K. Shanmugam: 1,200 people and 50 firms restricted from banking, telco and Singpass over scam links

Singapore authorities have restricted banking, telco and Singpass access for about 1,200 individuals and 50 entities linked to scams, as part of a new framework targeting money mules, Home Affairs Minister K. Shanmugam said.

- About 1,200 individuals and 50 corporate entities have had banking, telco and Singpass access restricted due to scam involvement.

- Restrictions are part of a facility restriction framework rolled out from October 2025 to curb money mule activity.

- Early results are positive, but authorities say more time is needed to assess long-term effectiveness.

SINGAPORE: About 1,200 individuals and 50 corporate entities have had their access to banking, telecommunications and Singpass services restricted because of their involvement in scams, Minister for Home Affairs K. Shanmugam said.

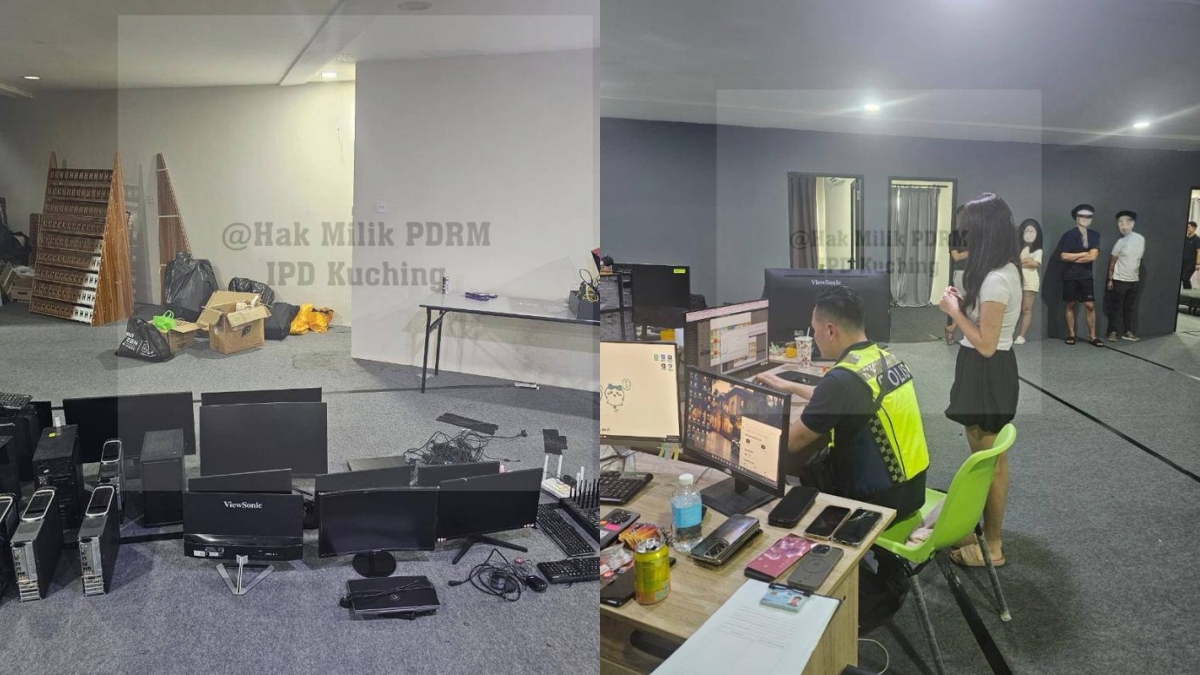

The restrictions cover convicted money mules and individuals under investigation who have been assessed as being at risk of further facilitating scams. The measures are part of broader efforts to disrupt scam operations and prevent repeat offending.

