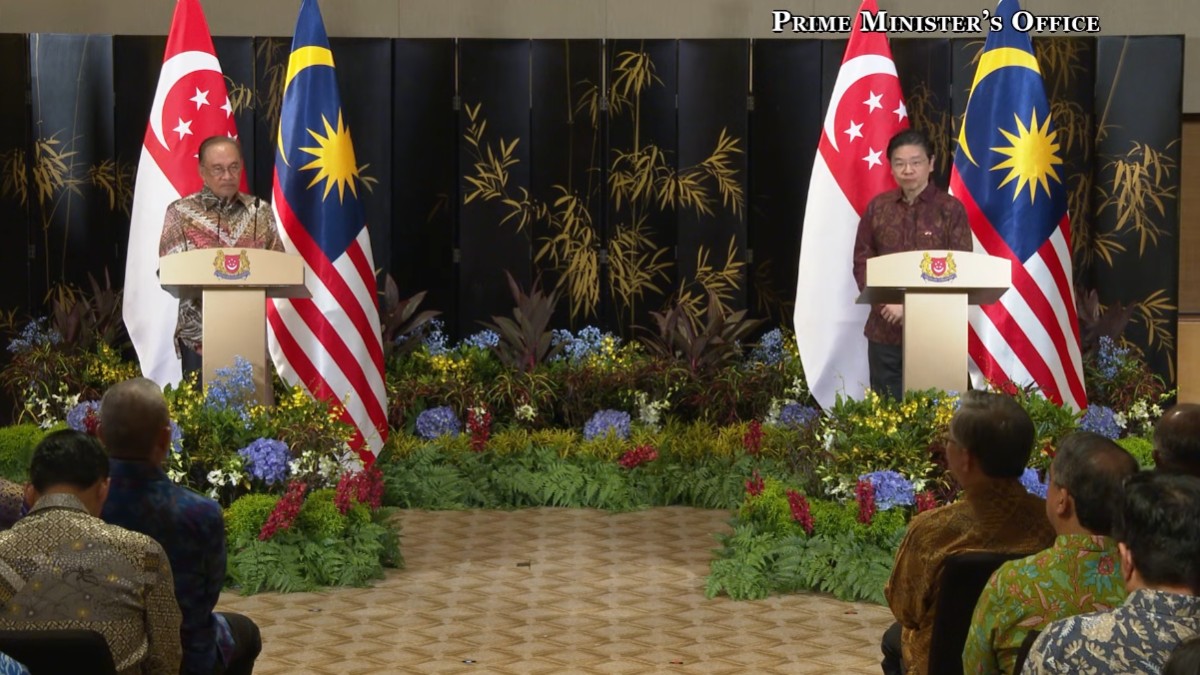

Michigan Governor Gretchen Whitmer meets PM Lawrence Wong in Singapore

Michigan Governor Gretchen Whitmer met Prime Minister Lawrence Wong on 1 September 2025 during her official visit to Singapore, with discussions centred on economic cooperation, innovation, and strengthening state-level ties. The visit coincides with renewed scrutiny over reports that Singapore’s sovereign wealth fund GIC owns more than 540,000 acres of land in Michigan’s Upper Peninsula.

- PM Lawrence Wong and Governor Gretchen Whitmer discussed trade, innovation, and investment cooperation.

- The visit comes amid reports that Singapore’s GIC owns over 540,000 acres of land in Michigan.

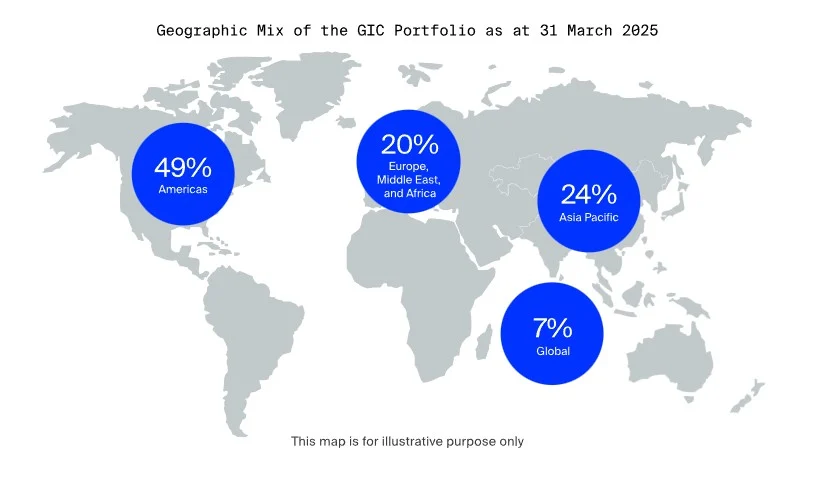

- GIC’s portfolio exposure to the Americas rose to 49%, with the US remaining its largest investment market.

