Thailand deputy finance minister quits, denies links to Cambodia cyberscam network amid new evidence

Thailand’s Deputy Finance Minister Vorapak Tanyawong resigned following reports linking him and his family to Cambodia-based cyberscam networks. Investigations allege that a Chinese-Cambodian criminal group paid his wife US$3 million in cryptocurrency earlier this year.

- Thailand’s Deputy Finance Minister Vorapak Tanyawong resigned on 22 October 2025 amid allegations connecting him to Cambodia-based cyberscam operations.

- The Whale Hunting newsletter reported that Vorapak’s wife received US$3 million in cryptocurrency from Chinese-Cambodian networks under investigation.

- Prime Minister Anutin Charnvirakul ordered Vorapak to submit an explanation before his resignation, which he said was to focus on his legal defence.

BANGKOK: Thailand’s Deputy Finance Minister Vorapak Tanyawong resigned on 22 October 2025 after reports linked his family to an extensive Cambodia-based cyberscam operation.

Prime Minister Anutin Charnvirakul had earlier instructed Vorapak, who took office in September 2025, to submit a written explanation regarding the accusations.

The controversy erupted after Whale Hunting, an investigative outlet, alleged that Vorapak’s wife received US$3 million in cryptocurrency from Chinese-Cambodian criminal networks earlier this year.

According to the report, these networks were among those Vorapak was himself tasked to investigate as part of a government anti-fraud committee.

Crypto trail traced to Cambodian and Singaporean networks

Whale Hunting claimed that Singapore corporate filings showed the payment originated from the network of Benjamin Mauerberger, a South African-born fraudster with a two-decade record of financial crimes.

The report identified Mauerberger’s wife, Cattaliya Beevor, as a recipient of similar transfers.

It alleged that the couple used a network of Singapore-based funds and Thai shell firms to channel Cambodian money into Thailand.

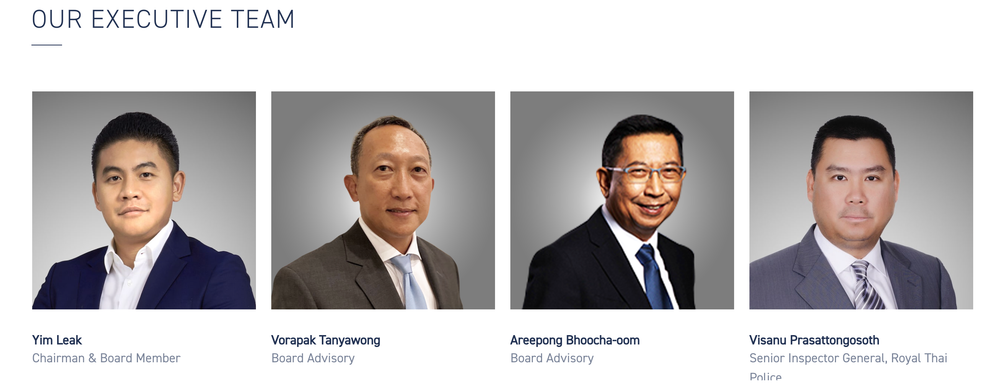

Their activities were reportedly linked to Cambodian tycoon Yim Leak, a member of the influential Hun Sen family, suggesting a complex web of cross-border corruption involving prominent business and political figures.

Investigators claim “illegal pipeline” into Thai financial sector

The Whale Hunting investigation further alleged that Mauerberger’s network gained control of 52% of Thai securities firm Finansia X PCL through covert share purchases.

It described this as an “illegal pipeline” connecting unregulated cryptocurrency to Thailand’s formal banking system.

The same syndicate, according to the report, previously used Singapore-based Capital Asia Investments to acquire a 20% stake in Bangchak Corporation, Thailand’s second-largest energy company, challenging the Thai state’s 35% ownership.

Analysts cited by Whale Hunting warned this could amount to a case of “systematic state capture” via financial infiltration.

Vorapak’s defence and public statement

At a press conference on 22 October, Vorapak denied all allegations, stating, “To fight this legal battle, I need time, and I am afraid it will interfere with my main role at the Ministry of Finance.”

He described his resignation as a personal decision aimed at clearing his name.

In a subsequent 1,000-word statement, Vorapak insisted that his wife “has no crypto accounts and never received any benefits.”

He stressed that he had no ties to Cambodian money-laundering operations and only knew Mauerberger “because their children attended the same school.”