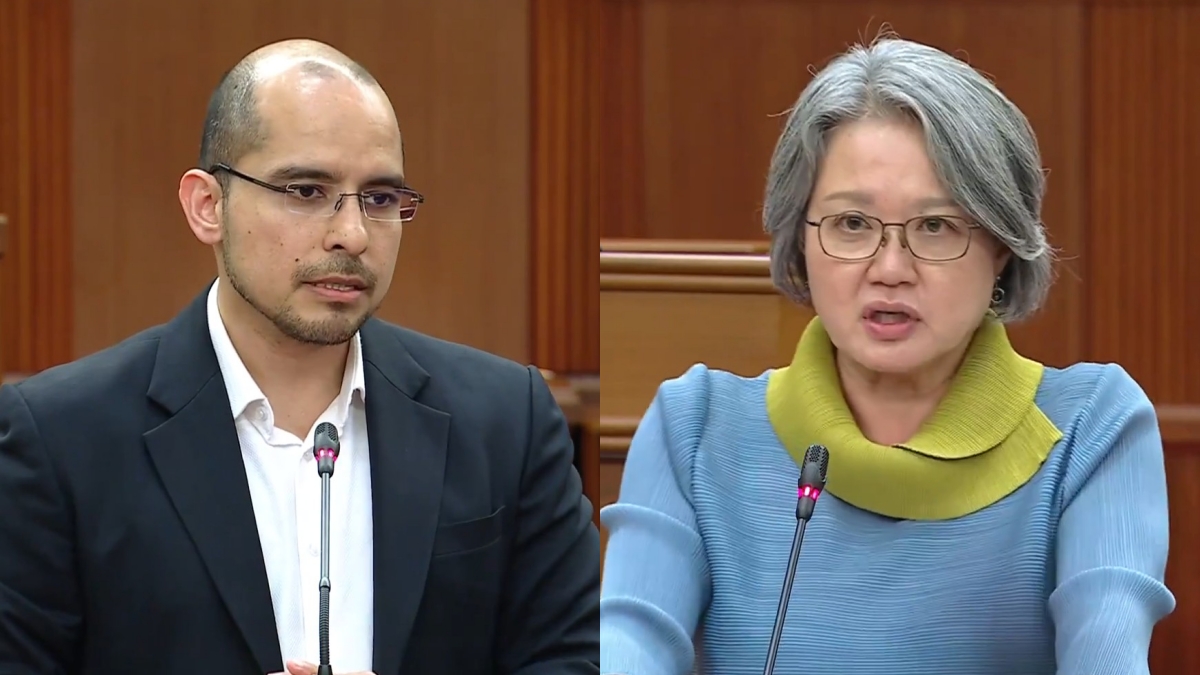

Mr Shanmugam was responding to Parliamentary questions filed by Nee Soon GRC MP Jackson Lam on 12 January 2026.

The question sought details on how quickly suspected money mule activities are detected and the extent of coordination between government agencies, banks and telcos.

Mr Lam also asked whether real-time alerts or automated account freezes were being expanded. He further requested data on how many suspected mules had their phone lines, bank accounts or Singpass restricted over the past two years.

In a written reply, Mr Shanmugam said the facility restriction framework took effect from October 2025 and is being implemented in phases. According to the Ministry of Home Affairs, the framework targets individuals and entities linked to scam activities.

Under the framework, access to financial services such as internet and mobile banking, card-based transactions and ATM services can be restricted. Affected individuals are also unable to subscribe to new mobile phone lines.

Restrictions are also placed on existing Singpass and Corppass accounts. This prevents affected persons from carrying out activities such as opening new bank accounts or managing corporate transactions.

Mr Shanmugam said the authorities are seeing positive early results from the framework. However, he added that more time is needed to assess its overall effectiveness in preventing reoffending.

Those under investigation will remain subject to the restrictions until the outcome of their cases is determined. This approach is intended to limit the potential for further misuse while investigations are ongoing.

Money mules who have been warned, fined or convicted will typically face restrictions for one year. Repeat offenders may be subject to restrictions for up to three years, according to Mr Shanmugam.

In 2025, almost 15 per cent of individuals who allowed their mobile phone lines to be used for scams were repeat offenders. According to police data cited in the reply, these offenders collectively held about 11,000 mobile lines.

The police said some money mules continued to apply for new mobile lines and sell them to scammers even while they were under investigation. This behaviour has contributed to sustained scam activity.

Authorities have also observed an increase in mobile lines used for scams being registered under corporate entities. This trend has raised concerns about the misuse of corporate accounts and identities.

The scale of scams in Singapore remains significant.

In 2024, there were 51,501 reported scam cases involving losses of more than S$1.1 billion, according to official figures.

In 2025, up to 30 November, more than 33,800 scam cases were reported. Losses for the same period exceeded S$840.3 million.

Mr Shanmugam said the scam situation continues to be of serious concern for the authorities. He noted that enforcement agencies have been intensifying efforts to disrupt scam networks.

When a scam is reported, the Anti-Scam Centre works closely with banks to trace the flow of funds.

According to Mr Shanmugam, accounts are typically frozen within a day, and sometimes within hours.

These rapid responses aim to prevent scam proceeds from being siphoned out of Singapore.

However, Mr Shanmugam said reactive measures alone are insufficient.

He added that the police also work proactively with banks and telcos. Accounts and mobile lines may be frozen when they are suspected of involvement in scams or assessed to have the potential to be misused.

According to the Ministry of Home Affairs, this proactive approach is intended to disrupt scam operations earlier and reduce opportunities for repeat offences.