SINGAPORE — Michigan Governor Gretchen Whitmer met Prime Minister Lawrence Wong on 1 September 2025 as part of her four-day official visit to Singapore, underscoring growing economic engagement between Singapore and individual US states.

The Ministry of Foreign Affairs (MFA) said both leaders reaffirmed the “longstanding and mutually beneficial partnership” between Singapore and the United States, spanning federal and state levels.

Wong welcomed Michigan’s interest in deepening economic collaboration, particularly in areas of technology, innovation, and advanced manufacturing — sectors in which both Singapore and Michigan have established global reputations.

Shared priorities in trade and innovation

During the meeting, the two leaders discussed trade policies, people-to-people ties, and potential collaboration in emerging technologies such as artificial intelligence, semiconductors, and clean energy.

In a Facebook post after the meeting, Wong noted that Singapore’s success as a small and open economy depended on fostering strong international partnerships. He also highlighted the United States’ economic importance to Singapore, describing it as the country’s largest foreign investor, top trading partner in services, and third-largest in goods.

“Our cooperation at both federal and state levels reinforces Singapore’s position as a trusted global hub,” Wong wrote, adding that such collaboration benefits citizens in both nations.

Engagements with Singapore ministers and agencies

Governor Whitmer also met Minister for Foreign Affairs Vivian Balakrishnan on the same day. Their discussion focused on how closer cooperation between Singapore and Michigan could strengthen the broader Singapore–US relationship.

Whitmer’s itinerary included meetings with the Economic Development Board (EDB), Enterprise Singapore, and Singapore-based companies operating in Michigan. A roundtable session with business leaders centred on entrepreneurship, investment opportunities, and building resilient supply chains.

She also attended a reception for University of Michigan alumni in Singapore — a gathering that reflected the personal connection shared by both leaders, as PM Wong is also a graduate of the university.

Whitmer’s visit, which runs from 30 August to 2 September, includes representatives from Michigan’s government and private sectors. The delegation’s agenda focuses on building industrial linkages, fostering start-up partnerships, and exploring opportunities for cooperation in clean tech and advanced manufacturing.