He added that his past business dealings through Finansia Syrus and Pilgrim Finansa were legitimate and fully audited.

Fresh evidence surfaces after denial

On 23 October, Whale Hunting released new documentation it said substantiated its earlier claims.

The outlet reported that the funds originated from Beteverse Limited, a Seychelles-registered shell company controlled by Li Hang, a senior executive at KuCoin—a major cryptocurrency exchange that was fined C$19.6 million (US$14.09 million) by Canada’s anti-money laundering agency in September.

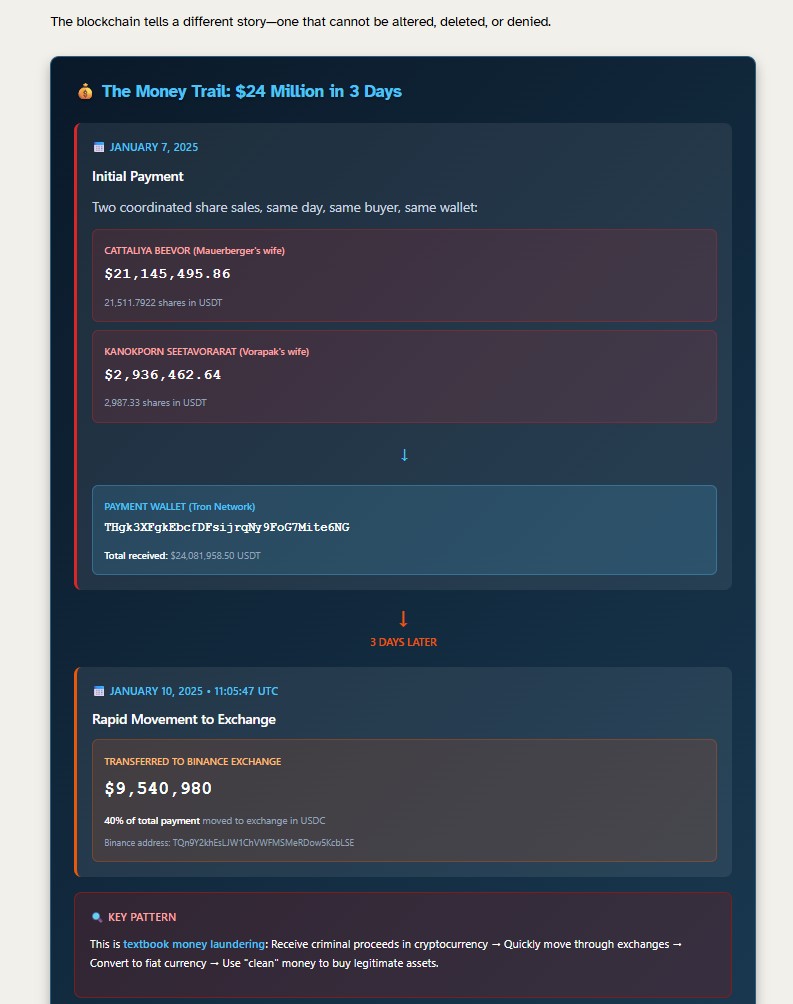

The report included 84 pages of corporate filings, wallet addresses, and blockchain transaction data showing approximately US$24 million flowing through crypto wallets connected to the network.

The funds were allegedly transferred to two women — Cattaliya Beevor and Kanokporn Seetavorarat, Vorapak’s wife — on the same day, via the same buyer, totalling US$24,081,958.50 in Tether (USDT) on the Tron blockchain.

Within three days, about 40% of the funds were moved to a Binance exchange wallet, which Whale Hunting said matched typical laundering patterns of “receive, move, and cash out.”

Political and institutional implications

Vorapak’s resignation has intensified scrutiny on Thailand’s oversight of cryptocurrency and its ties to transnational financial crime.

Analysts note that the emergence of blockchain evidence could test the government’s commitment to combating money-laundering networks that increasingly exploit digital assets and cross-border financial loopholes.

Corruption scandals have long shaped Thailand’s political landscape, but direct links between government officials and Southeast Asia’s multibillion-dollar cyberscam industry remain rare.

Observers warn that the case could mark a watershed moment in regional financial governance, especially if the evidence points to systemic weaknesses in anti-money-laundering controls across Thailand, Cambodia, and Singapore.

Vorapak, a veteran financier with a career spanning senior roles at the Thai branches of Bank of America and JP Morgan Chase, joined the government in 2024 as an adviser before his promotion to deputy minister.