Indonesia urged to convert coal oversupply crisis into clean energy opportunity

IEEFA's latest report urges Indonesia to repurpose ageing coal-fired plants using tailored business models and financing strategies, positioning its sovereign fund Danantara at the centre of a managed and just energy transition.

- Ageing coal-fired power plants are straining Indonesia’s national utility and driving up state subsidies.

- Policy groundwork exists for early coal plant retirement, but implementation is hindered by regulatory and financial complexity.

- Sovereign wealth fund Danantara is seen as pivotal in leading Indonesia’s coal exit strategy and renewable energy push.

Indonesia’s energy sector is facing rising pressure to reform its coal-heavy electricity system amid ageing infrastructure, financial inefficiencies, and global decarbonisation goals.

A new report from the Institute for Energy Economics and Financial Analysis (IEEFA), published on 19 November 2025, calls for a strategic shift from maintaining underperforming coal-fired power plants (CFPPs) to leveraging them as platforms for renewable energy deployment.

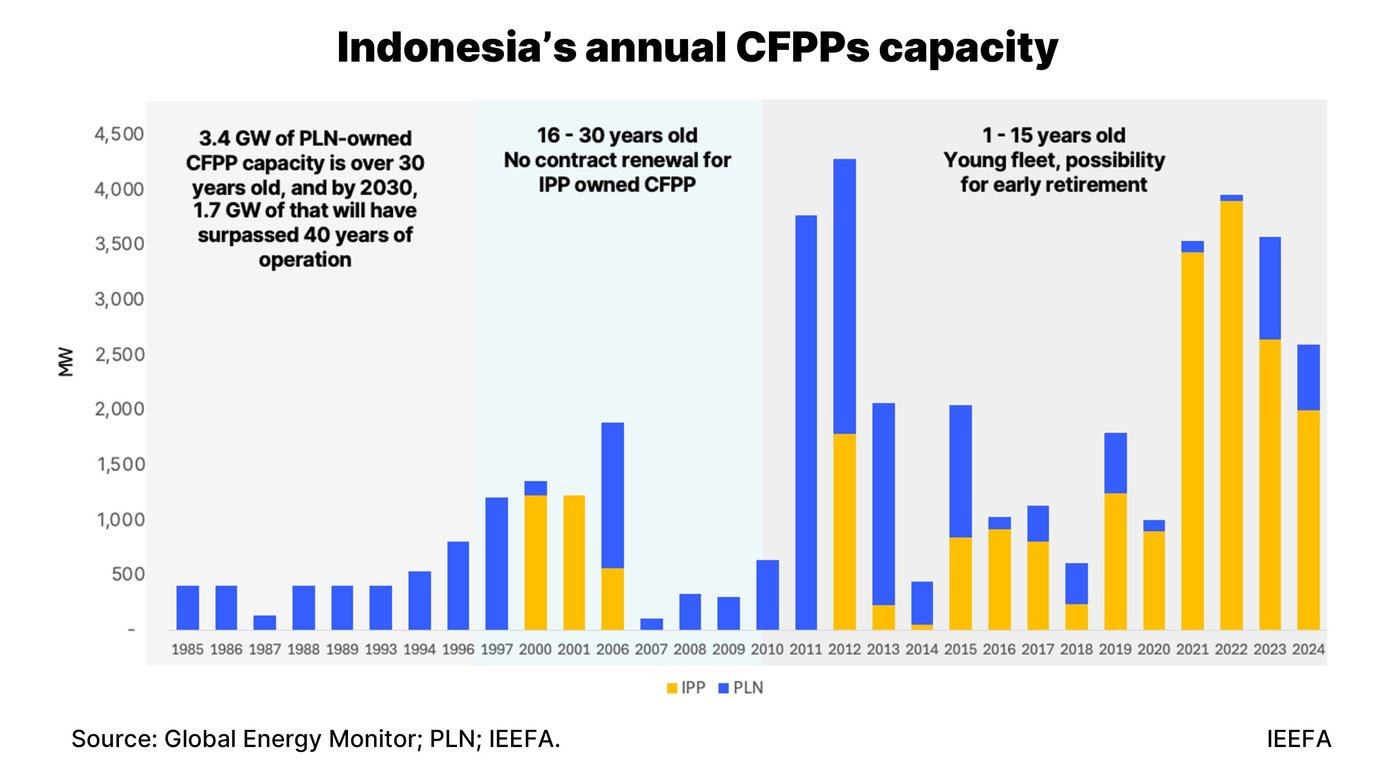

IEEFA reports that PT Perusahaan Listrik Negara (PLN), Indonesia’s national utility, is burdened with rising costs from outdated CFPPs and long-term Power Purchasing Agreements (PPAs) with Independent Power Producers (IPPs).

Despite policy-mandated price caps on coal, operational inefficiencies have driven up the cost of electricity generation from IDR637 per kilowatt-hour (kWh) in 2020 to IDR941/kWh in 2024.

This rise in generation costs, combined with a grid oversupply, has pushed government subsidies and compensation to PLN up by 24% in 2024, reaching US$11 billion—5% of the national budget.

According to Mutya Yustika, the report’s author and Research & Engagement Lead at IEEFA Asia, regulatory foundations such as Presidential Regulation No. 112/2022 and the Ministry of Energy and Mineral Resources (MEMR) Regulation No. 10/2025 exist to guide early CFPP retirement.

However, execution remains slow due to a lack of clear asset data, undefined retirement pathways, and complex contractual obligations.

Three major risks are outlined in the IEEFA report if Indonesia continues operating its ageing coal fleet:

-

Escalating operational and fuel costs due to inefficiencies and equipment degradation.

-

Persistent payments for electricity not dispatched under take-or-pay PPAs.

-

High refurbishment costs to extend plant life with minimal return on investment.

In light of these challenges, IEEFA recommends Indonesia move away from retrofitting coal plants and instead adopt business models suited to its asset profile. For PLN-owned CFPPs, divestment or repurposing through public-private partnerships (PPPs) could allow for risk-sharing and capital mobilisation.

Asset divestment would involve transferring plants to private investors with strategic incentives, though the model faces obstacles due to low asset valuation and political concerns.

A PPP model could be less politically sensitive, allowing PLN to maintain ownership while partnering with private actors to repurpose or replace assets using existing grid infrastructure.

For IPP-owned CFPPs, IEEFA outlines two blended finance options. A private sector-led model, such as the Philippines’ South Luzon Thermal Energy Corporation (SLTEC) project, allows developers to voluntarily retire plants using internal capital. A multilateral-led model, like Indonesia’s Cirebon-1 initiative, involves concessional finance and international collaboration.

The report also points to the potential of transition credits, which could monetise avoided emissions and help fund early coal retirement. However, these require strict monitoring and verification systems.

Central to the coal-to-clean strategy is Indonesia’s newly established sovereign wealth fund, Danantara. With oversight of PLN’s portfolio, Danantara is well-positioned to lead the identification and standardisation of CFPP retirement or repurposing pathways.

Yustika emphasises Danantara’s role in embedding just transition principles—such as worker reskilling and community support—into phase-out plans. The fund can also act as a conduit for blended finance, engaging multilateral banks and global investors to de-risk investments and drive energy innovation.

“The opportunity lies in shifting legacy coal assets into platforms for future-ready energy solutions,” says Yustika. “It changes the narrative from ‘retirement as a cost’ to ‘retirement as an opportunity’—especially when supported by robust regulation and targeted incentives.”

The IEEFA report concludes that Indonesia’s energy future hinges not just on reducing coal dependence, but on building an integrated clean energy transition strategy that is financially sustainable, socially just, and operationally effective.