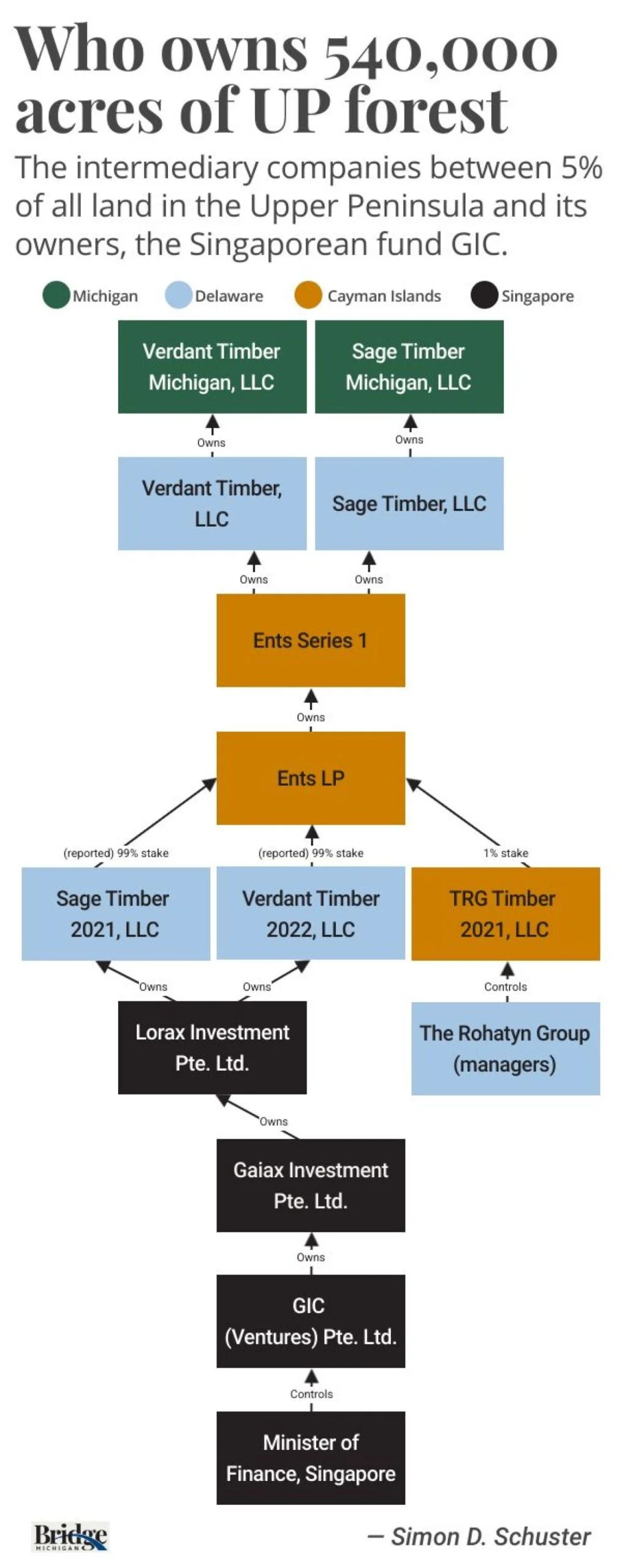

Reports of GIC land ownership in Michigan

The timing of Whitmer’s visit coincides with heightened media scrutiny in the United States over reports that Singapore’s sovereign wealth fund, GIC, owns vast tracts of land in Michigan’s Upper Peninsula.

In July, Bridge Michigan reported that GIC controls more than 540,000 acres — over five per cent of the region — including roughly one-sixth of Gogebic County near the Wisconsin border.

According to the report, these holdings were uncovered after filings by The Rohatyn Group, which manages the assets, identified GIC as the ultimate shareholder through a layered corporate structure.

Complex ownership structure revealed

Bridge Michigan described a multi-tiered structure involving five Michigan-based limited liability companies, several entities registered in Delaware, two Cayman Islands firms, and Singapore-based holding companies.

At the top of this structure, GIC (Ventures) Pte Ltd was identified as the sole shareholder. Further investigation by The Online Citizen found that two Singapore entities — Lorax Investment Pte Ltd and Gaiax Investment Pte Ltd — play key roles in managing the assets.

Both companies are registered at Capital Tower in Singapore, according to records from the Accounting and Corporate Regulatory Authority (ACRA).

Large-scale acquisitions and early returns

The Bridge Michigan report said GIC spent over US$450 million acquiring land parcels between 2021 and 2022. One major purchase included the Keweenaw Land Association in 2021 through an all-cash deal, although mineral rights were retained by the seller.

In May 2022, Verdant Timber Cub LLC — an entity linked to GIC — reportedly sold 39 acres for US$2.4 million after acquiring them for just US$37,500, indicating a sharp rise in land value.

The report sparked debate in Michigan about foreign ownership, transparency, and potential implications for land use, especially in regions with historical ties to forestry and mining.

GIC CEO declines to comment

When contacted by The Straits Times on 25 July, GIC Chief Executive Officer Lim Chow Kiat declined to address questions about the Michigan land holdings.

He reiterated GIC’s long-standing policy of not commenting on specific investments, but emphasised that all activities comply with legal and regulatory standards.

“We adopt practices that are consistent with the market,” Lim said, without confirming or denying the reported acquisitions.

GIC also did not respond to earlier requests for comment from both Bridge Michigan and The Online Citizen.

GIC’s growing exposure in the Americas

In its 2025 annual report, GIC announced a 20-year real rate of return of 3.8 per cent per annum as of 31 March, slightly lower than the previous year’s 3.9 per cent.

Without adjusting for inflation, the fund’s nominal annualised return stood at 5.7 per cent.

GIC’s portfolio exposure to the Americas — covering both North and Latin America — rose sharply from 44 per cent to 49 per cent in one year. The fund said the increase reflected both the appreciation of existing assets and the deployment of new capital, particularly in the United States, which remains its largest investment market.

GIC is chaired by former prime minister Lee Hsien Loong, while Prime Minister Lawrence Wong serves as deputy chairman.

Strengthening state-level cooperation

Despite the questions surrounding GIC’s reported land ownership, officials from both Singapore and Michigan emphasised that Whitmer’s visit focused primarily on economic partnerships and innovation.

Singapore and the United States share a Free Trade Agreement (FTA) and strong ties across multiple sectors, including energy, transport, and higher education.

Observers say Whitmer’s visit underscores a broader trend of increasing subnational diplomacy — where US states engage directly with foreign governments to advance trade and investment opportunities.

With Whitmer’s visit concluding on 2 September, both sides are expected to explore follow-up engagements in manufacturing, research, and climate technology, further deepening the state-to-state partnership between Singapore and Michigan.